Broad Bay Capital Management LP grew its stake in Wix.com Ltd. (NASDAQ:WIX - Free Report) by 43.0% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 345,791 shares of the information services provider's stock after buying an additional 104,015 shares during the period. Wix.com accounts for 8.3% of Broad Bay Capital Management LP's investment portfolio, making the stock its 3rd largest holding. Broad Bay Capital Management LP owned about 0.62% of Wix.com worth $56,495,000 as of its most recent filing with the Securities and Exchange Commission.

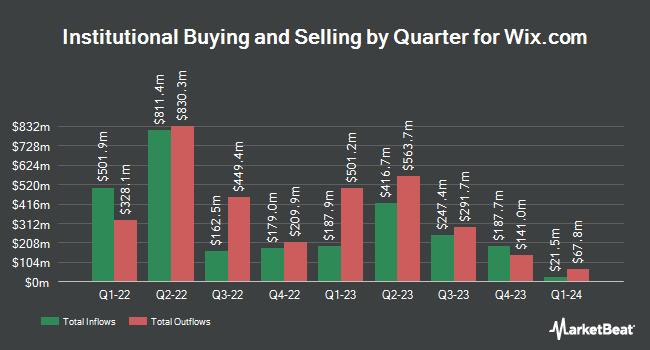

Other hedge funds have also recently added to or reduced their stakes in the company. Dorsal Capital Management LP grew its stake in Wix.com by 1.8% in the 4th quarter. Dorsal Capital Management LP now owns 1,425,000 shares of the information services provider's stock valued at $305,734,000 after acquiring an additional 25,000 shares during the last quarter. Whale Rock Capital Management LLC boosted its position in shares of Wix.com by 55.1% in the fourth quarter. Whale Rock Capital Management LLC now owns 1,071,565 shares of the information services provider's stock worth $229,904,000 after acquiring an additional 380,800 shares during the last quarter. Man Group plc raised its holdings in Wix.com by 1.5% in the fourth quarter. Man Group plc now owns 643,651 shares of the information services provider's stock valued at $138,095,000 after buying an additional 9,706 shares during the period. Dorsey Asset Management LLC grew its stake in shares of Wix.com by 4.5% in the fourth quarter. Dorsey Asset Management LLC now owns 578,741 shares of the information services provider's stock valued at $124,169,000 after buying an additional 24,847 shares in the last quarter. Finally, Durable Capital Partners LP purchased a new position in shares of Wix.com in the fourth quarter valued at $89,839,000. Institutional investors and hedge funds own 81.52% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on WIX shares. Zacks Research raised shares of Wix.com from a "strong sell" rating to a "hold" rating in a research report on Wednesday, August 20th. Cantor Fitzgerald reissued an "overweight" rating and set a $200.00 price target on shares of Wix.com in a research report on Wednesday, June 18th. Wells Fargo & Company raised shares of Wix.com from an "equal weight" rating to an "overweight" rating and raised their price target for the stock from $173.00 to $216.00 in a research report on Monday, June 16th. Citigroup reissued an "outperform" rating on shares of Wix.com in a research report on Monday, August 18th. Finally, Raymond James Financial reaffirmed a "strong-buy" rating on shares of Wix.com in a report on Thursday, August 7th. Three investment analysts have rated the stock with a Strong Buy rating, seventeen have issued a Buy rating and two have given a Hold rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus price target of $215.63.

View Our Latest Analysis on WIX

Wix.com Stock Performance

Shares of NASDAQ WIX traded up $2.21 during trading hours on Monday, hitting $141.08. The stock had a trading volume of 1,407,653 shares, compared to its average volume of 1,695,481. The firm's 50-day moving average price is $143.91 and its two-hundred day moving average price is $160.82. Wix.com Ltd. has a 52 week low of $114.89 and a 52 week high of $247.11. The company has a market capitalization of $7.92 billion, a P/E ratio of 50.21, a P/E/G ratio of 2.71 and a beta of 1.30.

Wix.com (NASDAQ:WIX - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The information services provider reported $2.28 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.79 by $0.49. The company had revenue of $489.93 million during the quarter, compared to analysts' expectations of $487.62 million. Wix.com had a net margin of 8.90% and a negative return on equity of 136.43%. The business's quarterly revenue was up 12.4% compared to the same quarter last year. During the same period in the prior year, the company earned $1.67 earnings per share. As a group, analysts expect that Wix.com Ltd. will post 3.65 EPS for the current fiscal year.

Wix.com declared that its Board of Directors has approved a share buyback plan on Monday, August 11th that authorizes the company to buyback $200.00 million in shares. This buyback authorization authorizes the information services provider to reacquire up to 2.9% of its shares through open market purchases. Shares buyback plans are typically a sign that the company's board believes its shares are undervalued.

About Wix.com

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

Featured Stories

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.