Five Star Bancorp (NASDAQ:FSBC - Get Free Report) is projected to release its Q3 2025 results after the market closes on Monday, October 27th. Analysts expect Five Star Bancorp to post earnings of $0.72 per share and revenue of $40.3370 million for the quarter. Interested persons can check the company's upcoming Q3 2025 earningsummary page for the latest details on the call scheduled for Tuesday, October 28, 2025 at 1:00 PM ET.

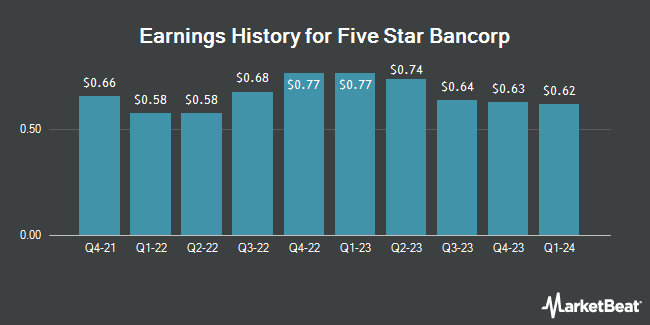

Five Star Bancorp (NASDAQ:FSBC - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The company reported $0.68 EPS for the quarter, topping the consensus estimate of $0.65 by $0.03. Five Star Bancorp had a return on equity of 12.89% and a net margin of 22.14%.The company had revenue of $38.33 million during the quarter, compared to analyst estimates of $37.60 million. On average, analysts expect Five Star Bancorp to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Five Star Bancorp Trading Up 2.5%

NASDAQ:FSBC opened at $32.29 on Monday. Five Star Bancorp has a 12 month low of $22.22 and a 12 month high of $35.13. The stock has a 50 day moving average of $32.25 and a two-hundred day moving average of $29.67. The firm has a market cap of $690.04 million, a P/E ratio of 13.18 and a beta of 0.51.

Insider Buying and Selling

In related news, COO Lydia Ann Ramirez-Medina sold 825 shares of the company's stock in a transaction that occurred on Friday, August 15th. The stock was sold at an average price of $30.94, for a total value of $25,525.50. Following the transaction, the chief operating officer directly owned 11,960 shares in the company, valued at approximately $370,042.40. This represents a 6.45% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 25.57% of the company's stock.

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in the business. Adage Capital Partners GP L.L.C. boosted its holdings in Five Star Bancorp by 26.0% during the 2nd quarter. Adage Capital Partners GP L.L.C. now owns 293,249 shares of the company's stock valued at $8,369,000 after acquiring an additional 60,584 shares during the period. Qube Research & Technologies Ltd boosted its holdings in Five Star Bancorp by 69.5% during the 2nd quarter. Qube Research & Technologies Ltd now owns 81,335 shares of the company's stock valued at $2,321,000 after acquiring an additional 33,350 shares during the period. Jane Street Group LLC purchased a new position in Five Star Bancorp during the 1st quarter valued at about $889,000. Gabelli Funds LLC purchased a new stake in shares of Five Star Bancorp during the second quarter worth $683,000. Finally, Marshall Wace LLP purchased a new stake in shares of Five Star Bancorp during the second quarter worth $509,000. 46.94% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several research analysts have recently weighed in on the company. DA Davidson boosted their target price on Five Star Bancorp from $37.00 to $39.00 and gave the stock a "buy" rating in a report on Friday, July 25th. Janney Montgomery Scott assumed coverage on Five Star Bancorp in a report on Friday, October 10th. They set a "buy" rating and a $37.00 target price on the stock. Keefe, Bruyette & Woods boosted their target price on Five Star Bancorp from $32.00 to $33.00 and gave the stock a "market perform" rating in a report on Monday, July 28th. Finally, Weiss Ratings restated a "buy (b-)" rating on shares of Five Star Bancorp in a report on Wednesday, October 8th. Six investment analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. According to data from MarketBeat.com, Five Star Bancorp presently has an average rating of "Moderate Buy" and a consensus target price of $35.40.

Get Our Latest Analysis on Five Star Bancorp

About Five Star Bancorp

(

Get Free Report)

Five Star Bancorp operates as the bank holding company for Five Star Bank that provides a range of banking products and services to small and medium-sized businesses, professionals, and individuals in Northern California. It accepts various deposits, such as money market accounts, noninterest-bearing and interest checking accounts, savings accounts, term certificate accounts, and time deposits.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Five Star Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Star Bancorp wasn't on the list.

While Five Star Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.