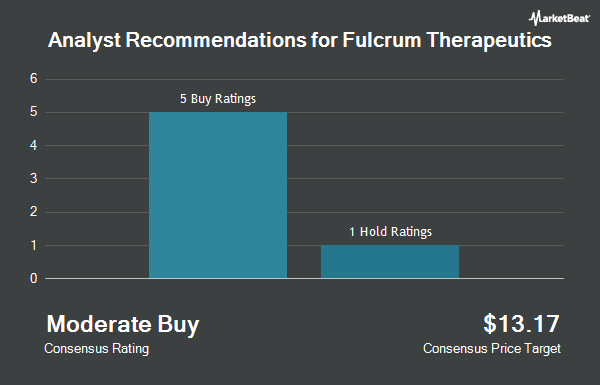

Fulcrum Therapeutics, Inc. (NASDAQ:FULC - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the eight research firms that are currently covering the company, Marketbeat.com reports. One equities research analyst has rated the stock with a sell rating, two have given a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company. The average 1 year price target among analysts that have updated their coverage on the stock in the last year is $7.5714.

Several equities analysts have recently commented on FULC shares. HC Wainwright raised shares of Fulcrum Therapeutics from a "neutral" rating to a "buy" rating and upped their price objective for the company from $4.00 to $12.00 in a research note on Tuesday, July 29th. Cantor Fitzgerald raised shares of Fulcrum Therapeutics from a "neutral" rating to an "overweight" rating and set a $10.00 price target for the company in a research note on Thursday, May 15th. Leerink Partners raised shares of Fulcrum Therapeutics from a "market perform" rating to an "outperform" rating and increased their price target for the stock from $4.00 to $12.00 in a research note on Friday, May 23rd. Wall Street Zen downgraded shares of Fulcrum Therapeutics from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. Finally, Piper Sandler reissued an "overweight" rating and issued a $9.00 price target (up from $6.00) on shares of Fulcrum Therapeutics in a research note on Thursday, May 29th.

Check Out Our Latest Stock Report on Fulcrum Therapeutics

Hedge Funds Weigh In On Fulcrum Therapeutics

A number of institutional investors have recently bought and sold shares of FULC. Wells Fargo & Company MN raised its stake in Fulcrum Therapeutics by 34.4% in the fourth quarter. Wells Fargo & Company MN now owns 34,264 shares of the company's stock worth $161,000 after buying an additional 8,761 shares in the last quarter. Mariner LLC bought a new position in Fulcrum Therapeutics in the fourth quarter worth about $78,000. MetLife Investment Management LLC increased its stake in shares of Fulcrum Therapeutics by 145.8% during the fourth quarter. MetLife Investment Management LLC now owns 40,107 shares of the company's stock valued at $189,000 after purchasing an additional 23,792 shares in the last quarter. Hsbc Holdings PLC increased its stake in shares of Fulcrum Therapeutics by 55.0% during the fourth quarter. Hsbc Holdings PLC now owns 75,959 shares of the company's stock valued at $355,000 after purchasing an additional 26,944 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD increased its stake in shares of Fulcrum Therapeutics by 46.6% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 52,368 shares of the company's stock valued at $247,000 after purchasing an additional 16,656 shares in the last quarter. 89.83% of the stock is owned by institutional investors.

Fulcrum Therapeutics Stock Up 1.7%

Shares of NASDAQ:FULC traded up $0.11 during midday trading on Friday, hitting $6.63. 227,121 shares of the stock traded hands, compared to its average volume of 640,652. The stock has a market capitalization of $358.62 million, a PE ratio of -5.43 and a beta of 2.47. The business's 50 day moving average is $7.11 and its two-hundred day moving average is $5.32. Fulcrum Therapeutics has a one year low of $2.32 and a one year high of $9.30.

Fulcrum Therapeutics (NASDAQ:FULC - Get Free Report) last issued its quarterly earnings data on Tuesday, July 29th. The company reported ($0.28) EPS for the quarter, beating the consensus estimate of ($0.29) by $0.01. As a group, sell-side analysts forecast that Fulcrum Therapeutics will post -0.16 earnings per share for the current year.

Fulcrum Therapeutics Company Profile

(

Get Free Report)

Fulcrum Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on developing products for improving the lives of patients with genetically defined diseases in the areas of high unmet medical need in the United States. Its product candidates are losmapimod, a small molecule for the treatment of facioscapulohumeral muscular dystrophy is under phase III clinical trial; and pociredir, a fetal hemoglobin inducer for the treatment of sickle cell disease and beta-thalassemia is under phase I clinical trial.

Featured Articles

Before you consider Fulcrum Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fulcrum Therapeutics wasn't on the list.

While Fulcrum Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.