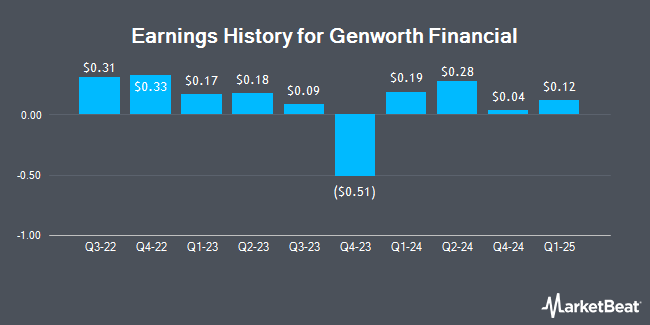

Genworth Financial (NYSE:GNW - Get Free Report) posted its quarterly earnings results on Wednesday. The financial services provider reported $0.16 earnings per share for the quarter, topping analysts' consensus estimates of $0.05 by $0.11, Zacks reports. Genworth Financial had a net margin of 2.61% and a return on equity of 1.91%. The business had revenue of $1.80 billion for the quarter.

Genworth Financial Price Performance

Shares of Genworth Financial stock traded up $0.09 on Tuesday, hitting $7.95. The company's stock had a trading volume of 4,231,647 shares, compared to its average volume of 6,304,828. Genworth Financial has a 52-week low of $5.99 and a 52-week high of $8.28. The company has a quick ratio of 0.29, a current ratio of 0.29 and a debt-to-equity ratio of 0.16. The firm has a fifty day moving average price of $7.44 and a 200-day moving average price of $7.09. The company has a market capitalization of $3.29 billion, a P/E ratio of 17.67 and a beta of 1.12.

Analyst Upgrades and Downgrades

GNW has been the topic of a number of recent analyst reports. Wall Street Zen cut shares of Genworth Financial from a "hold" rating to a "sell" rating in a research note on Thursday, May 22nd. Keefe, Bruyette & Woods boosted their price objective on shares of Genworth Financial from $9.00 to $9.50 and gave the stock an "outperform" rating in a research report on Wednesday, July 9th.

View Our Latest Report on GNW

Institutional Investors Weigh In On Genworth Financial

Several institutional investors and hedge funds have recently made changes to their positions in GNW. Strs Ohio acquired a new stake in shares of Genworth Financial during the 1st quarter worth about $82,000. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its holdings in Genworth Financial by 4.9% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,184,144 shares of the financial services provider's stock valued at $8,396,000 after buying an additional 55,071 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Genworth Financial by 2.9% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 252,152 shares of the financial services provider's stock valued at $1,788,000 after buying an additional 7,106 shares during the period. Finally, Royal Bank of Canada raised its holdings in Genworth Financial by 75.8% in the first quarter. Royal Bank of Canada now owns 118,058 shares of the financial services provider's stock valued at $837,000 after buying an additional 50,911 shares during the period. 81.85% of the stock is currently owned by hedge funds and other institutional investors.

Genworth Financial Company Profile

(

Get Free Report)

Genworth Financial, Inc, together with its subsidiaries, provides mortgage and long-term care insurance products in the United States and internationally. It operates in three segments: Enact, Long-Term Care Insurance, and Life and Annuities. The Enact segment offers private mortgage insurance products primarily insuring prime-based, individually underwritten residential mortgage loans; and pool mortgage insurance products.

See Also

Before you consider Genworth Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genworth Financial wasn't on the list.

While Genworth Financial currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.