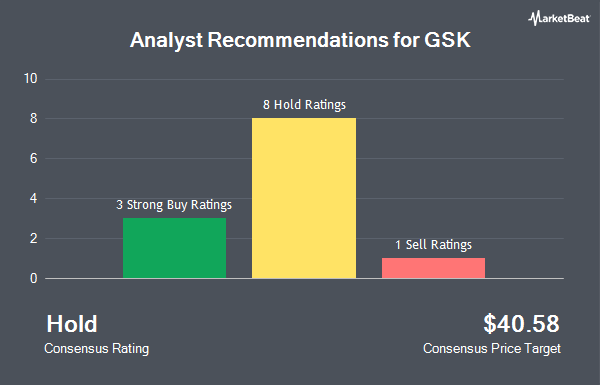

Shares of GSK PLC Sponsored ADR (NYSE:GSK - Get Free Report) have been given an average recommendation of "Reduce" by the eight ratings firms that are presently covering the firm, Marketbeat.com reports. One investment analyst has rated the stock with a sell recommendation and seven have given a hold recommendation to the company. The average 1-year price target among brokers that have issued ratings on the stock in the last year is $37.3750.

GSK has been the subject of several research reports. Hsbc Global Res raised GSK to a "strong sell" rating in a research report on Monday, April 28th. Berenberg Bank reissued a "hold" rating on shares of GSK in a research report on Tuesday, June 3rd. Finally, Wall Street Zen raised GSK from a "hold" rating to a "buy" rating in a research report on Sunday, August 3rd.

Check Out Our Latest Report on GSK

Hedge Funds Weigh In On GSK

Institutional investors and hedge funds have recently made changes to their positions in the stock. Twin Peaks Wealth Advisors LLC acquired a new position in shares of GSK during the second quarter worth about $25,000. HHM Wealth Advisors LLC raised its position in shares of GSK by 222.2% during the 1st quarter. HHM Wealth Advisors LLC now owns 667 shares of the pharmaceutical company's stock worth $26,000 after acquiring an additional 460 shares in the last quarter. Costello Asset Management INC acquired a new stake in shares of GSK during the 1st quarter worth about $31,000. Richardson Financial Services Inc. raised its position in shares of GSK by 127.9% during the 1st quarter. Richardson Financial Services Inc. now owns 841 shares of the pharmaceutical company's stock worth $33,000 after acquiring an additional 472 shares in the last quarter. Finally, SOA Wealth Advisors LLC. raised its position in shares of GSK by 252.1% during the 2nd quarter. SOA Wealth Advisors LLC. now owns 845 shares of the pharmaceutical company's stock worth $32,000 after acquiring an additional 605 shares in the last quarter. 15.74% of the stock is owned by institutional investors and hedge funds.

GSK Trading Up 0.2%

NYSE GSK traded up $0.0650 during trading on Wednesday, hitting $40.1450. The stock had a trading volume of 3,403,643 shares, compared to its average volume of 3,847,922. The company has a market capitalization of $81.77 billion, a PE ratio of 18.59, a PEG ratio of 1.74 and a beta of 0.51. The company has a quick ratio of 0.57, a current ratio of 0.87 and a debt-to-equity ratio of 1.07. The firm has a 50 day moving average price of $38.34 and a 200 day moving average price of $38.13. GSK has a twelve month low of $31.72 and a twelve month high of $44.67.

GSK (NYSE:GSK - Get Free Report) last released its earnings results on Wednesday, July 30th. The pharmaceutical company reported $1.23 earnings per share for the quarter, beating the consensus estimate of $1.12 by $0.11. The company had revenue of $10.64 billion during the quarter, compared to the consensus estimate of $7.92 billion. GSK had a return on equity of 49.22% and a net margin of 10.81%.GSK's revenue was up 1.3% compared to the same quarter last year. During the same period in the previous year, the company posted $0.43 EPS. GSK has set its FY 2025 guidance at 4.590-4.590 EPS. As a group, equities research analysts forecast that GSK will post 4.14 earnings per share for the current year.

GSK Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, October 9th. Stockholders of record on Friday, August 15th will be given a dividend of $0.4206 per share. The ex-dividend date of this dividend is Friday, August 15th. This represents a $1.68 dividend on an annualized basis and a dividend yield of 4.2%. GSK's payout ratio is currently 77.78%.

About GSK

(

Get Free Report)

GSK plc, together with its subsidiaries, engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through two segments, Commercial Operations and Total R&D.

Further Reading

Before you consider GSK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GSK wasn't on the list.

While GSK currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.