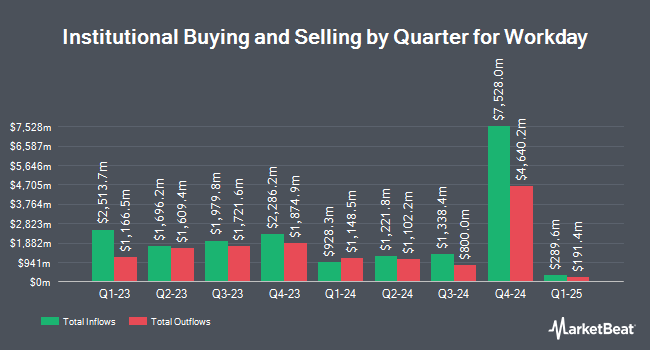

XTX Topco Ltd boosted its position in Workday, Inc. (NASDAQ:WDAY - Free Report) by 571.0% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 16,064 shares of the software maker's stock after acquiring an additional 13,670 shares during the quarter. XTX Topco Ltd's holdings in Workday were worth $3,751,000 at the end of the most recent reporting period.

A number of other hedge funds have also added to or reduced their stakes in WDAY. Janney Montgomery Scott LLC boosted its position in Workday by 5.0% in the first quarter. Janney Montgomery Scott LLC now owns 22,645 shares of the software maker's stock valued at $5,288,000 after buying an additional 1,070 shares in the last quarter. Kingswood Wealth Advisors LLC boosted its position in Workday by 13.9% in the first quarter. Kingswood Wealth Advisors LLC now owns 1,136 shares of the software maker's stock valued at $265,000 after buying an additional 139 shares in the last quarter. Sowell Financial Services LLC acquired a new stake in Workday in the first quarter valued at approximately $290,000. D.A. Davidson & CO. boosted its position in Workday by 27.8% in the first quarter. D.A. Davidson & CO. now owns 1,601 shares of the software maker's stock valued at $374,000 after buying an additional 348 shares in the last quarter. Finally, Golden State Wealth Management LLC boosted its position in Workday by 9,166.7% in the first quarter. Golden State Wealth Management LLC now owns 278 shares of the software maker's stock valued at $65,000 after buying an additional 275 shares in the last quarter. 89.81% of the stock is owned by institutional investors.

Insider Activity at Workday

In other news, major shareholder David A. Duffield sold 72,551 shares of the stock in a transaction on Tuesday, July 8th. The shares were sold at an average price of $239.61, for a total value of $17,383,945.11. Following the transaction, the insider owned 102,997 shares of the company's stock, valued at $24,679,111.17. This represents a 41.33% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Carl M. Eschenbach sold 6,250 shares of the stock in a transaction on Tuesday, July 1st. The stock was sold at an average price of $239.43, for a total transaction of $1,496,437.50. Following the completion of the transaction, the chief executive officer directly owned 1,472 shares in the company, valued at $352,440.96. The trade was a 80.94% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 329,005 shares of company stock worth $79,203,523 in the last ninety days. Insiders own 19.31% of the company's stock.

Workday Stock Down 0.8%

WDAY traded down $1.95 during midday trading on Wednesday, hitting $237.68. The company had a trading volume of 1,323,990 shares, compared to its average volume of 2,111,376. Workday, Inc. has a 52 week low of $199.81 and a 52 week high of $294.00. The company has a quick ratio of 2.07, a current ratio of 2.07 and a debt-to-equity ratio of 0.33. The company has a market capitalization of $63.46 billion, a price-to-earnings ratio of 131.31, a PEG ratio of 3.62 and a beta of 1.21. The stock's 50 day moving average price is $240.57 and its 200 day moving average price is $246.43.

Workday (NASDAQ:WDAY - Get Free Report) last posted its quarterly earnings results on Thursday, May 22nd. The software maker reported $2.23 earnings per share for the quarter, beating the consensus estimate of $2.01 by $0.22. The firm had revenue of $2.24 billion during the quarter, compared to the consensus estimate of $2.22 billion. Workday had a net margin of 5.60% and a return on equity of 8.00%. The business's revenue was up 12.6% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.74 earnings per share. On average, research analysts anticipate that Workday, Inc. will post 2.63 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

WDAY has been the topic of a number of recent research reports. JMP Securities reiterated a "market outperform" rating and set a $315.00 price target on shares of Workday in a report on Friday, May 23rd. KeyCorp cut their price target on shares of Workday from $335.00 to $325.00 and set an "overweight" rating on the stock in a report on Friday, May 23rd. Royal Bank Of Canada reiterated an "outperform" rating and set a $340.00 price target on shares of Workday in a report on Friday, May 23rd. Guggenheim reiterated a "neutral" rating on shares of Workday in a report on Friday, May 23rd. Finally, Mizuho cut their price target on shares of Workday from $320.00 to $275.00 and set an "outperform" rating on the stock in a report on Tuesday, April 15th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating, nineteen have given a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat, Workday currently has an average rating of "Moderate Buy" and a consensus target price of $296.88.

View Our Latest Research Report on Workday

Workday Profile

(

Free Report)

Workday, Inc provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. The company offers a suite of financial management applications to maintain accounting information in the general ledger; manage financial processes, such as payables and receivables; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations.

Further Reading

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.