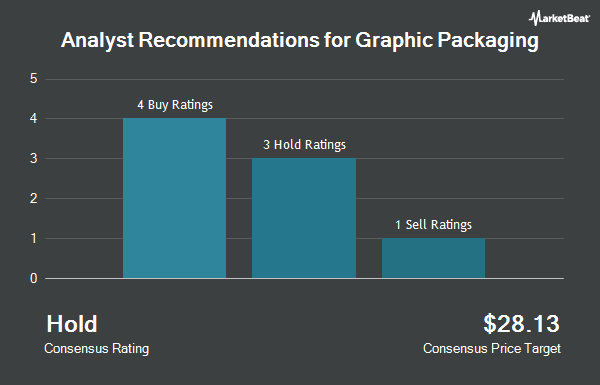

Graphic Packaging Holding Company (NYSE:GPK - Get Free Report) has received a consensus rating of "Hold" from the nine analysts that are presently covering the firm, Marketbeat reports. Five analysts have rated the stock with a hold recommendation and four have given a buy recommendation to the company. The average twelve-month price objective among brokerages that have updated their coverage on the stock in the last year is $26.00.

A number of analysts have recently issued reports on GPK shares. UBS Group started coverage on shares of Graphic Packaging in a research note on Wednesday, June 4th. They set a "neutral" rating and a $24.00 target price for the company. Wells Fargo & Company lowered their target price on shares of Graphic Packaging from $23.00 to $20.00 and set an "equal weight" rating for the company in a research note on Wednesday, September 17th. BNP Paribas Exane lowered shares of Graphic Packaging from an "outperform" rating to a "neutral" rating in a research note on Wednesday, June 25th. Truist Financial decreased their price objective on Graphic Packaging from $24.00 to $23.00 and set a "hold" rating for the company in a report on Friday, July 11th. Finally, Royal Bank Of Canada decreased their price objective on Graphic Packaging from $26.00 to $25.00 and set an "outperform" rating for the company in a report on Wednesday, June 18th.

Read Our Latest Report on GPK

Graphic Packaging Stock Down 0.6%

NYSE GPK opened at $19.20 on Friday. The company has a quick ratio of 0.56, a current ratio of 1.43 and a debt-to-equity ratio of 1.68. The company has a fifty day moving average of $21.79 and a two-hundred day moving average of $22.88. The firm has a market capitalization of $5.69 billion, a price-to-earnings ratio of 10.85, a PEG ratio of 6.56 and a beta of 0.75. Graphic Packaging has a 52 week low of $19.06 and a 52 week high of $30.70.

Graphic Packaging (NYSE:GPK - Get Free Report) last posted its quarterly earnings data on Tuesday, July 29th. The industrial products company reported $0.42 EPS for the quarter, topping the consensus estimate of $0.40 by $0.02. The company had revenue of $2.20 billion during the quarter, compared to analyst estimates of $2.13 billion. Graphic Packaging had a net margin of 6.18% and a return on equity of 21.13%. Graphic Packaging has set its FY 2025 guidance at 1.900-2.20 EPS. On average, analysts predict that Graphic Packaging will post 2.47 earnings per share for the current year.

Graphic Packaging Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 8th. Investors of record on Monday, September 15th will be issued a $0.11 dividend. This represents a $0.44 annualized dividend and a dividend yield of 2.3%. The ex-dividend date is Monday, September 15th. Graphic Packaging's payout ratio is presently 24.86%.

Insider Activity

In related news, Director Philip R. Martens sold 7,015 shares of Graphic Packaging stock in a transaction dated Monday, August 4th. The stock was sold at an average price of $21.80, for a total value of $152,927.00. Following the completion of the sale, the director directly owned 26,811 shares in the company, valued at $584,479.80. The trade was a 20.74% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, EVP Joseph P. Yost sold 30,000 shares of Graphic Packaging stock in a transaction dated Monday, August 25th. The shares were sold at an average price of $22.72, for a total value of $681,600.00. Following the completion of the sale, the executive vice president owned 255,203 shares of the company's stock, valued at $5,798,212.16. The trade was a 10.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 93,752 shares of company stock valued at $2,073,663 over the last 90 days. 1.41% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Graphic Packaging

A number of large investors have recently added to or reduced their stakes in GPK. Millennium Management LLC raised its holdings in Graphic Packaging by 106.5% in the fourth quarter. Millennium Management LLC now owns 105,601 shares of the industrial products company's stock worth $2,868,000 after purchasing an additional 54,466 shares in the last quarter. ProShare Advisors LLC raised its holdings in Graphic Packaging by 7.3% in the fourth quarter. ProShare Advisors LLC now owns 14,043 shares of the industrial products company's stock worth $381,000 after purchasing an additional 960 shares in the last quarter. Vident Advisory LLC raised its holdings in Graphic Packaging by 6.9% in the fourth quarter. Vident Advisory LLC now owns 9,965 shares of the industrial products company's stock worth $271,000 after purchasing an additional 647 shares in the last quarter. Universal Beteiligungs und Servicegesellschaft mbH bought a new position in Graphic Packaging in the fourth quarter worth about $6,851,000. Finally, Park Square Financial Group LLC bought a new position in Graphic Packaging in the fourth quarter worth about $79,000. 99.67% of the stock is currently owned by institutional investors.

About Graphic Packaging

(

Get Free Report)

Graphic Packaging Holding Company, together with its subsidiaries, designs, produces, and sells consumer packaging products to brands in food, beverage, foodservice, household, and other consumer products. It operates through three segments: Paperboard Manufacturing, Americas Paperboard Packaging, and Europe Paperboard Packaging.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Graphic Packaging, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graphic Packaging wasn't on the list.

While Graphic Packaging currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.