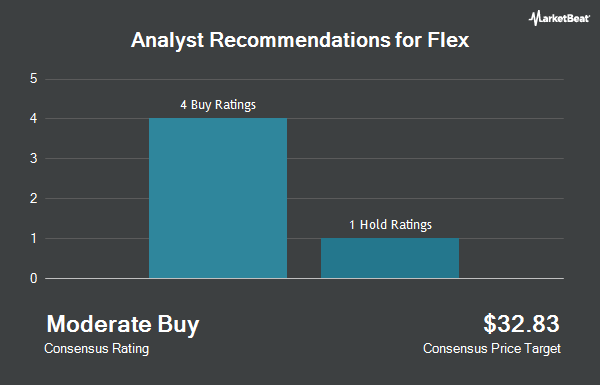

Shares of Flex Ltd. (NASDAQ:FLEX - Get Free Report) have been assigned a consensus rating of "Buy" from the six ratings firms that are currently covering the stock, Marketbeat Ratings reports. Six analysts have rated the stock with a buy recommendation. The average 1-year price objective among analysts that have issued a report on the stock in the last year is $45.33.

Several equities research analysts recently issued reports on FLEX shares. Wall Street Zen raised Flex from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, May 28th. The Goldman Sachs Group dropped their price target on Flex from $53.00 to $41.00 and set a "buy" rating on the stock in a research report on Thursday, April 10th. Stifel Nicolaus started coverage on Flex in a research report on Tuesday, February 11th. They set a "buy" rating and a $52.00 price target on the stock. KeyCorp upped their price target on Flex from $35.00 to $44.00 and gave the company an "overweight" rating in a research report on Friday, May 9th. Finally, JPMorgan Chase & Co. dropped their price target on Flex from $52.00 to $40.00 and set an "overweight" rating on the stock in a research report on Thursday, April 17th.

View Our Latest Analysis on Flex

Insiders Place Their Bets

In other Flex news, EVP David Scott Offer sold 87,093 shares of the stock in a transaction on Friday, May 2nd. The stock was sold at an average price of $36.43, for a total value of $3,172,797.99. Following the sale, the executive vice president now directly owns 71,001 shares of the company's stock, valued at $2,586,566.43. This trade represents a 55.09% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CAO Daniel Wendler sold 4,502 shares of the stock in a transaction on Tuesday, May 13th. The stock was sold at an average price of $41.99, for a total value of $189,038.98. Following the completion of the sale, the chief accounting officer now directly owns 38,676 shares in the company, valued at $1,624,005.24. This represents a 10.43% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 710,106 shares of company stock valued at $29,050,539 over the last three months. Company insiders own 0.82% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the business. Evergreen Capital Management LLC grew its stake in shares of Flex by 1.0% in the fourth quarter. Evergreen Capital Management LLC now owns 24,098 shares of the technology company's stock worth $925,000 after purchasing an additional 246 shares in the last quarter. Rockefeller Capital Management L.P. grew its stake in shares of Flex by 2.1% in the fourth quarter. Rockefeller Capital Management L.P. now owns 12,709 shares of the technology company's stock worth $488,000 after purchasing an additional 266 shares in the last quarter. Dynasty Wealth Management LLC grew its stake in shares of Flex by 0.7% in the first quarter. Dynasty Wealth Management LLC now owns 37,233 shares of the technology company's stock worth $1,232,000 after purchasing an additional 276 shares in the last quarter. WealthTrust Axiom LLC grew its stake in shares of Flex by 1.8% in the first quarter. WealthTrust Axiom LLC now owns 17,120 shares of the technology company's stock worth $566,000 after purchasing an additional 300 shares in the last quarter. Finally, SBI Securities Co. Ltd. grew its stake in shares of Flex by 30.8% in the first quarter. SBI Securities Co. Ltd. now owns 1,299 shares of the technology company's stock worth $43,000 after purchasing an additional 306 shares in the last quarter. Institutional investors own 94.30% of the company's stock.

Flex Stock Performance

Shares of FLEX opened at $42.56 on Friday. The business's 50 day moving average is $36.25 and its two-hundred day moving average is $38.16. Flex has a 52-week low of $25.11 and a 52-week high of $45.10. The firm has a market cap of $15.89 billion, a price-to-earnings ratio of 17.16, a PEG ratio of 2.43 and a beta of 1.04. The company has a quick ratio of 0.83, a current ratio of 1.41 and a debt-to-equity ratio of 0.63.

Flex (NASDAQ:FLEX - Get Free Report) last announced its earnings results on Wednesday, May 7th. The technology company reported $0.73 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.69 by $0.04. Flex had a return on equity of 17.93% and a net margin of 3.95%. The company had revenue of $6.40 billion for the quarter, compared to analyst estimates of $6.22 billion. During the same period in the prior year, the company posted $0.57 EPS. Flex's quarterly revenue was up 3.7% on a year-over-year basis. Analysts forecast that Flex will post 2.33 EPS for the current fiscal year.

About Flex

(

Get Free ReportFlex Ltd. provides technology, supply chain, and manufacturing solutions in Asia, the Americas, and Europe. It operates through three segments: Flex Agility Solutions (FAS), Flex Reliability Solutions (FRS), and Nextracker. The FAS segment offers flexible supply and manufacturing system comprising communications, enterprise and cloud solution, which includes data, edge, and communications infrastructure; lifestyle solution including appliances, consumer packaging, floorcare, micro mobility, and audio; and consumer devices, such as mobile and high velocity consumer devices.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Flex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flex wasn't on the list.

While Flex currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.