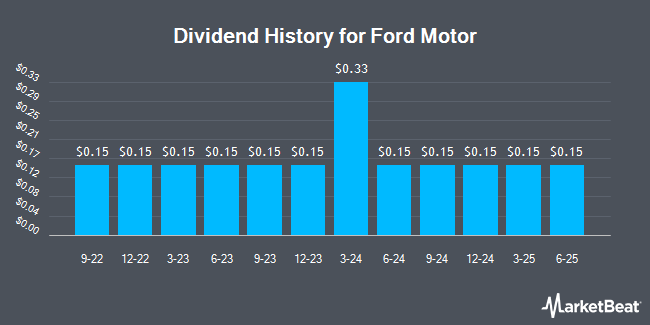

Ford Motor Company (NYSE:F - Get Free Report) announced a quarterly dividend on Wednesday, July 30th, RTT News reports. Stockholders of record on Monday, August 11th will be given a dividend of 0.15 per share by the auto manufacturer on Tuesday, September 2nd. This represents a c) annualized dividend and a dividend yield of 5.6%. The ex-dividend date is Monday, August 11th.

Ford Motor has a payout ratio of 45.5% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect Ford Motor to earn $1.54 per share next year, which means the company should continue to be able to cover its $0.60 annual dividend with an expected future payout ratio of 39.0%.

Ford Motor Trading Down 2.4%

Shares of F stock traded down $0.27 during trading hours on Friday, reaching $10.80. 73,499,128 shares of the stock were exchanged, compared to its average volume of 67,465,712. Ford Motor has a 12-month low of $8.44 and a 12-month high of $11.97. The company's 50-day moving average price is $10.91 and its 200-day moving average price is $10.22. The firm has a market capitalization of $42.95 billion, a price-to-earnings ratio of 13.85, a price-to-earnings-growth ratio of 3.23 and a beta of 1.49. The company has a current ratio of 1.10, a quick ratio of 0.97 and a debt-to-equity ratio of 2.24.

Ford Motor (NYSE:F - Get Free Report) last released its earnings results on Wednesday, July 30th. The auto manufacturer reported $0.37 earnings per share for the quarter, topping the consensus estimate of $0.33 by $0.04. The business had revenue of $50.18 billion during the quarter, compared to the consensus estimate of $42.91 billion. Ford Motor had a return on equity of 12.46% and a net margin of 1.70%. The business's revenue for the quarter was up 5.0% compared to the same quarter last year. During the same period last year, the company earned $0.47 earnings per share. As a group, equities analysts anticipate that Ford Motor will post 1.47 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of research firms have recently issued reports on F. Citigroup increased their price objective on shares of Ford Motor from $10.00 to $11.00 and gave the company a "neutral" rating in a research note on Wednesday, May 7th. Sanford C. Bernstein cut Ford Motor from a "market perform" rating to an "underperform" rating and dropped their target price for the company from $9.40 to $7.00 in a research report on Wednesday, April 9th. The Goldman Sachs Group boosted their price target on Ford Motor from $9.00 to $10.00 and gave the stock a "neutral" rating in a research report on Tuesday, May 6th. Wolfe Research upgraded Ford Motor from an "underperform" rating to a "peer perform" rating in a research note on Wednesday, April 30th. Finally, Piper Sandler lifted their target price on Ford Motor from $9.00 to $9.50 and gave the company a "neutral" rating in a research note on Thursday. Three equities research analysts have rated the stock with a sell rating, thirteen have given a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat, Ford Motor has a consensus rating of "Hold" and an average price target of $10.40.

Get Our Latest Stock Analysis on Ford Motor

Ford Motor Company Profile

(

Get Free Report)

Ford Motor Company develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide. It operates through Ford Blue, Ford Model e, and Ford Pro; Ford Next; and Ford Credit segments. The company sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments.

See Also

Before you consider Ford Motor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ford Motor wasn't on the list.

While Ford Motor currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.