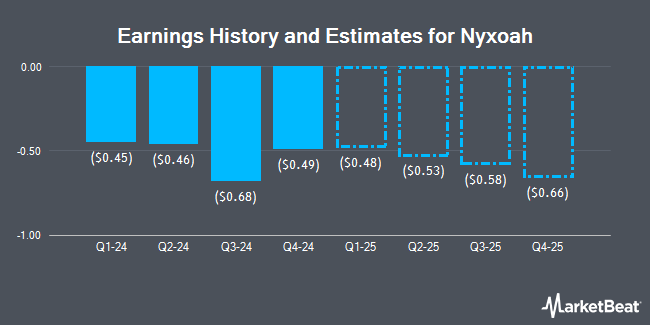

Nyxoah SA (NASDAQ:NYXH - Free Report) - Investment analysts at Cantor Fitzgerald dropped their FY2025 earnings estimates for shares of Nyxoah in a report released on Wednesday, August 20th. Cantor Fitzgerald analyst R. Osborn now anticipates that the company will earn ($2.53) per share for the year, down from their prior forecast of ($2.36). The consensus estimate for Nyxoah's current full-year earnings is ($1.91) per share. Cantor Fitzgerald also issued estimates for Nyxoah's FY2026 earnings at ($1.61) EPS.

Nyxoah Trading Down 3.2%

NASDAQ NYXH traded down $0.21 during trading on Friday, hitting $6.20. The company had a trading volume of 34,577 shares, compared to its average volume of 105,589. The company has a current ratio of 2.63, a quick ratio of 2.38 and a debt-to-equity ratio of 0.29. Nyxoah has a one year low of $5.55 and a one year high of $11.87. The company has a market cap of $211.00 million, a price-to-earnings ratio of -2.69 and a beta of 1.61. The company's fifty day moving average is $7.39 and its 200-day moving average is $7.81.

Nyxoah (NASDAQ:NYXH - Get Free Report) last issued its quarterly earnings data on Monday, August 18th. The company reported ($0.63) EPS for the quarter, missing the consensus estimate of ($0.62) by ($0.01). Nyxoah had a negative return on equity of 79.18% and a negative net margin of 1,541.84%.The company had revenue of $1.58 million during the quarter, compared to the consensus estimate of $1.33 million.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of NYXH. LPL Financial LLC bought a new position in shares of Nyxoah in the 4th quarter worth about $102,000. Geode Capital Management LLC increased its stake in shares of Nyxoah by 19.4% in the 4th quarter. Geode Capital Management LLC now owns 17,100 shares of the company's stock worth $137,000 after acquiring an additional 2,774 shares in the last quarter. Renaissance Technologies LLC bought a new position in shares of Nyxoah in the 4th quarter worth about $187,000. Walleye Capital LLC increased its stake in shares of Nyxoah by 23.9% in the 4th quarter. Walleye Capital LLC now owns 14,831 shares of the company's stock worth $119,000 after acquiring an additional 2,862 shares in the last quarter. Finally, Ameriprise Financial Inc. bought a new position in shares of Nyxoah in the 4th quarter worth about $135,000.

Nyxoah Company Profile

(

Get Free Report)

Nyxoah SA, a medical technology company, focuses on the development and commercialization of solutions to treat sleep disordered breathing conditions. The company's lead solution comprises Genio system, a CE-Marked, patient-centric, and hypoglossal neurostimulation therapy to treat moderate to severe obstructive sleep apnea.

Featured Stories

Before you consider Nyxoah, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nyxoah wasn't on the list.

While Nyxoah currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.