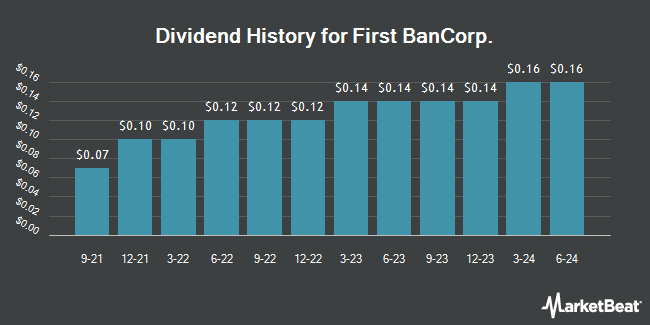

First BanCorp. (NYSE:FBP - Get Free Report) declared a quarterly dividend on Wednesday, October 22nd. Investors of record on Friday, November 28th will be paid a dividend of 0.18 per share by the bank on Friday, December 12th. This represents a c) dividend on an annualized basis and a yield of 3.5%. The ex-dividend date is Friday, November 28th.

First BanCorp. has a payout ratio of 33.5% meaning its dividend is sufficiently covered by earnings. Research analysts expect First BanCorp. to earn $2.10 per share next year, which means the company should continue to be able to cover its $0.72 annual dividend with an expected future payout ratio of 34.3%.

First BanCorp. Stock Performance

Shares of FBP opened at $20.50 on Thursday. The company's 50 day moving average price is $21.75 and its 200 day moving average price is $20.75. First BanCorp. has a 52 week low of $16.40 and a 52 week high of $22.60. The company has a market capitalization of $3.29 billion, a PE ratio of 10.90, a PEG ratio of 1.13 and a beta of 0.93. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.80 and a current ratio of 0.80.

First BanCorp. (NYSE:FBP - Get Free Report) last posted its earnings results on Thursday, October 23rd. The bank reported $0.51 EPS for the quarter, topping the consensus estimate of $0.48 by $0.03. First BanCorp. had a net margin of 24.71% and a return on equity of 17.54%. Research analysts expect that First BanCorp. will post 1.85 EPS for the current fiscal year.

Insider Activity

In related news, CEO Aurelio Aleman sold 50,000 shares of the company's stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $22.30, for a total transaction of $1,115,000.00. Following the completion of the sale, the chief executive officer directly owned 1,059,547 shares of the company's stock, valued at approximately $23,627,898.10. This represents a 4.51% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 2.30% of the company's stock.

Hedge Funds Weigh In On First BanCorp.

Several large investors have recently bought and sold shares of the stock. Choreo LLC increased its stake in First BanCorp. by 4.7% in the second quarter. Choreo LLC now owns 11,061 shares of the bank's stock valued at $230,000 after acquiring an additional 499 shares during the period. California State Teachers Retirement System raised its position in First BanCorp. by 0.4% in the second quarter. California State Teachers Retirement System now owns 151,294 shares of the bank's stock worth $3,151,000 after purchasing an additional 529 shares in the last quarter. Xponance Inc. raised its position in First BanCorp. by 5.0% in the first quarter. Xponance Inc. now owns 12,191 shares of the bank's stock worth $234,000 after purchasing an additional 584 shares in the last quarter. Farther Finance Advisors LLC raised its position in First BanCorp. by 103.4% in the first quarter. Farther Finance Advisors LLC now owns 1,383 shares of the bank's stock worth $27,000 after purchasing an additional 703 shares in the last quarter. Finally, Covestor Ltd raised its position in First BanCorp. by 19.6% in the first quarter. Covestor Ltd now owns 4,340 shares of the bank's stock worth $83,000 after purchasing an additional 711 shares in the last quarter. 97.91% of the stock is currently owned by institutional investors and hedge funds.

About First BanCorp.

(

Get Free Report)

First BanCorp. operates as a bank holding company for FirstBank Puerto Rico that provides a range of financial products and services to consumers and commercial customers. The company operates through six segments: Commercial and Corporate Banking, Mortgage Banking, Consumer (Retail) Banking, Treasury and Investments, United States Operations, and Virgin Islands Operations.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider First BanCorp., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First BanCorp. wasn't on the list.

While First BanCorp. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.