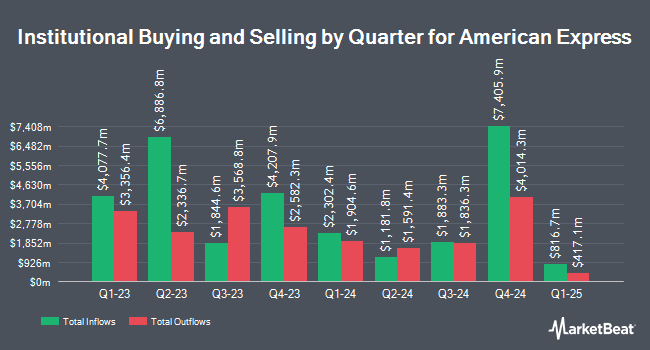

Zions Bancorporation National Association UT acquired a new position in American Express Company (NYSE:AXP - Free Report) in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 1,943 shares of the payment services company's stock, valued at approximately $523,000.

Other institutional investors and hedge funds have also modified their holdings of the company. Principal Financial Group Inc. lifted its stake in shares of American Express by 5.5% in the first quarter. Principal Financial Group Inc. now owns 680,308 shares of the payment services company's stock worth $183,037,000 after buying an additional 35,295 shares during the last quarter. Pinnacle Financial Partners Inc lifted its stake in shares of American Express by 1.4% in the first quarter. Pinnacle Financial Partners Inc now owns 167,534 shares of the payment services company's stock worth $45,243,000 after buying an additional 2,259 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its stake in shares of American Express by 6.4% in the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 94,458 shares of the payment services company's stock worth $25,088,000 after buying an additional 5,693 shares during the last quarter. Navis Wealth Advisors LLC lifted its stake in shares of American Express by 368.7% in the first quarter. Navis Wealth Advisors LLC now owns 3,548 shares of the payment services company's stock worth $955,000 after buying an additional 2,791 shares during the last quarter. Finally, Cambridge Investment Research Advisors Inc. lifted its stake in shares of American Express by 8.9% in the first quarter. Cambridge Investment Research Advisors Inc. now owns 95,443 shares of the payment services company's stock worth $25,679,000 after buying an additional 7,822 shares during the last quarter. 84.33% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research firms recently commented on AXP. DZ Bank cut shares of American Express from a "hold" rating to a "sell" rating in a research note on Monday, July 21st. Redburn Atlantic upgraded shares of American Express from a "sell" rating to a "neutral" rating and cut their target price for the company from $270.00 to $255.00 in a research note on Wednesday, April 23rd. Truist Financial upped their target price on shares of American Express from $335.00 to $340.00 and gave the company a "buy" rating in a research note on Wednesday, July 9th. JPMorgan Chase & Co. upped their target price on shares of American Express from $260.00 to $342.00 and gave the company a "neutral" rating in a research note on Friday, July 11th. Finally, Keefe, Bruyette & Woods upped their target price on shares of American Express from $360.00 to $371.00 and gave the company an "outperform" rating in a research note on Wednesday, July 9th. Two analysts have rated the stock with a sell rating, sixteen have given a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat, American Express has a consensus rating of "Hold" and an average target price of $311.05.

View Our Latest Analysis on AXP

American Express Stock Up 0.9%

AXP opened at $297.41 on Friday. The firm's 50-day simple moving average is $306.59 and its 200-day simple moving average is $290.69. The company has a debt-to-equity ratio of 1.80, a quick ratio of 1.60 and a current ratio of 1.61. American Express Company has a twelve month low of $220.43 and a twelve month high of $329.14. The firm has a market cap of $206.96 billion, a price-to-earnings ratio of 20.87, a PEG ratio of 1.58 and a beta of 1.28.

American Express (NYSE:AXP - Get Free Report) last posted its earnings results on Friday, July 18th. The payment services company reported $4.08 earnings per share for the quarter, topping the consensus estimate of $3.86 by $0.22. American Express had a net margin of 14.78% and a return on equity of 32.87%. The business had revenue of $17.86 billion for the quarter, compared to analyst estimates of $17.70 billion. During the same quarter in the prior year, the firm earned $3.49 EPS. The firm's quarterly revenue was up 9.3% compared to the same quarter last year. Equities research analysts anticipate that American Express Company will post 15.33 EPS for the current fiscal year.

American Express Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, August 8th. Investors of record on Thursday, July 3rd were given a dividend of $0.82 per share. The ex-dividend date was Thursday, July 3rd. This represents a $3.28 annualized dividend and a yield of 1.1%. American Express's dividend payout ratio is 23.02%.

Insider Buying and Selling

In related news, insider Anna Marrs sold 5,500 shares of the company's stock in a transaction dated Tuesday, July 29th. The shares were sold at an average price of $310.77, for a total transaction of $1,709,235.00. Following the transaction, the insider owned 20,311 shares in the company, valued at $6,312,049.47. This represents a 21.31% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Glenda G. Mcneal sold 50,000 shares of the company's stock in a transaction dated Tuesday, July 29th. The stock was sold at an average price of $309.50, for a total transaction of $15,475,000.00. Following the transaction, the insider owned 10,957 shares in the company, valued at approximately $3,391,191.50. This trade represents a 82.03% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 134,219 shares of company stock worth $40,555,901 in the last 90 days. Corporate insiders own 0.20% of the company's stock.

American Express Profile

(

Free Report)

American Express Company, together with its subsidiaries, operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally. It operates through four segments: U.S. Consumer Services, Commercial Services, International Card Services, and Global Merchant and Network Services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American Express, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Express wasn't on the list.

While American Express currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report