XTX Topco Ltd lessened its holdings in shares of PagSeguro Digital Ltd. (NYSE:PAGS - Free Report) by 87.5% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 17,135 shares of the company's stock after selling 119,529 shares during the period. XTX Topco Ltd's holdings in PagSeguro Digital were worth $131,000 as of its most recent SEC filing.

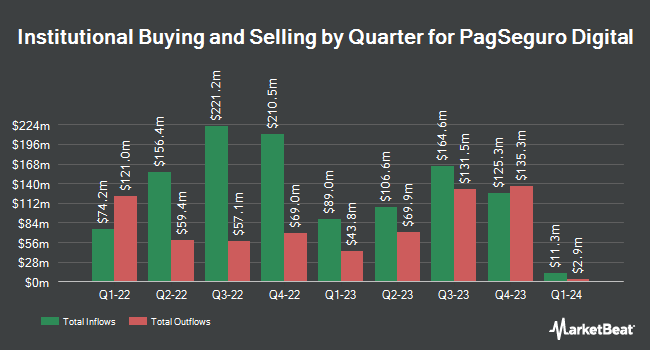

A number of other hedge funds have also recently modified their holdings of the business. Mirae Asset Global Investments Co. Ltd. boosted its stake in PagSeguro Digital by 626.4% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 5,143 shares of the company's stock worth $39,000 after purchasing an additional 4,435 shares in the last quarter. State of Wyoming boosted its stake in PagSeguro Digital by 32.8% in the 4th quarter. State of Wyoming now owns 6,436 shares of the company's stock worth $40,000 after purchasing an additional 1,591 shares in the last quarter. Harbor Capital Advisors Inc. boosted its stake in PagSeguro Digital by 166.9% in the 1st quarter. Harbor Capital Advisors Inc. now owns 6,685 shares of the company's stock worth $51,000 after purchasing an additional 4,180 shares in the last quarter. Signaturefd LLC boosted its stake in PagSeguro Digital by 50.6% in the 1st quarter. Signaturefd LLC now owns 6,863 shares of the company's stock worth $52,000 after purchasing an additional 2,306 shares in the last quarter. Finally, Advisory Services Network LLC bought a new position in PagSeguro Digital in the 4th quarter worth about $66,000. Institutional investors own 45.88% of the company's stock.

PagSeguro Digital Stock Performance

PAGS opened at $8.78 on Friday. The stock has a market capitalization of $2.89 billion, a P/E ratio of 7.19, a P/E/G ratio of 0.64 and a beta of 1.57. The company's 50-day simple moving average is $8.74 and its two-hundred day simple moving average is $8.50. PagSeguro Digital Ltd. has a 52-week low of $6.11 and a 52-week high of $14.82.

PagSeguro Digital (NYSE:PAGS - Get Free Report) last posted its earnings results on Wednesday, May 14th. The company reported $0.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.29 by $0.02. PagSeguro Digital had a net margin of 11.15% and a return on equity of 15.43%. The business had revenue of $857.50 million for the quarter, compared to analysts' expectations of $914.45 million. Research analysts forecast that PagSeguro Digital Ltd. will post 1.17 EPS for the current fiscal year.

PagSeguro Digital Cuts Dividend

The firm also recently disclosed a -- dividend, which will be paid on Friday, August 15th. Stockholders of record on Wednesday, July 16th will be paid a $0.12 dividend. This represents a dividend yield of 150.0%. The ex-dividend date is Wednesday, July 16th. PagSeguro Digital's dividend payout ratio is 11.48%.

Analysts Set New Price Targets

A number of brokerages recently issued reports on PAGS. Susquehanna dropped their price target on shares of PagSeguro Digital from $16.00 to $14.00 and set a "positive" rating on the stock in a research note on Wednesday, May 14th. Barclays dropped their price target on shares of PagSeguro Digital from $13.00 to $12.00 and set an "overweight" rating on the stock in a research note on Wednesday, April 23rd. JPMorgan Chase & Co. upped their price target on shares of PagSeguro Digital from $12.00 to $13.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 16th. Finally, Citigroup upgraded shares of PagSeguro Digital from a "neutral" rating to a "buy" rating and upped their target price for the company from $7.00 to $10.00 in a research note on Tuesday, April 22nd. One analyst has rated the stock with a sell rating, four have issued a hold rating, four have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $11.36.

Check Out Our Latest Research Report on PagSeguro Digital

PagSeguro Digital Company Profile

(

Free Report)

PagSeguro Digital Ltd., together with its subsidiaries, provides financial technology solutions and services for consumers, individual entrepreneurs, micro-merchants, and small and medium-sized companies in Brazil and internationally. The company's products and services include PagSeguro Ecosystem, a digital ecosystem that operates as a closed loop where its clients are able to address their primary day to day financial needs, including receiving and spending funds, and managing and growing their businesses; PagBank digital account, which offers payment and banking services through the PagBank mobile app, as well as centralizes various cash-in options, functionalities, services, and cash-out options in a single ecosystem; and PlugPag, a tool for medium-sized and larger merchants that enables them to connect their point of sale (POS) device directly to their enterprise resource planning software or sales automation system through Bluetooth.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PagSeguro Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PagSeguro Digital wasn't on the list.

While PagSeguro Digital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.