Haemonetics (NYSE:HAE - Get Free Report)'s stock had its "neutral" rating restated by analysts at JPMorgan Chase & Co. in a note issued to investors on Friday, MarketBeat Ratings reports. They currently have a $62.00 price target on the medical instruments supplier's stock, down from their prior price target of $85.00. JPMorgan Chase & Co.'s price target suggests a potential upside of 19.24% from the stock's previous close.

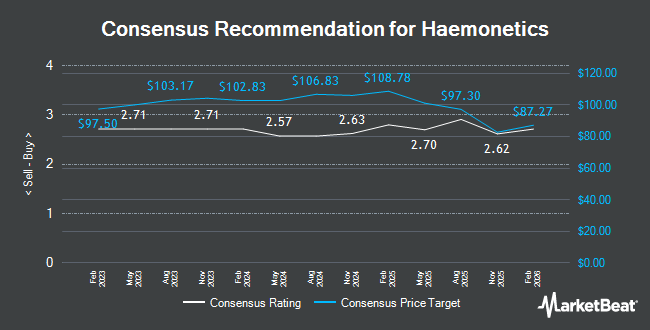

Several other analysts also recently weighed in on HAE. Baird R W upgraded Haemonetics to a "strong-buy" rating in a research note on Wednesday, June 25th. Wall Street Zen lowered Haemonetics from a "buy" rating to a "hold" rating in a research note on Tuesday, May 13th. Citigroup upgraded Haemonetics from a "neutral" rating to a "buy" rating and set a $90.00 price objective on the stock in a report on Wednesday, July 9th. Mizuho reduced their target price on Haemonetics from $90.00 to $70.00 and set an "outperform" rating for the company in a research note on Friday. Finally, Barrington Research dropped their price target on shares of Haemonetics from $95.00 to $86.00 and set an "outperform" rating for the company in a research note on Friday. One research analyst has rated the stock with a sell rating, two have given a hold rating, nine have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $85.18.

Read Our Latest Report on HAE

Haemonetics Stock Down 0.9%

Haemonetics stock traded down $0.48 during midday trading on Friday, hitting $51.99. 878,186 shares of the company were exchanged, compared to its average volume of 787,515. The company has a market cap of $2.51 billion, a PE ratio of 15.91, a price-to-earnings-growth ratio of 0.88 and a beta of 0.40. Haemonetics has a fifty-two week low of $50.68 and a fifty-two week high of $94.99. The company's fifty day moving average price is $72.56 and its 200-day moving average price is $67.23. The company has a debt-to-equity ratio of 1.04, a current ratio of 1.72 and a quick ratio of 1.04.

Haemonetics (NYSE:HAE - Get Free Report) last posted its earnings results on Thursday, August 7th. The medical instruments supplier reported $1.10 EPS for the quarter, topping analysts' consensus estimates of $1.01 by $0.09. The business had revenue of $321.39 million for the quarter, compared to analysts' expectations of $305.12 million. Haemonetics had a net margin of 12.14% and a return on equity of 26.64%. The business's revenue for the quarter was down 4.4% compared to the same quarter last year. During the same period in the previous year, the company posted $1.02 earnings per share. On average, research analysts predict that Haemonetics will post 4.55 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of the business. Geode Capital Management LLC lifted its holdings in Haemonetics by 1.9% in the second quarter. Geode Capital Management LLC now owns 1,244,624 shares of the medical instruments supplier's stock worth $92,873,000 after acquiring an additional 23,257 shares during the last quarter. Royce & Associates LP grew its holdings in shares of Haemonetics by 0.7% during the first quarter. Royce & Associates LP now owns 1,161,296 shares of the medical instruments supplier's stock valued at $73,800,000 after purchasing an additional 8,028 shares during the last quarter. Boston Trust Walden Corp raised its position in shares of Haemonetics by 22.1% during the 1st quarter. Boston Trust Walden Corp now owns 1,118,331 shares of the medical instruments supplier's stock worth $71,070,000 after purchasing an additional 202,609 shares during the period. Royal Bank of Canada lifted its holdings in shares of Haemonetics by 2.3% in the 1st quarter. Royal Bank of Canada now owns 1,075,604 shares of the medical instruments supplier's stock worth $68,355,000 after purchasing an additional 24,650 shares during the last quarter. Finally, Dimensional Fund Advisors LP boosted its position in Haemonetics by 1.1% during the 4th quarter. Dimensional Fund Advisors LP now owns 992,229 shares of the medical instruments supplier's stock valued at $77,470,000 after purchasing an additional 10,990 shares during the period. 99.67% of the stock is owned by institutional investors and hedge funds.

About Haemonetics

(

Get Free Report)

Haemonetics Corporation, a healthcare company, provides suite of medical products and solutions in the United States and internationally. The company offers automated plasma collection systems, donor management software, and supporting software solutions including NexSys PCS and PCS2 plasmapheresis equipment and related disposables and solutions, as well as integrated information technology platforms for plasma customers to manage their donors, operations, and supply chain; and NexLynk DMS donor management system and Donor360 app.

Read More

Before you consider Haemonetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haemonetics wasn't on the list.

While Haemonetics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.