Arete started coverage on shares of Genius Sports (NYSE:GENI - Free Report) in a report issued on Wednesday, Marketbeat Ratings reports. The firm issued a buy rating and a $15.00 price target on the stock.

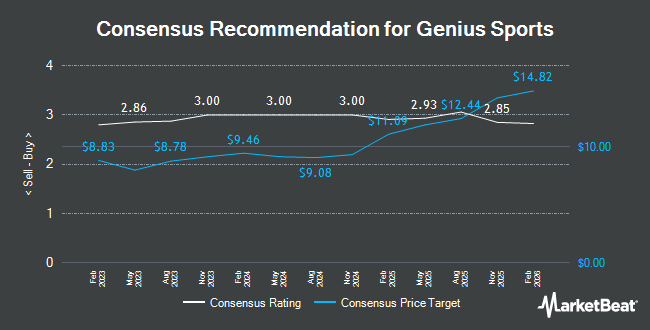

A number of other equities research analysts have also weighed in on GENI. Benchmark restated a "buy" rating and set a $12.00 price objective on shares of Genius Sports in a research report on Thursday, April 17th. Citigroup restated an "outperform" rating on shares of Genius Sports in a research report on Monday, June 30th. Needham & Company LLC restated a "buy" rating and issued a $13.00 price target on shares of Genius Sports in a research report on Thursday, June 12th. Guggenheim assumed coverage on shares of Genius Sports in a research report on Tuesday, March 18th. They issued a "buy" rating and a $12.00 price target for the company. Finally, Deutsche Bank Aktiengesellschaft assumed coverage on shares of Genius Sports in a research report on Monday, April 21st. They issued a "buy" rating and a $12.00 price target for the company. One research analyst has rated the stock with a hold rating, fourteen have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus price target of $12.63.

Read Our Latest Stock Report on Genius Sports

Genius Sports Stock Performance

Shares of GENI traded down $0.37 during mid-day trading on Wednesday, reaching $10.52. The company had a trading volume of 3,588,870 shares, compared to its average volume of 3,377,245. The company's 50 day simple moving average is $10.01 and its 200 day simple moving average is $9.62. Genius Sports has a 1-year low of $5.43 and a 1-year high of $11.40. The company has a market capitalization of $2.26 billion, a price-to-earnings ratio of -55.34 and a beta of 1.86.

Genius Sports (NYSE:GENI - Get Free Report) last posted its quarterly earnings results on Tuesday, May 6th. The company reported ($0.03) earnings per share for the quarter, beating analysts' consensus estimates of ($0.05) by $0.02. Genius Sports had a negative net margin of 8.54% and a negative return on equity of 6.90%. The company had revenue of $143.99 million for the quarter, compared to the consensus estimate of $143.31 million. During the same period last year, the company posted ($0.11) EPS. The firm's quarterly revenue was up 20.3% compared to the same quarter last year. As a group, equities analysts forecast that Genius Sports will post -0.1 earnings per share for the current fiscal year.

Genius Sports announced that its Board of Directors has approved a stock repurchase program on Tuesday, May 6th that authorizes the company to buyback $100.00 million in shares. This buyback authorization authorizes the company to buy up to 4.4% of its shares through open market purchases. Shares buyback programs are often an indication that the company's leadership believes its stock is undervalued.

Institutional Trading of Genius Sports

Several large investors have recently modified their holdings of GENI. Quarry LP bought a new stake in Genius Sports in the 1st quarter valued at about $37,000. Pacer Advisors Inc. increased its position in Genius Sports by 61.5% in the 1st quarter. Pacer Advisors Inc. now owns 3,754 shares of the company's stock valued at $38,000 after buying an additional 1,430 shares in the last quarter. Emerald Mutual Fund Advisers Trust bought a new stake in Genius Sports in the 4th quarter valued at about $58,000. IPG Investment Advisors LLC bought a new stake in Genius Sports in the 1st quarter valued at about $107,000. Finally, Park National Corp OH bought a new stake in Genius Sports in the 1st quarter valued at about $107,000. Institutional investors and hedge funds own 81.91% of the company's stock.

Genius Sports Company Profile

(

Get Free Report)

Genius Sports Limited engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries. It offers technology infrastructure for the collection, integration, and distribution of live data of sports leagues; streaming solutions comprising technology, automatic production, and distribution for sports to commercialize video footage of their games; and end-to-end integrity services to sports leagues, such as full-time active monitoring technology, which uses mathematical algorithms to identify and flag suspicious betting activity in global betting markets, as well as a full suite of online and offline educational and consultancy services.

See Also

Before you consider Genius Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genius Sports wasn't on the list.

While Genius Sports currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.