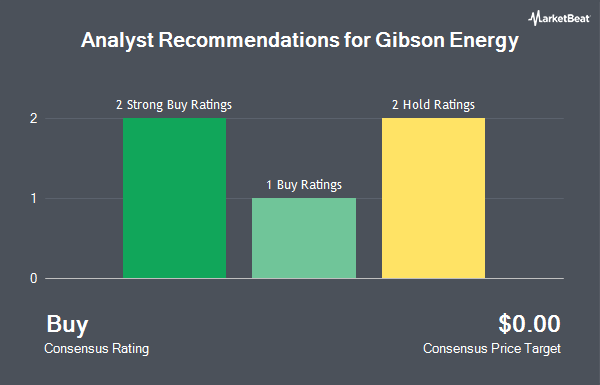

Shares of Gibson Energy Inc. (OTCMKTS:GBNXF - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the seven ratings firms that are currently covering the firm, Marketbeat.com reports. Four analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating on the company.

GBNXF has been the topic of several analyst reports. TD Securities lowered shares of Gibson Energy from a "strong-buy" rating to a "hold" rating in a report on Tuesday, June 17th. Scotiabank reiterated an "outperform" rating on shares of Gibson Energy in a report on Wednesday, July 30th. National Bankshares restated a "sector perform" rating on shares of Gibson Energy in a report on Wednesday, July 30th. Finally, Raymond James Financial restated a "strong-buy" rating on shares of Gibson Energy in a report on Tuesday, June 17th.

Get Our Latest Research Report on GBNXF

Gibson Energy Trading Down 0.3%

GBNXF traded down $0.06 during mid-day trading on Friday, hitting $19.20. The stock had a trading volume of 142,758 shares, compared to its average volume of 28,338. The stock's fifty day simple moving average is $18.51 and its 200-day simple moving average is $16.98. The company has a debt-to-equity ratio of 2.78, a current ratio of 0.71 and a quick ratio of 0.58. The firm has a market capitalization of $3.15 billion, a price-to-earnings ratio of 27.43 and a beta of 0.84. Gibson Energy has a 1-year low of $13.94 and a 1-year high of $19.34.

Gibson Energy (OTCMKTS:GBNXF - Get Free Report) last posted its earnings results on Monday, July 28th. The company reported $0.27 earnings per share for the quarter, topping the consensus estimate of $0.20 by $0.07. The company had revenue of $1.28 billion for the quarter, compared to analyst estimates of $1.28 billion. Gibson Energy had a net margin of 1.48% and a return on equity of 17.12%. As a group, research analysts forecast that Gibson Energy will post 1.09 EPS for the current fiscal year.

About Gibson Energy

(

Get Free Report)

Gibson Energy Inc, together with its subsidiaries, engages in the gathering, storage, optimization, processing, and marketing of liquids and refined products in Canada and the United States. It operates through Infrastructure and Marketing segments. The Infrastructure segment operates a network of liquid infrastructure assets that include oil terminals, rail loading and unloading facilities, gathering pipelines, a crude oil processing facility, and other terminals.

See Also

Before you consider Gibson Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gibson Energy wasn't on the list.

While Gibson Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.