Five9 (NASDAQ:FIVN - Get Free Report)'s stock had its "buy" rating restated by stock analysts at Rosenblatt Securities in a report issued on Friday,Benzinga reports. They presently have a $36.00 price target on the software maker's stock. Rosenblatt Securities' target price would indicate a potential upside of 39.37% from the stock's current price.

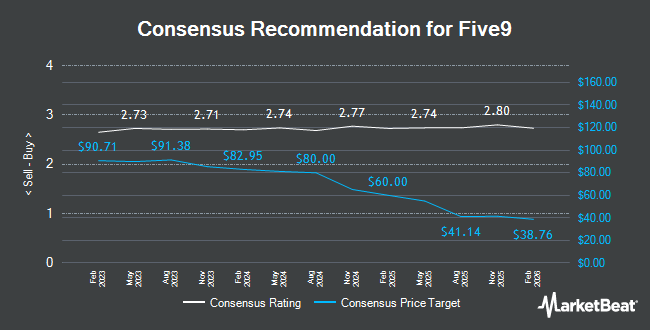

FIVN has been the subject of a number of other reports. Needham & Company LLC lowered their price target on shares of Five9 from $52.00 to $40.00 and set a "buy" rating for the company in a research report on Friday, May 2nd. UBS Group lowered their price target on shares of Five9 from $55.00 to $35.00 and set a "buy" rating for the company in a research report on Friday, May 2nd. Mizuho lowered their price target on shares of Five9 from $55.00 to $42.00 and set an "outperform" rating for the company in a research report on Tuesday, April 15th. Evercore ISI decreased their target price on shares of Five9 from $55.00 to $40.00 and set an "outperform" rating for the company in a report on Friday, May 2nd. Finally, Wells Fargo & Company decreased their target price on shares of Five9 from $45.00 to $23.00 and set an "equal weight" rating for the company in a report on Tuesday, April 22nd. Seven research analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $42.05.

Check Out Our Latest Stock Analysis on FIVN

Five9 Price Performance

Shares of Five9 stock opened at $25.83 on Friday. The firm has a market cap of $1.97 billion, a PE ratio of -286.97, a price-to-earnings-growth ratio of 2.60 and a beta of 1.19. Five9 has a 12-month low of $21.04 and a 12-month high of $49.90. The company has a quick ratio of 2.02, a current ratio of 2.02 and a debt-to-equity ratio of 1.12. The company's fifty day simple moving average is $27.46 and its two-hundred day simple moving average is $30.14.

Five9 (NASDAQ:FIVN - Get Free Report) last announced its earnings results on Thursday, July 31st. The software maker reported $0.76 earnings per share for the quarter, beating analysts' consensus estimates of $0.65 by $0.11. The firm had revenue of $283.27 million for the quarter, compared to analyst estimates of $275.18 million. Five9 had a negative net margin of 0.48% and a positive return on equity of 6.06%. The company's revenue for the quarter was up 12.4% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.52 EPS. As a group, equities analysts expect that Five9 will post 0.28 EPS for the current year.

Insider Transactions at Five9

In related news, EVP Panos Kozanian sold 3,816 shares of the company's stock in a transaction on Wednesday, June 4th. The shares were sold at an average price of $28.28, for a total transaction of $107,916.48. Following the sale, the executive vice president owned 123,218 shares of the company's stock, valued at $3,484,605.04. This represents a 3.00% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Michael Burkland sold 12,594 shares of the company's stock in a transaction on Tuesday, June 3rd. The shares were sold at an average price of $27.17, for a total transaction of $342,178.98. Following the sale, the chief executive officer directly owned 391,462 shares in the company, valued at approximately $10,636,022.54. The trade was a 3.12% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 32,866 shares of company stock valued at $913,042. 1.60% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Five9

A number of hedge funds have recently bought and sold shares of FIVN. LPL Financial LLC purchased a new stake in Five9 during the fourth quarter valued at $328,000. Wellington Management Group LLP grew its holdings in shares of Five9 by 50.9% in the fourth quarter. Wellington Management Group LLP now owns 1,783,870 shares of the software maker's stock worth $72,496,000 after purchasing an additional 601,348 shares during the last quarter. Geode Capital Management LLC grew its holdings in shares of Five9 by 8.7% in the fourth quarter. Geode Capital Management LLC now owns 1,317,450 shares of the software maker's stock worth $53,558,000 after purchasing an additional 105,265 shares during the last quarter. ExodusPoint Capital Management LP grew its holdings in shares of Five9 by 112.1% in the fourth quarter. ExodusPoint Capital Management LP now owns 111,144 shares of the software maker's stock worth $4,517,000 after purchasing an additional 58,733 shares during the last quarter. Finally, Conquis Financial LLC bought a new position in shares of Five9 in the fourth quarter worth about $122,000. Hedge funds and other institutional investors own 96.64% of the company's stock.

About Five9

(

Get Free Report)

Five9, Inc, together with its subsidiaries, provides intelligent cloud software for contact centers in the United States, India, and internationally. It offers a virtual contact center cloud platform that delivers a suite of applications, which enables the breadth of contact center-related customer service, sales, and marketing functions.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Five9, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five9 wasn't on the list.

While Five9 currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.