Group 1 Automotive (NYSE:GPI - Get Free Report) was upgraded by research analysts at Wall Street Zen from a "hold" rating to a "buy" rating in a report released on Saturday.

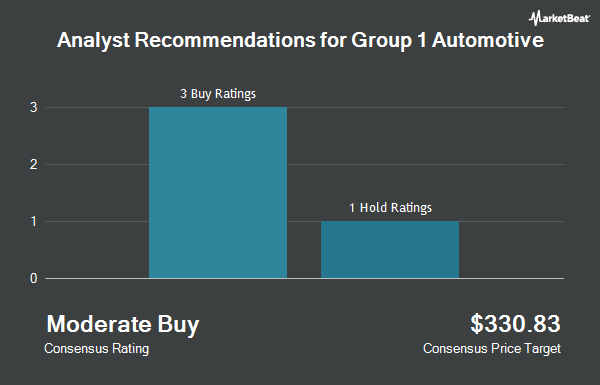

A number of other equities research analysts have also recently commented on the stock. Bank of America increased their price objective on shares of Group 1 Automotive from $510.00 to $565.00 and gave the company a "buy" rating in a research note on Monday, June 16th. JPMorgan Chase & Co. raised their price target on shares of Group 1 Automotive from $415.00 to $425.00 and gave the stock a "neutral" rating in a research note on Tuesday, August 5th. Citigroup raised their price target on shares of Group 1 Automotive from $463.00 to $495.00 and gave the stock a "buy" rating in a research note on Tuesday, May 13th. Guggenheim cut shares of Group 1 Automotive from a "buy" rating to a "neutral" rating in a research note on Wednesday, May 14th. Finally, Morgan Stanley raised their price target on shares of Group 1 Automotive from $470.00 to $485.00 and gave the stock an "overweight" rating in a research note on Thursday, August 14th. Four research analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the stock. According to MarketBeat, Group 1 Automotive currently has a consensus rating of "Hold" and a consensus target price of $479.43.

View Our Latest Stock Report on Group 1 Automotive

Group 1 Automotive Price Performance

NYSE GPI traded down $4.36 during trading hours on Friday, reaching $448.34. The company's stock had a trading volume of 20,294 shares, compared to its average volume of 165,727. The stock has a market cap of $5.80 billion, a PE ratio of 12.32, a PEG ratio of 1.10 and a beta of 0.83. Group 1 Automotive has a fifty-two week low of $336.33 and a fifty-two week high of $490.09. The company's 50-day moving average is $438.21 and its two-hundred day moving average is $429.41. The company has a debt-to-equity ratio of 0.97, a quick ratio of 0.24 and a current ratio of 1.05.

Group 1 Automotive (NYSE:GPI - Get Free Report) last issued its quarterly earnings data on Thursday, July 24th. The company reported $11.52 EPS for the quarter, beating analysts' consensus estimates of $10.31 by $1.21. The firm had revenue of $5.70 billion for the quarter, compared to analysts' expectations of $5.65 billion. Group 1 Automotive had a net margin of 2.18% and a return on equity of 18.10%. The firm's revenue was up 21.4% on a year-over-year basis. During the same period in the prior year, the company earned $9.82 EPS. Analysts forecast that Group 1 Automotive will post 41 EPS for the current year.

Insider Activity at Group 1 Automotive

In other news, Director Steven Mizell sold 525 shares of the business's stock in a transaction on Tuesday, July 29th. The shares were sold at an average price of $417.98, for a total transaction of $219,439.50. Following the transaction, the director directly owned 8 shares of the company's stock, valued at approximately $3,343.84. The trade was a 98.50% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Daniel James Mchenry sold 3,000 shares of the business's stock in a transaction on Tuesday, June 10th. The stock was sold at an average price of $441.71, for a total transaction of $1,325,130.00. Following the transaction, the chief financial officer directly owned 16,674 shares in the company, valued at approximately $7,365,072.54. The trade was a 15.25% decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.10% of the stock is owned by insiders.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the company. Bessemer Group Inc. lifted its position in shares of Group 1 Automotive by 119.4% during the fourth quarter. Bessemer Group Inc. now owns 68 shares of the company's stock worth $29,000 after purchasing an additional 37 shares in the last quarter. Elequin Capital LP bought a new stake in shares of Group 1 Automotive in the first quarter worth $29,000. MAI Capital Management increased its stake in shares of Group 1 Automotive by 131.3% in the second quarter. MAI Capital Management now owns 74 shares of the company's stock worth $32,000 after buying an additional 42 shares during the last quarter. Signaturefd LLC increased its stake in shares of Group 1 Automotive by 90.5% in the second quarter. Signaturefd LLC now owns 80 shares of the company's stock worth $35,000 after buying an additional 38 shares during the last quarter. Finally, Elevation Point Wealth Partners LLC bought a new stake in shares of Group 1 Automotive in the second quarter worth $43,000. 99.92% of the stock is owned by institutional investors and hedge funds.

Group 1 Automotive Company Profile

(

Get Free Report)

Group 1 Automotive, Inc, through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom. The company sells new and used cars, light trucks, and vehicle parts, as well as service and insurance contracts; arranges related vehicle financing; and offers automotive maintenance and repair services.

See Also

Before you consider Group 1 Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Group 1 Automotive wasn't on the list.

While Group 1 Automotive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.