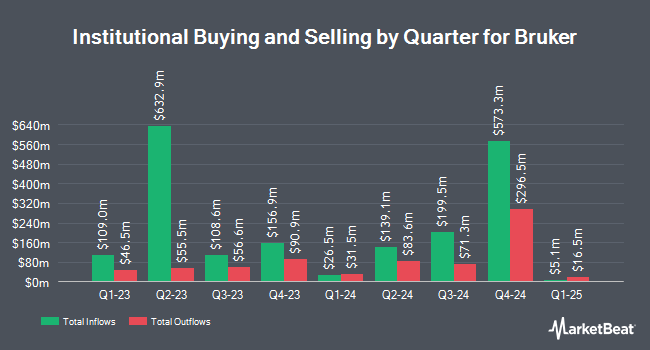

XTX Topco Ltd bought a new position in Bruker Corporation (NASDAQ:BRKR - Free Report) in the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor bought 15,017 shares of the medical research company's stock, valued at approximately $627,000.

Several other institutional investors have also recently made changes to their positions in the company. London Co. of Virginia boosted its holdings in shares of Bruker by 78.4% in the 4th quarter. London Co. of Virginia now owns 4,193,454 shares of the medical research company's stock worth $245,820,000 after buying an additional 1,843,294 shares during the last quarter. Sculptor Capital LP boosted its holdings in shares of Bruker by 484.1% in the 4th quarter. Sculptor Capital LP now owns 1,714,015 shares of the medical research company's stock worth $100,476,000 after buying an additional 1,420,569 shares during the last quarter. FIL Ltd boosted its holdings in shares of Bruker by 262.3% in the 4th quarter. FIL Ltd now owns 1,961,416 shares of the medical research company's stock worth $114,978,000 after buying an additional 1,420,102 shares during the last quarter. Steadfast Capital Management LP purchased a new position in shares of Bruker in the 4th quarter worth about $63,997,000. Finally, Marshall Wace LLP boosted its holdings in shares of Bruker by 4,510.3% in the 4th quarter. Marshall Wace LLP now owns 783,988 shares of the medical research company's stock worth $45,957,000 after buying an additional 766,983 shares during the last quarter. Institutional investors own 79.52% of the company's stock.

Bruker Price Performance

Shares of Bruker stock traded down $0.73 on Friday, reaching $30.43. The stock had a trading volume of 3,943,871 shares, compared to its average volume of 4,038,396. Bruker Corporation has a 1 year low of $30.19 and a 1 year high of $72.94. The company has a market cap of $4.62 billion, a P/E ratio of 58.52, a price-to-earnings-growth ratio of 2.58 and a beta of 1.16. The company has a current ratio of 1.61, a quick ratio of 0.74 and a debt-to-equity ratio of 1.31. The business's 50 day moving average is $39.45 and its two-hundred day moving average is $42.65.

Bruker (NASDAQ:BRKR - Get Free Report) last announced its quarterly earnings results on Monday, August 4th. The medical research company reported $0.32 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.33 by ($0.01). Bruker had a return on equity of 17.89% and a net margin of 2.31%. The firm had revenue of $797.40 million during the quarter, compared to analysts' expectations of $811.17 million. During the same period in the previous year, the company posted $0.52 earnings per share. The company's quarterly revenue was down .4% compared to the same quarter last year. As a group, research analysts anticipate that Bruker Corporation will post 2.69 EPS for the current year.

Bruker Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, June 27th. Stockholders of record on Monday, June 16th were issued a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a dividend yield of 0.7%. The ex-dividend date of this dividend was Monday, June 16th. Bruker's dividend payout ratio is presently 38.46%.

Wall Street Analyst Weigh In

BRKR has been the topic of a number of research analyst reports. UBS Group cut their price target on shares of Bruker from $57.00 to $45.00 and set a "neutral" rating on the stock in a report on Thursday, May 8th. Bank of America cut their target price on shares of Bruker from $61.00 to $50.00 and set a "buy" rating for the company in a research report on Thursday, June 26th. Stifel Nicolaus set a $40.00 price target on shares of Bruker and gave the company a "hold" rating in a research report on Tuesday. Jefferies Financial Group set a $60.00 price objective on shares of Bruker and gave the stock a "buy" rating in a report on Monday, August 4th. Finally, Wells Fargo & Company cut their price objective on shares of Bruker from $60.00 to $50.00 and set an "overweight" rating for the company in a report on Tuesday. Six equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $51.30.

View Our Latest Report on BRKR

Insider Activity

In other news, CEO Frank H. Laukien purchased 2,608 shares of the stock in a transaction dated Friday, June 6th. The shares were purchased at an average cost of $38.36 per share, with a total value of $100,042.88. Following the completion of the acquisition, the chief executive officer owned 38,462,171 shares in the company, valued at $1,475,408,879.56. This represents a 0.01% increase in their position. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Insiders own 27.30% of the company's stock.

About Bruker

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

See Also

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.