Northland Securities assumed coverage on shares of Genius Sports (NYSE:GENI - Get Free Report) in a research report issued to clients and investors on Friday,Briefing.com Automated Import reports. The brokerage set an "outperform" rating and a $14.00 price target on the stock. Northland Securities' price objective indicates a potential upside of 30.41% from the stock's previous close.

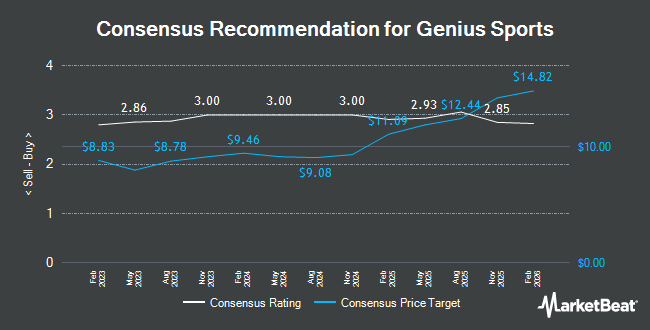

Other research analysts also recently issued reports about the stock. Benchmark reaffirmed a "buy" rating and set a $12.00 price objective on shares of Genius Sports in a research report on Thursday, April 17th. Needham & Company LLC reiterated a "buy" rating and issued a $13.00 target price on shares of Genius Sports in a research note on Thursday, June 12th. Truist Financial initiated coverage on shares of Genius Sports in a research note on Tuesday, July 1st. They issued a "buy" rating and a $14.00 target price for the company. JMP Securities set a $13.00 target price on shares of Genius Sports and gave the company a "market outperform" rating in a research note on Monday, June 30th. Finally, Citigroup restated an "outperform" rating on shares of Genius Sports in a research note on Monday, June 30th. One research analyst has rated the stock with a hold rating, fifteen have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and a consensus price target of $12.72.

Check Out Our Latest Stock Analysis on GENI

Genius Sports Price Performance

Genius Sports stock opened at $10.74 on Friday. The firm's 50 day simple moving average is $10.08 and its 200-day simple moving average is $9.76. The company has a market cap of $2.31 billion, a P/E ratio of -56.50 and a beta of 1.86. Genius Sports has a fifty-two week low of $5.76 and a fifty-two week high of $11.74.

Genius Sports (NYSE:GENI - Get Free Report) last released its earnings results on Tuesday, May 6th. The company reported ($0.03) earnings per share for the quarter, topping the consensus estimate of ($0.05) by $0.02. Genius Sports had a negative net margin of 8.54% and a negative return on equity of 6.90%. The business had revenue of $143.99 million for the quarter, compared to the consensus estimate of $143.31 million. During the same period last year, the firm posted ($0.11) earnings per share. The firm's quarterly revenue was up 20.3% compared to the same quarter last year. On average, analysts expect that Genius Sports will post -0.1 EPS for the current fiscal year.

Genius Sports announced that its board has authorized a stock buyback program on Tuesday, May 6th that permits the company to repurchase $100.00 million in outstanding shares. This repurchase authorization permits the company to buy up to 4.4% of its shares through open market purchases. Shares repurchase programs are often an indication that the company's board believes its shares are undervalued.

Institutional Investors Weigh In On Genius Sports

Large investors have recently made changes to their positions in the company. Quarry LP bought a new stake in Genius Sports during the 1st quarter worth about $37,000. Pacer Advisors Inc. grew its holdings in Genius Sports by 61.5% during the 1st quarter. Pacer Advisors Inc. now owns 3,754 shares of the company's stock worth $38,000 after acquiring an additional 1,430 shares during the last quarter. Emerald Mutual Fund Advisers Trust bought a new stake in Genius Sports during the 4th quarter worth about $58,000. Park National Corp OH bought a new stake in Genius Sports during the 1st quarter worth about $107,000. Finally, IPG Investment Advisors LLC bought a new stake in Genius Sports during the 1st quarter worth about $107,000. Institutional investors own 81.91% of the company's stock.

About Genius Sports

(

Get Free Report)

Genius Sports Limited engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries. It offers technology infrastructure for the collection, integration, and distribution of live data of sports leagues; streaming solutions comprising technology, automatic production, and distribution for sports to commercialize video footage of their games; and end-to-end integrity services to sports leagues, such as full-time active monitoring technology, which uses mathematical algorithms to identify and flag suspicious betting activity in global betting markets, as well as a full suite of online and offline educational and consultancy services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Genius Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genius Sports wasn't on the list.

While Genius Sports currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.