Westfield Capital Management Co. LP lowered its position in Onto Innovation Inc. (NYSE:ONTO - Free Report) by 27.3% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 203,566 shares of the semiconductor company's stock after selling 76,617 shares during the quarter. Westfield Capital Management Co. LP owned 0.42% of Onto Innovation worth $24,701,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

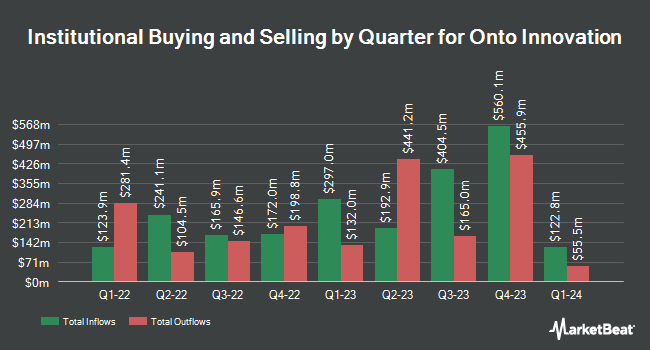

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Invesco Ltd. increased its stake in shares of Onto Innovation by 33.9% in the fourth quarter. Invesco Ltd. now owns 1,406,034 shares of the semiconductor company's stock valued at $234,344,000 after buying an additional 356,161 shares during the period. Massachusetts Financial Services Co. MA increased its position in Onto Innovation by 48.4% during the 1st quarter. Massachusetts Financial Services Co. MA now owns 1,291,415 shares of the semiconductor company's stock valued at $156,700,000 after purchasing an additional 421,165 shares during the period. Geneva Capital Management LLC increased its position in Onto Innovation by 0.5% during the 1st quarter. Geneva Capital Management LLC now owns 1,015,323 shares of the semiconductor company's stock valued at $123,199,000 after purchasing an additional 4,632 shares during the period. Royal Bank of Canada increased its position in Onto Innovation by 32.0% during the 4th quarter. Royal Bank of Canada now owns 485,408 shares of the semiconductor company's stock valued at $80,903,000 after purchasing an additional 117,798 shares during the period. Finally, Northern Trust Corp increased its position in Onto Innovation by 21.7% during the 4th quarter. Northern Trust Corp now owns 479,478 shares of the semiconductor company's stock valued at $79,915,000 after purchasing an additional 85,492 shares during the period. Institutional investors and hedge funds own 98.35% of the company's stock.

Onto Innovation Trading Up 2.7%

Shares of ONTO traded up $2.44 during trading hours on Thursday, reaching $92.44. The stock had a trading volume of 2,149,119 shares, compared to its average volume of 1,140,586. Onto Innovation Inc. has a 12 month low of $85.88 and a 12 month high of $228.42. The firm has a 50-day simple moving average of $98.08 and a 200 day simple moving average of $124.56. The company has a market capitalization of $4.51 billion, a price-to-earnings ratio of 20.91, a P/E/G ratio of 0.58 and a beta of 1.44.

Onto Innovation (NYSE:ONTO - Get Free Report) last issued its earnings results on Thursday, August 7th. The semiconductor company reported $1.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.27 by ($0.02). Onto Innovation had a return on equity of 14.85% and a net margin of 21.36%. During the same period in the prior year, the firm earned $1.32 earnings per share. The business's revenue for the quarter was up 4.7% compared to the same quarter last year. On average, equities analysts forecast that Onto Innovation Inc. will post 6.26 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have weighed in on ONTO. Oppenheimer decreased their target price on shares of Onto Innovation from $150.00 to $130.00 and set an "outperform" rating for the company in a research report on Friday, May 9th. Jefferies Financial Group set a $110.00 price target on Onto Innovation and gave the stock a "hold" rating in a report on Tuesday, May 20th. Wall Street Zen upgraded Onto Innovation from a "sell" rating to a "hold" rating in a report on Saturday, May 17th. Stifel Nicolaus cut their price target on Onto Innovation from $200.00 to $180.00 and set a "buy" rating on the stock in a report on Tuesday, April 15th. Finally, Needham & Company LLC cut their price target on Onto Innovation from $230.00 to $150.00 and set a "buy" rating on the stock in a report on Friday, May 9th. Three analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $141.67.

Check Out Our Latest Analysis on ONTO

Onto Innovation Profile

(

Free Report)

Onto Innovation Inc engages in the design, development, manufacture, and support of process control tools that performs optical metrology. The company offers lithography systems and process control analytical software. It also offers process and yield management solutions, and device packaging and test facilities through standalone systems for optical metrology, macro-defect inspection, packaging lithography, and transparent and opaque thin film measurements.

Featured Articles

Before you consider Onto Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onto Innovation wasn't on the list.

While Onto Innovation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.