XTX Topco Ltd lifted its holdings in shares of Williams Companies, Inc. (The) (NYSE:WMB - Free Report) by 1,003.4% during the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 62,219 shares of the pipeline company's stock after purchasing an additional 56,580 shares during the period. XTX Topco Ltd's holdings in Williams Companies were worth $3,718,000 at the end of the most recent reporting period.

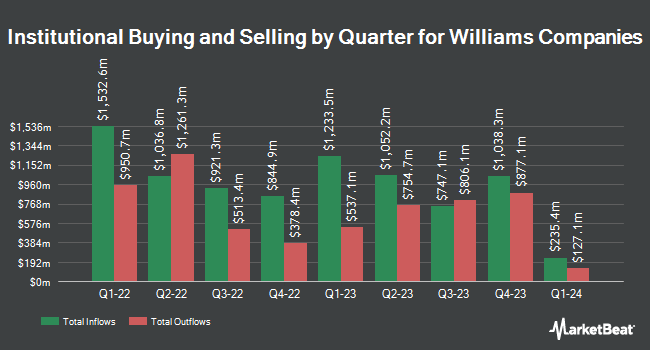

Other large investors also recently made changes to their positions in the company. Menard Financial Group LLC bought a new stake in shares of Williams Companies during the fourth quarter worth $26,000. HWG Holdings LP acquired a new position in shares of Williams Companies during the first quarter valued at $26,000. Hoey Investments Inc. acquired a new position in shares of Williams Companies during the fourth quarter valued at $28,000. Iron Horse Wealth Management LLC lifted its stake in shares of Williams Companies by 4,490.9% during the first quarter. Iron Horse Wealth Management LLC now owns 505 shares of the pipeline company's stock valued at $30,000 after acquiring an additional 494 shares during the period. Finally, Abound Financial LLC acquired a new position in shares of Williams Companies during the first quarter valued at $32,000. Institutional investors own 86.44% of the company's stock.

Williams Companies Trading Up 0.6%

Shares of Williams Companies stock traded up $0.37 during trading hours on Wednesday, hitting $59.26. The company's stock had a trading volume of 4,463,344 shares, compared to its average volume of 6,160,201. Williams Companies, Inc. has a 12 month low of $40.41 and a 12 month high of $63.45. The stock has a 50 day moving average of $59.37 and a 200 day moving average of $58.24. The company has a market capitalization of $72.26 billion, a PE ratio of 31.69, a price-to-earnings-growth ratio of 1.95 and a beta of 0.65. The company has a debt-to-equity ratio of 1.63, a current ratio of 0.40 and a quick ratio of 0.36.

Williams Companies (NYSE:WMB - Get Free Report) last announced its quarterly earnings results on Monday, May 5th. The pipeline company reported $0.60 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.55 by $0.05. The company had revenue of $3.05 billion during the quarter, compared to the consensus estimate of $2.90 billion. Williams Companies had a return on equity of 15.95% and a net margin of 21.18%. The company's revenue for the quarter was up 10.0% compared to the same quarter last year. During the same period in the prior year, the company earned $0.59 earnings per share. Analysts predict that Williams Companies, Inc. will post 2.08 earnings per share for the current year.

Williams Companies Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Investors of record on Friday, September 12th will be issued a dividend of $0.50 per share. The ex-dividend date of this dividend is Friday, September 12th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 3.37%. Williams Companies's payout ratio is presently 106.95%.

Analyst Ratings Changes

WMB has been the topic of several research reports. TD Cowen initiated coverage on Williams Companies in a research note on Monday, July 7th. They set a "buy" rating and a $67.00 price target on the stock. Scotiabank upped their price target on Williams Companies from $59.00 to $60.00 and gave the company a "sector perform" rating in a research note on Tuesday, July 15th. Wells Fargo & Company upped their price target on Williams Companies from $64.00 to $67.00 and gave the company an "overweight" rating in a research note on Wednesday, May 28th. Wolfe Research raised Williams Companies from an "underperform" rating to a "peer perform" rating in a research note on Friday, June 13th. Finally, Royal Bank Of Canada reissued an "outperform" rating and issued a $63.00 target price on shares of Williams Companies in a research note on Tuesday, July 15th. Eight analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat.com, Williams Companies presently has a consensus rating of "Moderate Buy" and an average price target of $61.77.

View Our Latest Analysis on WMB

Insider Activity

In related news, SVP Terrance Lane Wilson sold 2,000 shares of the stock in a transaction dated Tuesday, July 1st. The stock was sold at an average price of $62.70, for a total transaction of $125,400.00. Following the completion of the transaction, the senior vice president directly owned 315,645 shares in the company, valued at approximately $19,790,941.50. This trade represents a 0.63% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 0.44% of the company's stock.

Williams Companies Company Profile

(

Free Report)

The Williams Companies, Inc, together with its subsidiaries, operates as an energy infrastructure company primarily in the United States. It operates through Transmission & Gulf of Mexico, Northeast G&P, West, and Gas & NGL Marketing Services segments. The Transmission & Gulf of Mexico segment comprises natural gas pipelines; Transco, Northwest pipeline, MountainWest, and related natural gas storage facilities; and natural gas gathering and processing, and crude oil production handling and transportation assets in the Gulf Coast region.

Recommended Stories

Before you consider Williams Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Williams Companies wasn't on the list.

While Williams Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.