Investment analysts at Raymond James Financial began coverage on shares of Hinge Health (NYSE:HNGE - Get Free Report) in a research note issued on Monday, MarketBeat Ratings reports. The firm set an "outperform" rating and a $45.00 price target on the stock. Raymond James Financial's target price suggests a potential upside of 13.09% from the company's previous close.

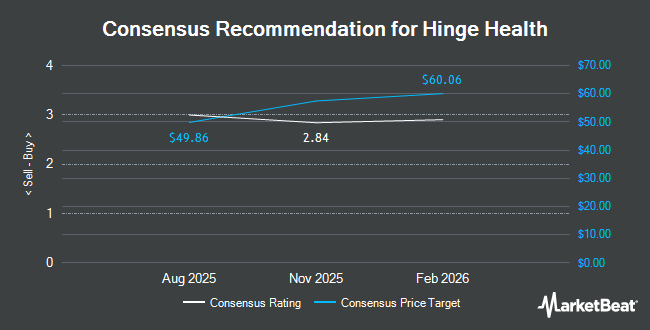

Several other research analysts have also issued reports on the stock. Bank of America started coverage on shares of Hinge Health in a research note on Monday. They set a "buy" rating and a $42.00 target price on the stock. Morgan Stanley started coverage on shares of Hinge Health in a report on Monday. They set an "overweight" rating and a $46.00 price objective on the stock. Canaccord Genuity Group started coverage on shares of Hinge Health in a report on Monday. They set a "buy" rating and a $52.00 price objective on the stock. Wall Street Zen upgraded shares of Hinge Health to a "hold" rating in a report on Monday, June 2nd. Finally, KeyCorp started coverage on shares of Hinge Health in a report on Monday. They set an "overweight" rating and a $45.00 price objective on the stock. One investment analyst has rated the stock with a hold rating and thirteen have given a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $46.00.

Read Our Latest Analysis on Hinge Health

Hinge Health Price Performance

NYSE HNGE traded up $1.79 on Monday, hitting $39.79. 771,425 shares of the company were exchanged, compared to its average volume of 1,215,089. Hinge Health has a 12 month low of $33.42 and a 12 month high of $43.80.

Hinge Health Company Profile

(

Get Free Report)

Our vision is to build a new health system that transforms outcomes, experience and costs by using technology to scale and automate the delivery of care. Hinge Health leverages software, including AI, to largely automate care for joint and muscle health, delivering an outstanding member experience, improved member outcomes, and cost reductions for our clients.

See Also

Before you consider Hinge Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hinge Health wasn't on the list.

While Hinge Health currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.