Tredje AP fonden grew its position in Zscaler, Inc. (NASDAQ:ZS - Free Report) by 53.7% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 107,090 shares of the company's stock after buying an additional 37,420 shares during the quarter. Tredje AP fonden owned approximately 0.07% of Zscaler worth $21,249,000 at the end of the most recent quarter.

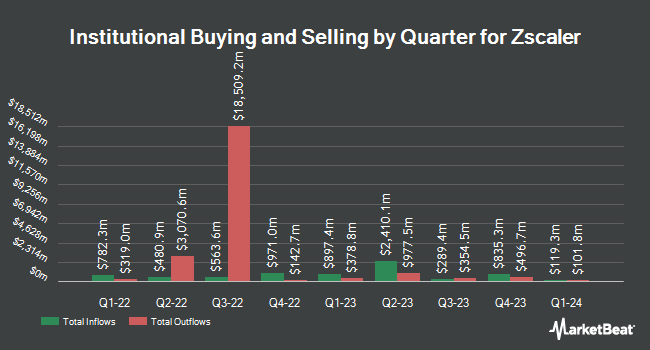

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Quintet Private Bank Europe S.A. boosted its holdings in shares of Zscaler by 4.7% during the first quarter. Quintet Private Bank Europe S.A. now owns 1,120 shares of the company's stock worth $222,000 after purchasing an additional 50 shares during the period. Corebridge Financial Inc. boosted its holdings in shares of Zscaler by 0.5% during the fourth quarter. Corebridge Financial Inc. now owns 11,695 shares of the company's stock worth $2,110,000 after purchasing an additional 54 shares during the period. Cerity Partners LLC boosted its holdings in shares of Zscaler by 0.3% during the first quarter. Cerity Partners LLC now owns 22,928 shares of the company's stock worth $4,549,000 after purchasing an additional 68 shares during the period. Koshinski Asset Management Inc. boosted its holdings in shares of Zscaler by 2.6% during the first quarter. Koshinski Asset Management Inc. now owns 2,801 shares of the company's stock worth $556,000 after purchasing an additional 70 shares during the period. Finally, Choreo LLC boosted its holdings in shares of Zscaler by 2.7% during the first quarter. Choreo LLC now owns 2,909 shares of the company's stock worth $577,000 after purchasing an additional 76 shares during the period. 46.45% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research firms recently commented on ZS. BNP Paribas upgraded shares of Zscaler from a "neutral" rating to an "outperform" rating and set a $260.00 price target for the company in a report on Monday, April 28th. Oppenheimer raised their price target on shares of Zscaler from $290.00 to $345.00 and gave the stock an "outperform" rating in a report on Friday, June 6th. Roth Capital reaffirmed a "neutral" rating on shares of Zscaler in a research report on Wednesday, May 28th. Piper Sandler reaffirmed a "neutral" rating and set a $260.00 price objective (up previously from $235.00) on shares of Zscaler in a research report on Friday, May 30th. Finally, Stephens reaffirmed an "overweight" rating and set a $255.00 price objective on shares of Zscaler in a research report on Tuesday, May 27th. Seven analysts have rated the stock with a hold rating, twenty-nine have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $296.82.

View Our Latest Report on ZS

Zscaler Stock Performance

Shares of NASDAQ:ZS traded down $2.34 on Wednesday, hitting $287.73. The stock had a trading volume of 1,051,130 shares, compared to its average volume of 1,598,249. Zscaler, Inc. has a twelve month low of $153.45 and a twelve month high of $318.46. The firm's 50 day moving average price is $294.03 and its 200-day moving average price is $236.88. The company has a market capitalization of $44.80 billion, a price-to-earnings ratio of -1,106.65 and a beta of 1.11.

Zscaler (NASDAQ:ZS - Get Free Report) last issued its earnings results on Thursday, May 29th. The company reported $0.84 EPS for the quarter, beating the consensus estimate of $0.76 by $0.08. Zscaler had a negative net margin of 1.52% and a negative return on equity of 0.59%. The company had revenue of $678.03 million for the quarter, compared to the consensus estimate of $667.13 million. During the same quarter in the previous year, the company earned $0.88 EPS. The firm's revenue for the quarter was up 22.6% compared to the same quarter last year. As a group, sell-side analysts predict that Zscaler, Inc. will post -0.1 EPS for the current year.

Insider Buying and Selling at Zscaler

In related news, insider Robert Schlossman sold 4,618 shares of the company's stock in a transaction dated Wednesday, June 4th. The shares were sold at an average price of $300.00, for a total transaction of $1,385,400.00. Following the transaction, the insider owned 95,612 shares in the company, valued at $28,683,600. This represents a 4.61% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Andrew William Fraser Brown sold 20,333 shares of the company's stock in a transaction dated Wednesday, June 4th. The stock was sold at an average price of $296.72, for a total transaction of $6,033,207.76. Following the transaction, the director owned 27,216 shares in the company, valued at approximately $8,075,531.52. This trade represents a 42.76% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 200,793 shares of company stock worth $58,752,794 over the last quarter. Corporate insiders own 18.10% of the company's stock.

About Zscaler

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Recommended Stories

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.