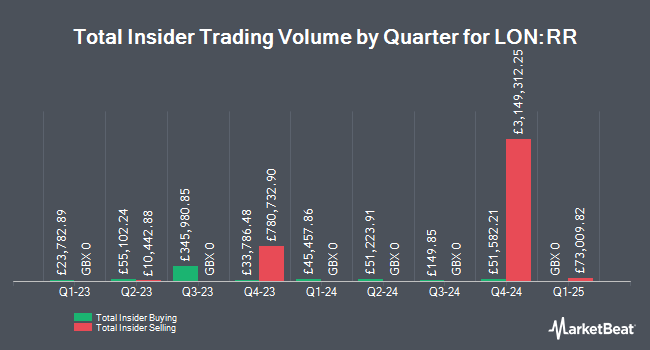

Rolls-Royce Holdings plc (LON:RR - Get Free Report) insider Helen McCabe acquired 17 shares of Rolls-Royce Holdings plc stock in a transaction on Monday, June 9th. The shares were purchased at an average price of GBX 876 ($11.93) per share, for a total transaction of £148.92 ($202.75).

Helen McCabe also recently made the following trade(s):

- On Wednesday, March 12th, Helen McCabe sold 400,659 shares of Rolls-Royce Holdings plc stock. The shares were sold at an average price of GBX 767 ($10.44), for a total value of £3,073,054.53 ($4,183,872.74).

Rolls-Royce Holdings plc Stock Performance

Shares of LON:RR traded down GBX 6 ($0.08) during midday trading on Friday, reaching GBX 887.40 ($12.08). The stock has a market capitalization of £76.11 billion, a P/E ratio of 32.35, a price-to-earnings-growth ratio of 0.55 and a beta of 1.82. The company's fifty day simple moving average is GBX 782.75 and its 200-day simple moving average is GBX 690.56. Rolls-Royce Holdings plc has a 12-month low of GBX 196.45 ($2.67) and a 12-month high of GBX 537.20 ($7.31).

Analyst Ratings Changes

A number of research firms have recently issued reports on RR. Shore Capital reiterated a "hold" rating on shares of Rolls-Royce Holdings plc in a research note on Thursday, May 1st. JPMorgan Chase & Co. restated an "overweight" rating and set a GBX 900 ($12.25) price objective on shares of Rolls-Royce Holdings plc in a report on Friday, March 28th. One analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of GBX 692.50 ($9.43).

Read Our Latest Research Report on RR

About Rolls-Royce Holdings plc

(

Get Free Report)

Rolls-Royce Holdings plc develops and delivers complex power and propulsion solutions for air, sea, and land in the United Kingdom and internationally. The company operates through four segments: Civil Aerospace, Defence, Power Systems, and New Markets. The Civil Aerospace segment develops, manufactures, markets, and sells aero engines for large commercial aircraft, regional jet, and business aviation markets, as well as provides aftermarket services.

See Also

Before you consider Rolls-Royce Holdings plc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rolls-Royce Holdings plc wasn't on the list.

While Rolls-Royce Holdings plc currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.