Zurcher Kantonalbank Zurich Cantonalbank acquired a new position in shares of HDFC Bank Limited (NYSE:HDB - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The fund acquired 5,434 shares of the bank's stock, valued at approximately $361,000.

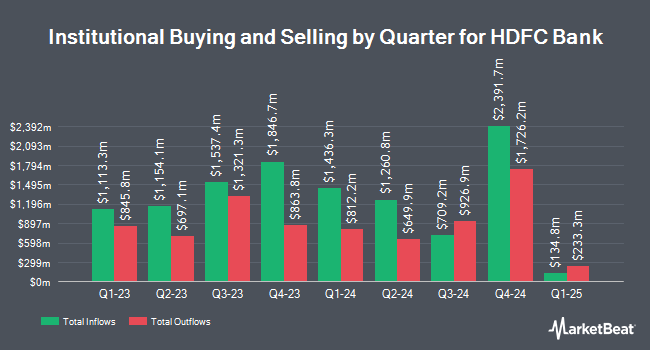

A number of other institutional investors have also made changes to their positions in the company. FourThought Financial Partners LLC raised its position in HDFC Bank by 9.2% during the first quarter. FourThought Financial Partners LLC now owns 9,946 shares of the bank's stock valued at $661,000 after buying an additional 841 shares during the period. HB Wealth Management LLC raised its stake in shares of HDFC Bank by 110.5% in the first quarter. HB Wealth Management LLC now owns 7,680 shares of the bank's stock valued at $510,000 after purchasing an additional 4,031 shares in the last quarter. Cetera Investment Advisers raised its holdings in shares of HDFC Bank by 44.6% in the 1st quarter. Cetera Investment Advisers now owns 23,213 shares of the bank's stock worth $1,542,000 after buying an additional 7,161 shares in the last quarter. Avantax Advisory Services Inc. raised its holdings in shares of HDFC Bank by 2.2% in the 1st quarter. Avantax Advisory Services Inc. now owns 62,285 shares of the bank's stock worth $4,138,000 after buying an additional 1,342 shares in the last quarter. Finally, ANTIPODES PARTNERS Ltd acquired a new stake in HDFC Bank during the 1st quarter valued at $3,482,000. 17.61% of the stock is currently owned by institutional investors.

HDFC Bank Stock Performance

Shares of HDB stock traded down $0.24 during trading on Tuesday, hitting $73.85. The company had a trading volume of 917,901 shares, compared to its average volume of 2,587,465. HDFC Bank Limited has a one year low of $57.78 and a one year high of $79.61. The firm has a market capitalization of $188.37 billion, a P/E ratio of 22.65, a price-to-earnings-growth ratio of 1.86 and a beta of 0.64. The stock's 50-day moving average price is $76.08 and its 200 day moving average price is $69.64.

HDFC Bank (NYSE:HDB - Get Free Report) last issued its quarterly earnings data on Saturday, July 19th. The bank reported $0.74 earnings per share for the quarter, missing the consensus estimate of $0.75 by ($0.01). The business had revenue of $5.10 billion during the quarter, compared to the consensus estimate of $5.03 billion. HDFC Bank had a return on equity of 11.60% and a net margin of 14.49%. On average, research analysts anticipate that HDFC Bank Limited will post 3.03 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen upgraded HDFC Bank from a "sell" rating to a "hold" rating in a research report on Saturday, July 26th.

View Our Latest Stock Report on HDB

About HDFC Bank

(

Free Report)

HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. The company operates in three segments: Wholesale Banking, Retail Banking, and Treasury Services. It accepts savings, salary, current, rural, public provident fund, pension, and demat accounts; fixed and recurring deposits; and safe deposit lockers, as well as offshore accounts and deposits, and overdrafts against fixed deposits.

Featured Stories

Before you consider HDFC Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HDFC Bank wasn't on the list.

While HDFC Bank currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.