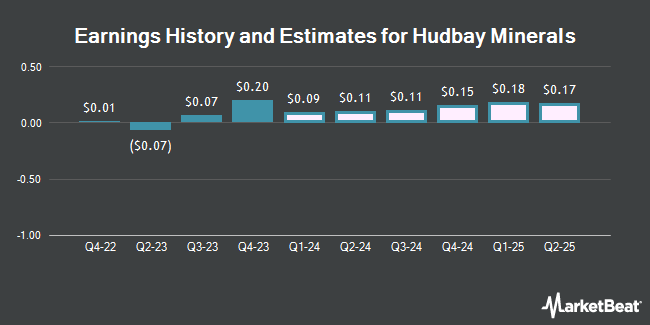

HudBay Minerals Inc (NYSE:HBM - Free Report) TSE: HBM - Stock analysts at Paradigm Capital raised their FY2025 earnings estimates for shares of HudBay Minerals in a research note issued on Wednesday, July 23rd. Paradigm Capital analyst J. Woolley now expects that the mining company will earn $0.81 per share for the year, up from their prior estimate of $0.53. The consensus estimate for HudBay Minerals' current full-year earnings is $0.79 per share. Paradigm Capital also issued estimates for HudBay Minerals' Q4 2025 earnings at $0.22 EPS, Q1 2026 earnings at ($0.08) EPS, Q2 2026 earnings at ($0.07) EPS, Q3 2026 earnings at ($0.07) EPS, Q4 2026 earnings at ($0.07) EPS, FY2026 earnings at ($0.29) EPS, FY2027 earnings at $1.18 EPS and FY2029 earnings at $0.68 EPS.

HudBay Minerals (NYSE:HBM - Get Free Report) TSE: HBM last released its quarterly earnings data on Monday, May 12th. The mining company reported $0.24 EPS for the quarter, topping analysts' consensus estimates of $0.10 by $0.14. HudBay Minerals had a net margin of 7.40% and a return on equity of 8.17%. The firm had revenue of $594.90 million during the quarter, compared to the consensus estimate of $537.36 million. During the same quarter in the previous year, the company posted $0.22 earnings per share. The firm's revenue was up 13.3% on a year-over-year basis.

Several other equities analysts have also recently weighed in on HBM. CIBC reaffirmed an "outperform" rating on shares of HudBay Minerals in a research note on Tuesday, July 15th. Wall Street Zen lowered HudBay Minerals from a "strong-buy" rating to a "buy" rating in a report on Friday, July 18th. Raymond James Financial raised HudBay Minerals to a "moderate buy" rating in a research report on Monday, June 30th. Scotiabank restated an "outperform" rating on shares of HudBay Minerals in a research report on Tuesday, May 13th. Finally, Desjardins started coverage on HudBay Minerals in a research report on Friday, April 4th. They set a "buy" rating on the stock. Six investment analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat, HudBay Minerals has a consensus rating of "Buy".

Check Out Our Latest Analysis on HBM

HudBay Minerals Price Performance

NYSE:HBM opened at $9.88 on Monday. The business's 50-day moving average price is $9.80 and its 200 day moving average price is $8.50. The firm has a market cap of $3.91 billion, a P/E ratio of 25.99, a PEG ratio of 0.26 and a beta of 1.63. HudBay Minerals has a 52-week low of $5.95 and a 52-week high of $11.13. The company has a quick ratio of 1.92, a current ratio of 2.32 and a debt-to-equity ratio of 0.42.

Hedge Funds Weigh In On HudBay Minerals

Several hedge funds have recently added to or reduced their stakes in the stock. Tower Research Capital LLC TRC boosted its stake in shares of HudBay Minerals by 9,877.4% during the 4th quarter. Tower Research Capital LLC TRC now owns 3,093 shares of the mining company's stock worth $25,000 after acquiring an additional 3,062 shares during the period. SBI Securities Co. Ltd. increased its holdings in HudBay Minerals by 64.6% in the 1st quarter. SBI Securities Co. Ltd. now owns 3,773 shares of the mining company's stock worth $29,000 after purchasing an additional 1,481 shares in the last quarter. Banque Cantonale Vaudoise acquired a new stake in shares of HudBay Minerals in the first quarter valued at about $33,000. Jones Financial Companies Lllp increased its stake in shares of HudBay Minerals by 131.6% in the first quarter. Jones Financial Companies Lllp now owns 6,570 shares of the mining company's stock valued at $50,000 after buying an additional 3,733 shares during the period. Finally, Algert Global LLC acquired a new stake in shares of HudBay Minerals in the fourth quarter valued at about $86,000. Institutional investors and hedge funds own 57.82% of the company's stock.

About HudBay Minerals

(

Get Free Report)

Hudbay Minerals Inc, a diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America. It produces copper concentrates containing gold, silver, and molybdenum; gold concentrates containing zinc; zinc concentrates; molybdenum concentrates; and silver/gold doré.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HudBay Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HudBay Minerals wasn't on the list.

While HudBay Minerals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.