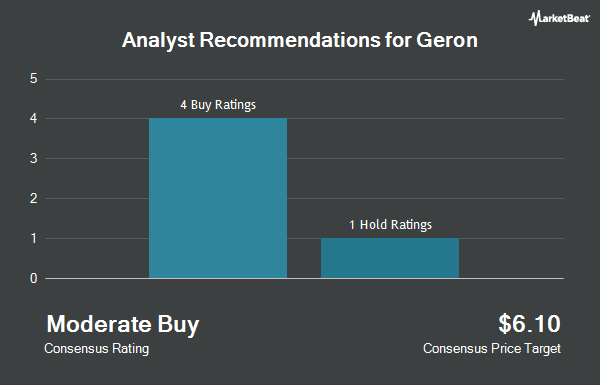

Geron Corporation (NASDAQ:GERN - Get Free Report) has been assigned an average rating of "Moderate Buy" from the nine brokerages that are covering the stock, Marketbeat.com reports. Three investment analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company. The average twelve-month target price among brokerages that have covered the stock in the last year is $5.06.

A number of brokerages have issued reports on GERN. Barclays restated an "overweight" rating and issued a $4.00 price objective (down previously from $9.00) on shares of Geron in a research note on Thursday, February 27th. Stifel Nicolaus reduced their price objective on Geron from $8.00 to $4.00 and set a "buy" rating for the company in a research note on Thursday, February 27th. HC Wainwright restated a "neutral" rating on shares of Geron in a research note on Wednesday, March 12th. Scotiabank downgraded Geron from a "sector outperform" rating to a "sector perform" rating and reduced their price objective for the company from $4.00 to $1.50 in a research note on Thursday, May 8th. Finally, Needham & Company LLC restated a "buy" rating and issued a $5.00 price objective on shares of Geron in a research note on Wednesday, March 12th.

Get Our Latest Report on GERN

Institutional Trading of Geron

A number of institutional investors have recently added to or reduced their stakes in GERN. SBI Securities Co. Ltd. purchased a new stake in Geron during the 4th quarter worth about $28,000. Frisch Financial Group Inc. raised its holdings in shares of Geron by 84.3% in the 1st quarter. Frisch Financial Group Inc. now owns 19,025 shares of the biopharmaceutical company's stock valued at $30,000 after acquiring an additional 8,700 shares in the last quarter. Integrated Wealth Concepts LLC purchased a new stake in shares of Geron in the 4th quarter valued at about $36,000. Focus Partners Advisor Solutions LLC purchased a new stake in shares of Geron in the 1st quarter valued at about $39,000. Finally, Sowell Financial Services LLC purchased a new stake in shares of Geron in the 1st quarter valued at about $43,000. Hedge funds and other institutional investors own 73.71% of the company's stock.

Geron Stock Down 6.0%

Shares of NASDAQ:GERN traded down $0.09 during mid-day trading on Friday, hitting $1.42. 8,832,593 shares of the company traded hands, compared to its average volume of 11,192,925. The stock has a market cap of $904.43 million, a P/E ratio of -6.76 and a beta of 0.69. The company has a current ratio of 7.87, a quick ratio of 6.97 and a debt-to-equity ratio of 0.44. Geron has a 12-month low of $1.17 and a 12-month high of $5.06. The stock has a 50-day moving average price of $1.41 and a two-hundred day moving average price of $2.15.

Geron (NASDAQ:GERN - Get Free Report) last posted its quarterly earnings data on Wednesday, May 7th. The biopharmaceutical company reported ($0.03) earnings per share for the quarter, topping the consensus estimate of ($0.04) by $0.01. The business had revenue of $39.60 million for the quarter, compared to analysts' expectations of $49.88 million. Geron had a negative return on equity of 47.86% and a negative net margin of 119.54%. The business's revenue was up 12927.3% on a year-over-year basis. During the same quarter in the previous year, the firm earned ($0.07) earnings per share. On average, equities research analysts forecast that Geron will post -0.25 earnings per share for the current year.

Geron Company Profile

(

Get Free ReportGeron Corporation, a late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies. It develops imetelstat, a telomerase inhibitor that is in Phase 3 clinical trials, which inhibits the uncontrolled proliferation of malignant stem and progenitor cells in myeloid hematologic malignancies for the treatment of low or intermediate-1 risk myelodysplastic syndromes and intermediate-2 or high-risk myelofibrosis.

Further Reading

Before you consider Geron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Geron wasn't on the list.

While Geron currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.