DekaBank Deutsche Girozentrale decreased its stake in Yum China (NYSE:YUMC - Free Report) by 78.0% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 219,990 shares of the company's stock after selling 781,117 shares during the period. DekaBank Deutsche Girozentrale owned approximately 0.06% of Yum China worth $11,300,000 as of its most recent SEC filing.

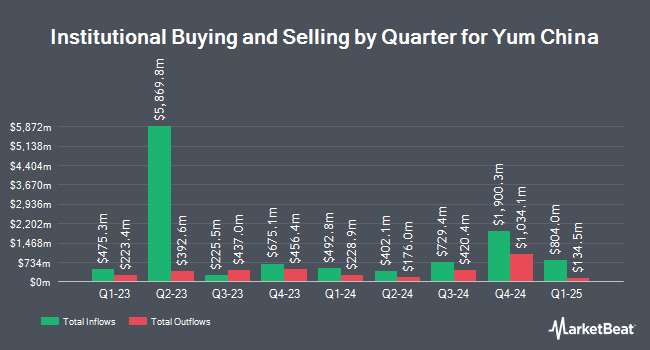

Other institutional investors have also recently added to or reduced their stakes in the company. Steward Partners Investment Advisory LLC boosted its position in shares of Yum China by 4.7% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 6,180 shares of the company's stock worth $298,000 after buying an additional 276 shares in the last quarter. Atria Investments Inc grew its position in shares of Yum China by 1.2% in the fourth quarter. Atria Investments Inc now owns 23,074 shares of the company's stock valued at $1,111,000 after purchasing an additional 273 shares during the last quarter. EverSource Wealth Advisors LLC increased its stake in shares of Yum China by 58.5% during the 4th quarter. EverSource Wealth Advisors LLC now owns 878 shares of the company's stock worth $42,000 after purchasing an additional 324 shares in the last quarter. Avantax Advisory Services Inc. acquired a new position in shares of Yum China during the 4th quarter worth approximately $231,000. Finally, Connor Clark & Lunn Investment Management Ltd. lifted its stake in Yum China by 305.9% in the 4th quarter. Connor Clark & Lunn Investment Management Ltd. now owns 280,094 shares of the company's stock valued at $13,492,000 after buying an additional 211,090 shares in the last quarter. Hedge funds and other institutional investors own 85.58% of the company's stock.

Yum China Trading Down 0.2%

Shares of YUMC traded down $0.11 on Monday, hitting $47.49. 1,332,270 shares of the stock traded hands, compared to its average volume of 2,882,486. The firm has a market capitalization of $17.63 billion, a P/E ratio of 19.87, a P/E/G ratio of 1.80 and a beta of 0.28. The company has a quick ratio of 1.11, a current ratio of 1.26 and a debt-to-equity ratio of 0.01. Yum China has a 1 year low of $28.50 and a 1 year high of $53.99. The stock's 50 day moving average is $44.44 and its two-hundred day moving average is $46.28.

Yum China (NYSE:YUMC - Get Free Report) last posted its quarterly earnings data on Wednesday, April 30th. The company reported $0.77 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.78 by ($0.01). Yum China had a return on equity of 14.08% and a net margin of 8.09%. The business had revenue of $2.98 billion for the quarter, compared to analyst estimates of $3.13 billion. During the same quarter last year, the business earned $0.71 EPS. Yum China's revenue for the quarter was up .8% compared to the same quarter last year. As a group, sell-side analysts predict that Yum China will post 2.54 earnings per share for the current year.

Yum China Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, June 18th. Stockholders of record on Wednesday, May 28th were issued a dividend of $0.24 per share. The ex-dividend date was Wednesday, May 28th. This represents a $0.96 annualized dividend and a dividend yield of 2.02%. Yum China's payout ratio is currently 40.17%.

Analyst Upgrades and Downgrades

Separately, Daiwa America raised Yum China to a "strong-buy" rating in a report on Wednesday, April 9th. One investment analyst has rated the stock with a hold rating, two have issued a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat, Yum China has a consensus rating of "Buy" and a consensus target price of $48.70.

Check Out Our Latest Report on YUMC

About Yum China

(

Free Report)

Yum China Holdings, Inc owns, operates, and franchises restaurants in the People's Republic of China. The company operates through KFC, Pizza Hut, and All Other segments. It operates restaurants under the KFC, Pizza Hut, Taco Bell, Lavazza, Little Sheep, and Huang Ji Huang concepts. The company also operates V-Gold Mall, a mobile e-commerce platform to sell products; and offers online food deliver services.

Featured Stories

Before you consider Yum China, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yum China wasn't on the list.

While Yum China currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.