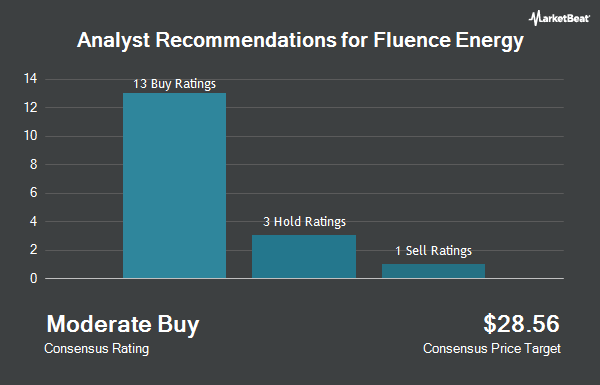

Shares of Fluence Energy, Inc. (NASDAQ:FLNC - Get Free Report) have been given a consensus rating of "Hold" by the twenty-four brokerages that are currently covering the stock, Marketbeat.com reports. Three investment analysts have rated the stock with a sell recommendation, seventeen have issued a hold recommendation and four have assigned a buy recommendation to the company. The average 1-year price target among brokerages that have issued a report on the stock in the last year is $8.1250.

FLNC has been the topic of several recent analyst reports. Barclays dropped their target price on shares of Fluence Energy from $9.00 to $8.00 and set an "equal weight" rating on the stock in a report on Tuesday, August 12th. Royal Bank Of Canada dropped their target price on shares of Fluence Energy from $8.00 to $7.00 and set a "sector perform" rating on the stock in a report on Wednesday, August 13th. BMO Capital Markets set a $5.00 target price on shares of Fluence Energy and gave the company a "market perform" rating in a report on Wednesday, June 25th. Hsbc Global Res lowered shares of Fluence Energy from a "hold" rating to a "moderate sell" rating in a report on Wednesday, August 13th. Finally, Seaport Res Ptn lowered shares of Fluence Energy from a "strong-buy" rating to a "hold" rating in a report on Tuesday, July 22nd.

View Our Latest Research Report on Fluence Energy

Institutional Investors Weigh In On Fluence Energy

Hedge funds and other institutional investors have recently bought and sold shares of the stock. Parallel Advisors LLC bought a new stake in Fluence Energy in the second quarter valued at $30,000. SBI Securities Co. Ltd. increased its stake in Fluence Energy by 462.6% in the first quarter. SBI Securities Co. Ltd. now owns 8,085 shares of the company's stock valued at $39,000 after purchasing an additional 6,648 shares in the last quarter. Ameritas Investment Partners Inc. increased its stake in Fluence Energy by 25.7% in the second quarter. Ameritas Investment Partners Inc. now owns 7,753 shares of the company's stock valued at $52,000 after purchasing an additional 1,586 shares in the last quarter. TFB Advisors LLC bought a new stake in Fluence Energy in the first quarter valued at $53,000. Finally, Voleon Capital Management LP bought a new stake in Fluence Energy in the first quarter valued at $55,000. 53.16% of the stock is owned by institutional investors.

Fluence Energy Price Performance

Shares of NASDAQ:FLNC opened at $11.91 on Monday. The firm has a market cap of $2.17 billion, a PE ratio of -56.71 and a beta of 2.66. The firm's fifty day moving average is $8.26 and its 200-day moving average is $6.36. The company has a debt-to-equity ratio of 0.75, a quick ratio of 1.06 and a current ratio of 1.64. Fluence Energy has a 52 week low of $3.46 and a 52 week high of $24.00.

Fluence Energy (NASDAQ:FLNC - Get Free Report) last issued its quarterly earnings results on Monday, August 11th. The company reported $0.01 EPS for the quarter, topping analysts' consensus estimates of ($0.02) by $0.03. The company had revenue of $602.53 million for the quarter, compared to analyst estimates of $738.52 million. Fluence Energy had a negative net margin of 0.76% and a negative return on equity of 3.42%. The business's revenue for the quarter was up 24.7% on a year-over-year basis. Fluence Energy has set its FY 2025 guidance at EPS. Sell-side analysts predict that Fluence Energy will post 0.08 earnings per share for the current year.

Fluence Energy Company Profile

(

Get Free Report)

Fluence Energy, Inc, through its subsidiaries, offers energy storage products and solution, services, and artificial intelligence enabled software-as-a-service products for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company sells energy storage products with integrated hardware, software, and digital intelligence.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fluence Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fluence Energy wasn't on the list.

While Fluence Energy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.