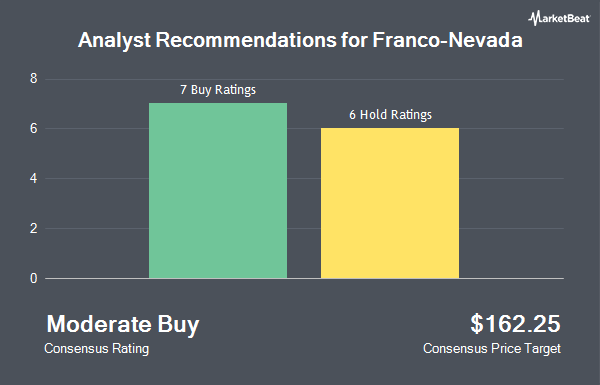

Franco-Nevada Corporation (NYSE:FNV - Get Free Report) TSE: FNV has earned an average recommendation of "Hold" from the fourteen research firms that are presently covering the stock, Marketbeat reports. Eight analysts have rated the stock with a hold recommendation and six have given a buy recommendation to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $210.2857.

Several equities analysts have issued reports on FNV shares. CIBC restated an "outperform" rating on shares of Franco-Nevada in a research note on Tuesday, July 15th. Wall Street Zen downgraded Franco-Nevada from a "buy" rating to a "hold" rating in a report on Friday, October 3rd. National Bankshares reissued a "sector perform" rating on shares of Franco-Nevada in a research report on Tuesday, June 24th. Scotiabank lifted their price target on Franco-Nevada from $182.00 to $184.00 and gave the stock a "sector perform" rating in a research report on Tuesday, August 12th. Finally, HC Wainwright boosted their price objective on Franco-Nevada from $195.00 to $200.00 and gave the company a "buy" rating in a research note on Tuesday, August 12th.

Check Out Our Latest Stock Report on FNV

Institutional Investors Weigh In On Franco-Nevada

Several hedge funds have recently made changes to their positions in FNV. MTM Investment Management LLC purchased a new stake in Franco-Nevada during the 2nd quarter valued at approximately $32,000. Smartleaf Asset Management LLC increased its holdings in shares of Franco-Nevada by 600.0% in the second quarter. Smartleaf Asset Management LLC now owns 196 shares of the basic materials company's stock valued at $32,000 after purchasing an additional 168 shares during the period. Cullen Frost Bankers Inc. purchased a new stake in shares of Franco-Nevada during the first quarter worth approximately $32,000. Golden State Wealth Management LLC raised its stake in shares of Franco-Nevada by 78.3% during the second quarter. Golden State Wealth Management LLC now owns 205 shares of the basic materials company's stock worth $34,000 after purchasing an additional 90 shares during the last quarter. Finally, Hexagon Capital Partners LLC lifted its holdings in shares of Franco-Nevada by 494.7% during the first quarter. Hexagon Capital Partners LLC now owns 226 shares of the basic materials company's stock worth $36,000 after purchasing an additional 188 shares during the period. Institutional investors and hedge funds own 77.06% of the company's stock.

Franco-Nevada Stock Down 5.3%

FNV stock opened at $203.81 on Friday. The stock has a market cap of $39.28 billion, a price-to-earnings ratio of 50.08, a PEG ratio of 2.79 and a beta of 0.42. Franco-Nevada has a fifty-two week low of $112.70 and a fifty-two week high of $225.63. The business has a 50 day moving average price of $199.22 and a 200 day moving average price of $176.31.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last issued its quarterly earnings data on Monday, August 11th. The basic materials company reported $1.24 earnings per share for the quarter, topping the consensus estimate of $1.10 by $0.14. Franco-Nevada had a net margin of 58.82% and a return on equity of 12.56%. The business had revenue of $369.40 million during the quarter, compared to the consensus estimate of $382.70 million. During the same quarter in the previous year, the firm earned $0.75 EPS. The company's revenue was up 42.0% compared to the same quarter last year. As a group, sell-side analysts anticipate that Franco-Nevada will post 3.09 EPS for the current year.

Franco-Nevada Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, September 25th. Investors of record on Thursday, September 11th were paid a dividend of $0.38 per share. The ex-dividend date was Thursday, September 11th. This represents a $1.52 dividend on an annualized basis and a yield of 0.7%. Franco-Nevada's dividend payout ratio is currently 37.35%.

About Franco-Nevada

(

Get Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.