Grove Collaborative (NYSE:GROV - Get Free Report) will likely be posting its Q2 2025 quarterly earnings results after the market closes on Thursday, August 7th. Analysts expect Grove Collaborative to post earnings of ($0.09) per share and revenue of $44.37 million for the quarter.

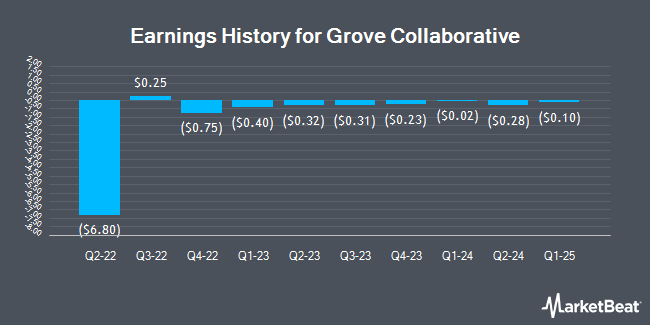

Grove Collaborative (NYSE:GROV - Get Free Report) last announced its quarterly earnings results on Wednesday, May 14th. The company reported ($0.10) earnings per share for the quarter, missing analysts' consensus estimates of ($0.04) by ($0.06). Grove Collaborative had a negative net margin of 14.26% and a negative return on equity of 6,372.67%. The company had revenue of $43.55 million during the quarter, compared to the consensus estimate of $47.01 million.

Grove Collaborative Stock Up 0.4%

NYSE:GROV traded up $0.01 during trading hours on Monday, reaching $1.39. The company had a trading volume of 35,928 shares, compared to its average volume of 177,507. The stock has a 50-day moving average of $1.31 and a two-hundred day moving average of $1.36. The firm has a market capitalization of $55.76 million, a PE ratio of -1.82 and a beta of 1.20. Grove Collaborative has a one year low of $1.02 and a one year high of $1.95.

Analyst Ratings Changes

Separately, Telsey Advisory Group reaffirmed a "market perform" rating and set a $1.20 price target (down previously from $2.00) on shares of Grove Collaborative in a research note on Thursday, May 15th.

View Our Latest Stock Analysis on GROV

Insider Activity at Grove Collaborative

In other Grove Collaborative news, Director John B. Replogle purchased 42,735 shares of the company's stock in a transaction dated Wednesday, May 21st. The shares were bought at an average price of $1.18 per share, with a total value of $50,427.30. Following the completion of the transaction, the director directly owned 497,859 shares in the company, valued at $587,473.62. This trade represents a 9.39% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders bought a total of 144,317 shares of company stock worth $175,557 over the last quarter. Company insiders own 29.40% of the company's stock.

Grove Collaborative Company Profile

(

Get Free Report)

Grove Collaborative Holdings, Inc operates as a plastic neutral consumer products retailer in the United States. It offers household, personal care, beauty, and other consumer products through retail channels, third parties, direct-to-consumer platform, and mobile applications, as well as online store.

Featured Articles

Before you consider Grove Collaborative, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grove Collaborative wasn't on the list.

While Grove Collaborative currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.