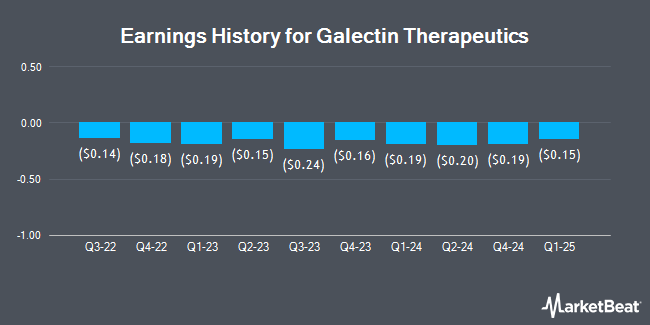

Galectin Therapeutics (NASDAQ:GALT - Get Free Report) posted its earnings results on Thursday. The company reported ($0.12) earnings per share for the quarter, topping analysts' consensus estimates of ($0.16) by $0.04, Zacks reports.

Galectin Therapeutics Stock Down 3.8%

Galectin Therapeutics stock traded down $0.15 during trading hours on Tuesday, hitting $3.75. The stock had a trading volume of 181,258 shares, compared to its average volume of 301,409. The business's 50 day simple moving average is $2.85 and its 200-day simple moving average is $1.90. Galectin Therapeutics has a one year low of $0.73 and a one year high of $4.41. The stock has a market cap of $240.23 million, a price-to-earnings ratio of -5.86 and a beta of 0.82.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on the company. Wall Street Zen upgraded Galectin Therapeutics from a "sell" rating to a "hold" rating in a research note on Saturday, June 21st. HC Wainwright reissued a "buy" rating and set a $6.00 target price on shares of Galectin Therapeutics in a report on Thursday, August 14th. One analyst has rated the stock with a Buy rating, According to data from MarketBeat.com, Galectin Therapeutics currently has an average rating of "Buy" and an average price target of $6.00.

Read Our Latest Stock Analysis on Galectin Therapeutics

Hedge Funds Weigh In On Galectin Therapeutics

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Jane Street Group LLC acquired a new position in shares of Galectin Therapeutics during the second quarter worth $1,580,000. Vivaldi Capital Management LP lifted its holdings in Galectin Therapeutics by 210.0% during the 2nd quarter. Vivaldi Capital Management LP now owns 172,443 shares of the company's stock worth $364,000 after buying an additional 116,815 shares during the period. XTX Topco Ltd grew its position in shares of Galectin Therapeutics by 226.6% in the 2nd quarter. XTX Topco Ltd now owns 42,805 shares of the company's stock valued at $90,000 after buying an additional 29,699 shares during the last quarter. Bank of America Corp DE raised its position in shares of Galectin Therapeutics by 101.4% during the fourth quarter. Bank of America Corp DE now owns 38,358 shares of the company's stock worth $49,000 after acquiring an additional 19,316 shares during the last quarter. Finally, Marshall Wace LLP bought a new position in Galectin Therapeutics during the 2nd quarter worth approximately $64,000. 11.68% of the stock is currently owned by institutional investors and hedge funds.

About Galectin Therapeutics

(

Get Free Report)

Galectin Therapeutics Inc, a clinical stage biopharmaceutical company, engages in the research and development of therapies for fibrotic, cancer, and other diseases. Its lead product candidate is belapectin (GR-MD-02) galectin-3 inhibitor, that is in Phase 2b/3 clinical trial, to prevent esophageal varices in patient with non-alcoholic steatohepatitis (NASH) cirrhosis; and Phase 2 clinical trial for the treatment of liver fibrosis, as well as severe skin disease, and melanoma and head and neck squamous cell carcinoma.

Read More

Before you consider Galectin Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Galectin Therapeutics wasn't on the list.

While Galectin Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.