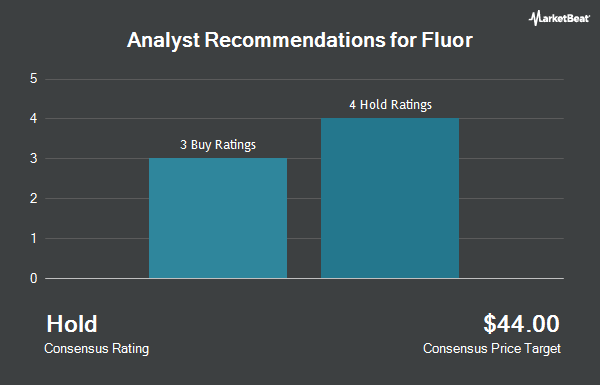

Shares of Fluor Co. (NYSE:FLR - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the eight ratings firms that are covering the stock, MarketBeat.com reports. Three analysts have rated the stock with a hold recommendation and five have assigned a buy recommendation to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $45.43.

A number of research analysts have recently commented on FLR shares. Wall Street Zen lowered Fluor from a "buy" rating to a "hold" rating in a report on Monday, May 5th. KeyCorp cut their target price on Fluor from $54.00 to $41.00 and set an "overweight" rating for the company in a research note on Friday, April 4th. Citigroup cut their target price on Fluor from $55.00 to $46.00 and set a "buy" rating for the company in a research note on Friday, April 25th. DA Davidson cut their target price on Fluor from $65.00 to $55.00 and set a "buy" rating for the company in a research note on Wednesday, February 19th. Finally, UBS Group cut their target price on Fluor from $49.00 to $48.00 and set a "buy" rating for the company in a research note on Wednesday, May 7th.

Get Our Latest Stock Analysis on Fluor

Fluor Stock Performance

Shares of FLR stock traded down $0.23 during trading hours on Friday, reaching $42.21. 4,645,568 shares of the company's stock were exchanged, compared to its average volume of 2,385,089. Fluor has a fifty-two week low of $29.20 and a fifty-two week high of $60.10. The stock has a market capitalization of $6.95 billion, a P/E ratio of 3.46, a P/E/G ratio of 1.36 and a beta of 1.24. The business has a fifty day moving average price of $36.03 and a 200-day moving average price of $43.53. The company has a quick ratio of 1.77, a current ratio of 1.69 and a debt-to-equity ratio of 0.28.

Fluor (NYSE:FLR - Get Free Report) last issued its quarterly earnings results on Friday, May 2nd. The construction company reported $0.73 EPS for the quarter, topping analysts' consensus estimates of $0.50 by $0.23. Fluor had a return on equity of 15.14% and a net margin of 13.14%. The company had revenue of $3.98 billion during the quarter, compared to analyst estimates of $4.27 billion. During the same period in the previous year, the company earned $0.47 earnings per share. The company's quarterly revenue was up 6.6% compared to the same quarter last year. Analysts predict that Fluor will post 2.5 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of FLR. Hurley Capital LLC acquired a new position in Fluor during the first quarter worth $29,000. Sterling Capital Management LLC raised its stake in Fluor by 196.2% during the fourth quarter. Sterling Capital Management LLC now owns 616 shares of the construction company's stock worth $30,000 after acquiring an additional 408 shares in the last quarter. Strategic Investment Solutions Inc. IL grew its holdings in shares of Fluor by 800.0% during the first quarter. Strategic Investment Solutions Inc. IL now owns 900 shares of the construction company's stock worth $32,000 after purchasing an additional 800 shares during the last quarter. Golden State Wealth Management LLC bought a new stake in shares of Fluor during the fourth quarter worth $33,000. Finally, SBI Securities Co. Ltd. grew its holdings in shares of Fluor by 222.9% during the first quarter. SBI Securities Co. Ltd. now owns 1,101 shares of the construction company's stock worth $39,000 after purchasing an additional 760 shares during the last quarter. 88.07% of the stock is currently owned by institutional investors and hedge funds.

About Fluor

(

Get Free ReportFluor Corporation provides engineering, procurement, and construction (EPC); fabrication and modularization; operation and maintenance; asset integrity; and project management services worldwide. The company operates through Energy Solutions, Urban Solutions, Mission Solutions, and Other segments. The Energy Solutions segment provides solutions to the energy transition markets, including asset decarbonization, carbon capture, renewable fuels, waste-to-energy, green chemicals, hydrogen, nuclear power, and other low-carbon energy sources.

Recommended Stories

Before you consider Fluor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fluor wasn't on the list.

While Fluor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.