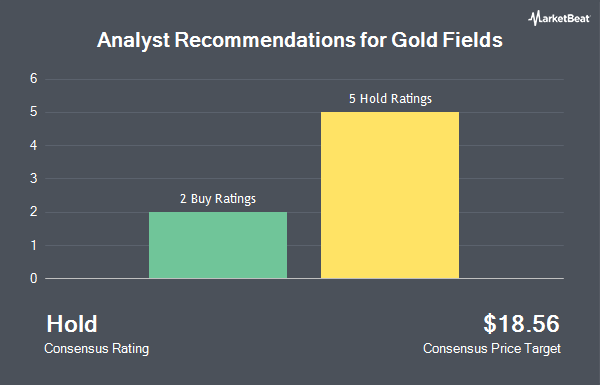

Gold Fields Limited (NYSE:GFI - Get Free Report) has earned a consensus recommendation of "Hold" from the nine analysts that are currently covering the firm, MarketBeat.com reports. Seven analysts have rated the stock with a hold recommendation and two have assigned a buy recommendation to the company. The average twelve-month price objective among analysts that have issued a report on the stock in the last year is $38.8333.

GFI has been the topic of several research analyst reports. BMO Capital Markets increased their price objective on shares of Gold Fields from $24.00 to $32.00 and gave the company a "market perform" rating in a research report on Monday, August 25th. Weiss Ratings reaffirmed a "buy (b)" rating on shares of Gold Fields in a research report on Saturday. Scotiabank raised their price target on shares of Gold Fields from $30.00 to $47.00 and gave the stock a "sector perform" rating in a research report on Thursday. Zacks Research lowered shares of Gold Fields from a "strong-buy" rating to a "hold" rating in a research report on Monday, October 6th. Finally, Capital One Financial set a $32.00 price target on shares of Gold Fields in a research report on Friday, August 22nd.

Check Out Our Latest Stock Analysis on Gold Fields

Gold Fields Price Performance

Shares of GFI opened at $40.17 on Friday. The company's 50-day moving average is $38.20 and its 200-day moving average is $29.10. Gold Fields has a fifty-two week low of $12.98 and a fifty-two week high of $47.18.

Gold Fields Increases Dividend

The firm also recently declared a semi-annual dividend, which was paid on Thursday, September 25th. Investors of record on Friday, September 12th were given a dividend of $0.3993 per share. This is a positive change from Gold Fields's previous semi-annual dividend of $0.38. This represents a yield of 130.0%. The ex-dividend date of this dividend was Friday, September 12th.

Hedge Funds Weigh In On Gold Fields

A number of hedge funds have recently bought and sold shares of the business. Benjamin Edwards Inc. bought a new position in Gold Fields during the third quarter worth about $281,000. Realta Investment Advisors acquired a new stake in Gold Fields during the third quarter worth about $239,000. Park Avenue Securities LLC grew its stake in Gold Fields by 0.9% during the third quarter. Park Avenue Securities LLC now owns 58,568 shares of the company's stock worth $2,458,000 after buying an additional 495 shares in the last quarter. Robeco Institutional Asset Management B.V. grew its stake in Gold Fields by 32.1% during the third quarter. Robeco Institutional Asset Management B.V. now owns 4,371,211 shares of the company's stock worth $183,416,000 after buying an additional 1,062,242 shares in the last quarter. Finally, D.A. Davidson & CO. grew its stake in Gold Fields by 4.3% during the third quarter. D.A. Davidson & CO. now owns 21,660 shares of the company's stock worth $909,000 after buying an additional 890 shares in the last quarter. 24.81% of the stock is owned by institutional investors.

Gold Fields Company Profile

(

Get Free Report)

Gold Fields Limited operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. It also explores for copper and silver deposits. The company was founded in 1887 and is based in Sandton, South Africa.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gold Fields, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Fields wasn't on the list.

While Gold Fields currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.