Fjarde AP Fonden Fourth Swedish National Pension Fund reduced its position in shares of Zillow Group, Inc. (NASDAQ:Z - Free Report) by 7.5% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 40,814 shares of the financial services provider's stock after selling 3,300 shares during the period. Fjarde AP Fonden Fourth Swedish National Pension Fund's holdings in Zillow Group were worth $2,798,000 at the end of the most recent reporting period.

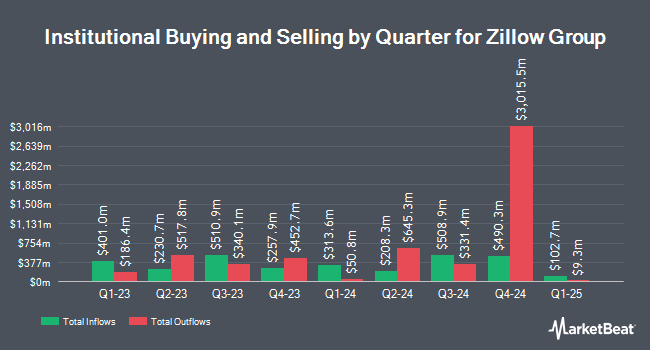

Other institutional investors and hedge funds have also made changes to their positions in the company. IFP Advisors Inc raised its position in shares of Zillow Group by 288.9% during the 1st quarter. IFP Advisors Inc now owns 455 shares of the financial services provider's stock valued at $31,000 after acquiring an additional 338 shares in the last quarter. National Pension Service increased its position in Zillow Group by 74.8% in the first quarter. National Pension Service now owns 577 shares of the financial services provider's stock worth $40,000 after buying an additional 247 shares during the period. GAMMA Investing LLC increased its position in Zillow Group by 47.7% in the first quarter. GAMMA Investing LLC now owns 607 shares of the financial services provider's stock worth $42,000 after buying an additional 196 shares during the period. Strategic Investment Solutions Inc. IL acquired a new stake in Zillow Group in the first quarter worth $49,000. Finally, Natixis acquired a new stake in Zillow Group in the fourth quarter worth $80,000. 71.01% of the stock is owned by institutional investors and hedge funds.

Zillow Group Stock Down 2.9%

NASDAQ Z traded down $2.40 during trading on Wednesday, hitting $81.10. The company's stock had a trading volume of 1,988,886 shares, compared to its average volume of 2,667,337. The firm has a 50 day moving average price of $76.49 and a 200 day moving average price of $72.75. The firm has a market cap of $19.65 billion, a P/E ratio of -311.92, a price-to-earnings-growth ratio of 15.91 and a beta of 2.09. Zillow Group, Inc. has a 52 week low of $52.86 and a 52 week high of $89.39.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on Z shares. Wells Fargo & Company raised Zillow Group to a "hold" rating in a research report on Monday, April 28th. Bank of America increased their target price on Zillow Group from $81.00 to $88.00 and gave the stock a "neutral" rating in a research report on Thursday, August 7th. JPMorgan Chase & Co. increased their target price on Zillow Group from $79.00 to $94.00 and gave the stock an "overweight" rating in a research report on Thursday, August 7th. Keefe, Bruyette & Woods dropped their target price on Zillow Group from $80.00 to $76.00 and set a "market perform" rating on the stock in a research report on Wednesday, May 7th. Finally, Wedbush reaffirmed an "outperform" rating and issued a $100.00 target price on shares of Zillow Group in a research report on Monday, May 5th. One research analyst has rated the stock with a Strong Buy rating, four have assigned a Buy rating and eight have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $88.29.

Get Our Latest Stock Report on Zillow Group

Insider Buying and Selling at Zillow Group

In other news, Chairman Richard N. Barton sold 150,000 shares of the business's stock in a transaction that occurred on Friday, August 15th. The stock was sold at an average price of $85.68, for a total transaction of $12,852,000.00. Following the sale, the chairman directly owned 2,501,225 shares in the company, valued at approximately $214,304,958. The trade was a 5.66% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, insider Dan Spaulding sold 5,680 shares of the business's stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $85.22, for a total value of $484,049.60. Following the sale, the insider owned 59,616 shares in the company, valued at approximately $5,080,475.52. This represents a 8.70% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 580,379 shares of company stock valued at $49,319,729 in the last quarter. 23.76% of the stock is currently owned by corporate insiders.

Zillow Group Profile

(

Free Report)

Zillow Group, Inc operates real estate brands in mobile applications and Websites in the United States. The company offers premier agent and rentals marketplaces, new construction marketplaces, advertising, display advertising, and business technology solutions, as well as dotloop and floor plans. It also provides mortgage originations and the sale of mortgages, and advertising to mortgage lenders and other mortgage professionals; and title and escrow services.

Featured Stories

Before you consider Zillow Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zillow Group wasn't on the list.

While Zillow Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.