Frontline (NYSE:FRO - Free Report) had its target price boosted by BTIG Research from $25.00 to $30.00 in a research report report published on Wednesday morning, MarketBeat.com reports. They currently have a buy rating on the shipping company's stock.

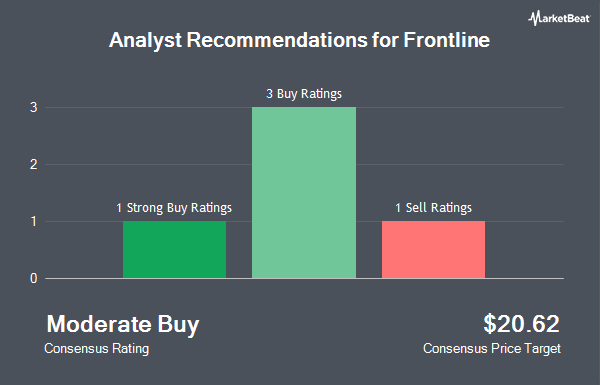

A number of other research firms have also weighed in on FRO. Wall Street Zen lowered shares of Frontline from a "hold" rating to a "sell" rating in a research report on Sunday, July 6th. Jefferies Financial Group reissued a "buy" rating and set a $25.00 target price on shares of Frontline in a research report on Friday, August 29th. One investment analyst has rated the stock with a Strong Buy rating, three have given a Buy rating and one has given a Sell rating to the company's stock. According to MarketBeat.com, Frontline has a consensus rating of "Moderate Buy" and an average price target of $21.87.

Read Our Latest Analysis on Frontline

Frontline Stock Performance

Frontline stock traded down $0.66 on Wednesday, reaching $23.21. 2,109,955 shares of the stock were exchanged, compared to its average volume of 2,575,094. The stock has a market cap of $5.17 billion, a PE ratio of 21.69 and a beta of 0.25. The company has a current ratio of 1.88, a quick ratio of 1.88 and a debt-to-equity ratio of 1.38. Frontline has a twelve month low of $12.40 and a twelve month high of $25.68. The firm has a fifty day moving average price of $20.23 and a two-hundred day moving average price of $17.98.

Frontline (NYSE:FRO - Get Free Report) last released its earnings results on Friday, August 29th. The shipping company reported $0.36 earnings per share for the quarter, missing analysts' consensus estimates of $0.42 by ($0.06). The firm had revenue of $282.95 million for the quarter, compared to analyst estimates of $328.71 million. Frontline had a return on equity of 10.27% and a net margin of 12.94%.The firm's revenue was up 34.2% on a year-over-year basis. During the same period in the prior year, the firm earned $0.62 EPS. Sell-side analysts anticipate that Frontline will post 1.78 EPS for the current year.

Frontline Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, September 24th. Shareholders of record on Friday, September 12th will be paid a dividend of $0.36 per share. This represents a $1.44 annualized dividend and a yield of 6.2%. The ex-dividend date of this dividend is Friday, September 12th. Frontline's dividend payout ratio is currently 134.58%.

Institutional Trading of Frontline

Several large investors have recently added to or reduced their stakes in the company. Signaturefd LLC grew its stake in Frontline by 59.3% during the first quarter. Signaturefd LLC now owns 2,657 shares of the shipping company's stock worth $39,000 after buying an additional 989 shares during the last quarter. Steward Partners Investment Advisory LLC grew its stake in shares of Frontline by 17.5% during the second quarter. Steward Partners Investment Advisory LLC now owns 9,730 shares of the shipping company's stock valued at $160,000 after purchasing an additional 1,447 shares during the last quarter. Financial Gravity Companies Inc. bought a new stake in shares of Frontline during the second quarter valued at approximately $25,000. TD Asset Management Inc grew its stake in shares of Frontline by 9.9% during the second quarter. TD Asset Management Inc now owns 17,079 shares of the shipping company's stock valued at $281,000 after purchasing an additional 1,535 shares during the last quarter. Finally, SBI Securities Co. Ltd. grew its stake in shares of Frontline by 9.3% during the second quarter. SBI Securities Co. Ltd. now owns 21,425 shares of the shipping company's stock valued at $352,000 after purchasing an additional 1,825 shares during the last quarter. 22.70% of the stock is owned by institutional investors.

About Frontline

(

Get Free Report)

Frontline plc, a shipping company, engages in the seaborne transportation of crude oil and oil products worldwide. It owns and operates oil and product tankers. As of December 31, 2022, the company operated a fleet of 70 vessels. It is also involved in the charter, purchase, and sale of vessels. The company was founded in 1985 and is based in Limassol, Cyprus.

Further Reading

Before you consider Frontline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Frontline wasn't on the list.

While Frontline currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.