Y Intercept Hong Kong Ltd bought a new position in Markel Group Inc. (NYSE:MKL - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 287 shares of the insurance provider's stock, valued at approximately $537,000.

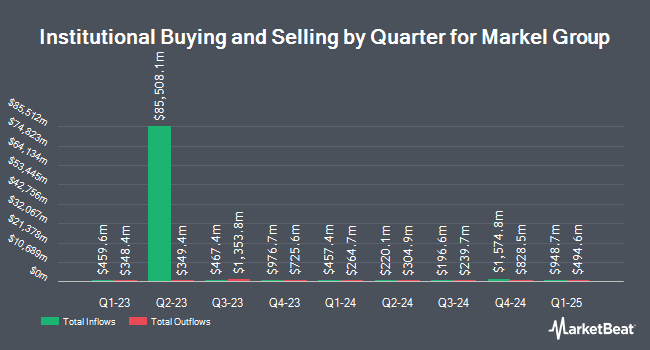

Several other institutional investors have also recently made changes to their positions in the company. Brighton Jones LLC purchased a new position in Markel Group during the 4th quarter valued at about $236,000. American Century Companies Inc. increased its position in Markel Group by 21.8% during the 4th quarter. American Century Companies Inc. now owns 15,938 shares of the insurance provider's stock valued at $27,513,000 after purchasing an additional 2,854 shares during the period. Sei Investments Co. increased its position in Markel Group by 0.9% during the 4th quarter. Sei Investments Co. now owns 7,067 shares of the insurance provider's stock valued at $12,199,000 after purchasing an additional 63 shares during the period. LPL Financial LLC increased its position in Markel Group by 7.9% during the 4th quarter. LPL Financial LLC now owns 6,164 shares of the insurance provider's stock valued at $10,641,000 after purchasing an additional 453 shares during the period. Finally, EntryPoint Capital LLC purchased a new position in Markel Group during the 4th quarter valued at about $221,000. Institutional investors own 77.12% of the company's stock.

Insider Buying and Selling

In related news, Director Greta J. Harris sold 90 shares of the business's stock in a transaction on Friday, May 23rd. The shares were sold at an average price of $1,861.44, for a total value of $167,529.60. Following the completion of the sale, the director owned 632 shares of the company's stock, valued at approximately $1,176,430.08. The trade was a 12.47% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 1.66% of the company's stock.

Analyst Upgrades and Downgrades

Separately, Argus upgraded shares of Markel Group from a "hold" rating to a "buy" rating in a report on Friday, May 30th. Four analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $1,820.33.

Read Our Latest Report on Markel Group

Markel Group Stock Performance

NYSE MKL traded down $16.78 on Monday, hitting $2,009.91. 41,689 shares of the company's stock traded hands, compared to its average volume of 37,394. The company has a current ratio of 0.62, a quick ratio of 0.62 and a debt-to-equity ratio of 0.26. Markel Group Inc. has a 1-year low of $1,491.03 and a 1-year high of $2,063.68. The firm's 50-day moving average price is $1,960.66 and its two-hundred day moving average price is $1,879.90. The firm has a market capitalization of $25.51 billion, a PE ratio of 14.81 and a beta of 0.84.

Markel Group Profile

(

Free Report)

Markel Group Inc, a diverse holding company, engages in marketing and underwriting specialty insurance products in the United States, Bermuda, the United Kingdom, and Germany. The company offers general and professional liability, personal lines, marine and energy, specialty programs, and workers' compensation insurance products; and property coverages that include fire, allied lines, and other specialized property coverages, including catastrophe-exposed property risks, such as earthquake and wind.

Further Reading

Before you consider Markel Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Markel Group wasn't on the list.

While Markel Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.