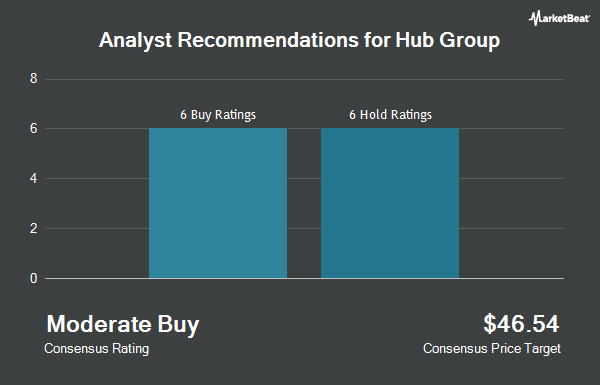

Shares of Hub Group, Inc. (NASDAQ:HUBG - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the ten brokerages that are covering the firm, Marketbeat reports. Four research analysts have rated the stock with a hold recommendation, five have assigned a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1 year target price among brokerages that have updated their coverage on the stock in the last year is $40.3478.

A number of research firms have issued reports on HUBG. TD Cowen lowered their target price on Hub Group from $40.00 to $36.00 and set a "hold" rating for the company in a report on Friday, May 9th. Deutsche Bank Aktiengesellschaft upgraded Hub Group from a "hold" rating to a "buy" rating and set a $41.00 price objective for the company in a report on Wednesday, July 23rd. Stifel Nicolaus decreased their price objective on Hub Group from $46.00 to $45.00 and set a "buy" rating for the company in a report on Friday, August 1st. JPMorgan Chase & Co. reduced their price target on Hub Group from $39.00 to $36.00 and set a "neutral" rating for the company in a report on Tuesday, July 8th. Finally, Barclays reduced their price target on Hub Group from $45.00 to $40.00 and set an "equal weight" rating for the company in a report on Monday, May 12th.

View Our Latest Stock Report on HUBG

Hub Group Trading Down 0.8%

Hub Group stock traded down $0.28 during mid-day trading on Friday, hitting $36.78. 1,877,770 shares of the company's stock were exchanged, compared to its average volume of 517,885. The firm has a market capitalization of $2.25 billion, a P/E ratio of 22.29, a PEG ratio of 1.24 and a beta of 1.12. Hub Group has a fifty-two week low of $30.75 and a fifty-two week high of $53.21. The company has a quick ratio of 1.42, a current ratio of 1.42 and a debt-to-equity ratio of 0.08. The company's 50 day simple moving average is $35.06 and its 200-day simple moving average is $35.60.

Hub Group (NASDAQ:HUBG - Get Free Report) last released its earnings results on Thursday, July 31st. The transportation company reported $0.45 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.44 by $0.01. The firm had revenue of $905.65 million during the quarter, compared to analysts' expectations of $913.53 million. Hub Group had a return on equity of 6.81% and a net margin of 2.65%.The company's revenue was down 8.2% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.47 EPS. Hub Group has set its FY 2025 guidance at 1.800-2.050 EPS. On average, equities analysts anticipate that Hub Group will post 2.2 earnings per share for the current year.

Hub Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Monday, June 23rd were issued a dividend of $0.125 per share. This represents a $0.50 dividend on an annualized basis and a dividend yield of 1.4%. The ex-dividend date was Monday, June 23rd. Hub Group's payout ratio is currently 30.30%.

Institutional Investors Weigh In On Hub Group

Institutional investors have recently made changes to their positions in the stock. Farther Finance Advisors LLC boosted its stake in shares of Hub Group by 440.3% in the first quarter. Farther Finance Advisors LLC now owns 859 shares of the transportation company's stock valued at $32,000 after buying an additional 700 shares during the period. Smartleaf Asset Management LLC boosted its stake in shares of Hub Group by 33.4% in the second quarter. Smartleaf Asset Management LLC now owns 1,282 shares of the transportation company's stock valued at $44,000 after buying an additional 321 shares during the period. GAMMA Investing LLC boosted its stake in shares of Hub Group by 161.9% in the second quarter. GAMMA Investing LLC now owns 1,375 shares of the transportation company's stock valued at $46,000 after buying an additional 850 shares during the period. Caitong International Asset Management Co. Ltd boosted its stake in shares of Hub Group by 139,500.0% in the first quarter. Caitong International Asset Management Co. Ltd now owns 1,396 shares of the transportation company's stock valued at $52,000 after buying an additional 1,395 shares during the period. Finally, NewEdge Advisors LLC boosted its stake in shares of Hub Group by 333.8% in the second quarter. NewEdge Advisors LLC now owns 1,488 shares of the transportation company's stock valued at $50,000 after buying an additional 1,145 shares during the period. 46.77% of the stock is currently owned by institutional investors.

About Hub Group

(

Get Free Report)

Hub Group, Inc, a supply chain solutions provider, offers transportation and logistics management services in North America. The company's transportation services include intermodal, truckload, less-than-truckload, flatbed, temperature-controlled, and dedicated and regional trucking, as well as final mile, railcar, small parcel, and international transportation.

Featured Articles

Before you consider Hub Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hub Group wasn't on the list.

While Hub Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.