Yoffe Investment Management LLC bought a new position in Merck & Co., Inc. (NYSE:MRK - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor bought 7,387 shares of the company's stock, valued at approximately $735,000. Merck & Co., Inc. comprises 1.1% of Yoffe Investment Management LLC's portfolio, making the stock its 25th largest holding.

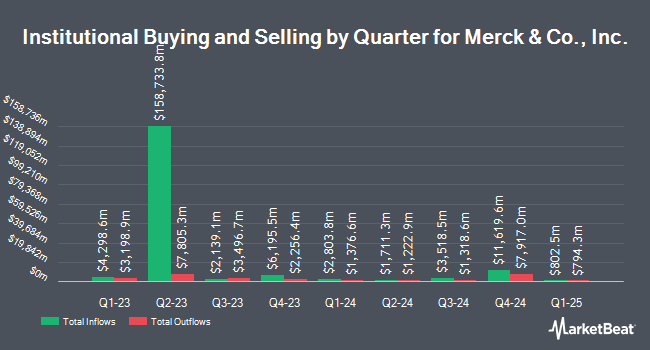

A number of other institutional investors and hedge funds also recently made changes to their positions in MRK. Norges Bank purchased a new stake in Merck & Co., Inc. in the 4th quarter valued at $3,479,799,000. Bank of New York Mellon Corp grew its stake in shares of Merck & Co., Inc. by 29.7% in the 4th quarter. Bank of New York Mellon Corp now owns 24,213,537 shares of the company's stock worth $2,408,763,000 after acquiring an additional 5,550,824 shares in the last quarter. Wellington Management Group LLP raised its holdings in shares of Merck & Co., Inc. by 6.5% in the fourth quarter. Wellington Management Group LLP now owns 80,742,030 shares of the company's stock valued at $8,032,217,000 after purchasing an additional 4,932,647 shares during the last quarter. Northern Trust Corp lifted its position in shares of Merck & Co., Inc. by 16.8% during the fourth quarter. Northern Trust Corp now owns 31,377,107 shares of the company's stock valued at $3,121,395,000 after purchasing an additional 4,511,742 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its holdings in Merck & Co., Inc. by 63.1% during the fourth quarter. Dimensional Fund Advisors LP now owns 11,577,535 shares of the company's stock worth $1,151,642,000 after purchasing an additional 4,480,007 shares during the last quarter. Institutional investors and hedge funds own 76.07% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have commented on the stock. Wall Street Zen lowered shares of Merck & Co., Inc. from a "strong-buy" rating to a "buy" rating in a research note on Friday, April 25th. Deutsche Bank Aktiengesellschaft downgraded Merck & Co., Inc. from a "buy" rating to a "hold" rating and decreased their price target for the company from $128.00 to $105.00 in a research report on Tuesday, February 18th. TD Cowen cut Merck & Co., Inc. from a "buy" rating to a "hold" rating and cut their price objective for the stock from $121.00 to $100.00 in a research report on Monday, February 10th. Bank of America decreased their target price on Merck & Co., Inc. from $118.00 to $112.00 and set a "buy" rating for the company in a research report on Wednesday, February 5th. Finally, Cantor Fitzgerald downgraded shares of Merck & Co., Inc. from an "overweight" rating to a "cautious" rating in a report on Tuesday, May 20th. One equities research analyst has rated the stock with a sell rating, twelve have given a hold rating, seven have issued a buy rating and three have issued a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $109.19.

Get Our Latest Report on Merck & Co., Inc.

Insider Buying and Selling at Merck & Co., Inc.

In other Merck & Co., Inc. news, SVP Dalton E. Smart III sold 4,262 shares of the stock in a transaction that occurred on Friday, April 25th. The shares were sold at an average price of $82.76, for a total value of $352,723.12. Following the sale, the senior vice president now directly owns 7,778 shares in the company, valued at $643,707.28. This represents a 35.40% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Insiders own 0.09% of the company's stock.

Merck & Co., Inc. Stock Performance

MRK traded down $0.11 on Thursday, hitting $76.06. The company's stock had a trading volume of 5,006,225 shares, compared to its average volume of 15,961,775. Merck & Co., Inc. has a 12 month low of $73.31 and a 12 month high of $134.63. The firm has a market cap of $191.00 billion, a P/E ratio of 11.30, a price-to-earnings-growth ratio of 0.77 and a beta of 0.43. The company has a quick ratio of 1.15, a current ratio of 1.36 and a debt-to-equity ratio of 0.79. The company's 50 day simple moving average is $80.74 and its 200-day simple moving average is $90.95.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last posted its quarterly earnings results on Thursday, April 24th. The company reported $2.22 EPS for the quarter, topping analysts' consensus estimates of $2.16 by $0.06. The firm had revenue of $15.53 billion during the quarter, compared to analyst estimates of $15.59 billion. Merck & Co., Inc. had a return on equity of 45.35% and a net margin of 26.67%. The business's revenue for the quarter was down 1.6% on a year-over-year basis. During the same period last year, the company earned $2.07 earnings per share. Analysts forecast that Merck & Co., Inc. will post 9.01 EPS for the current year.

Merck & Co., Inc. Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, July 8th. Shareholders of record on Monday, June 16th will be paid a $0.81 dividend. The ex-dividend date is Monday, June 16th. This represents a $3.24 annualized dividend and a yield of 4.26%. Merck & Co., Inc.'s dividend payout ratio is currently 47.16%.

Merck & Co., Inc. Profile

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

See Also

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report