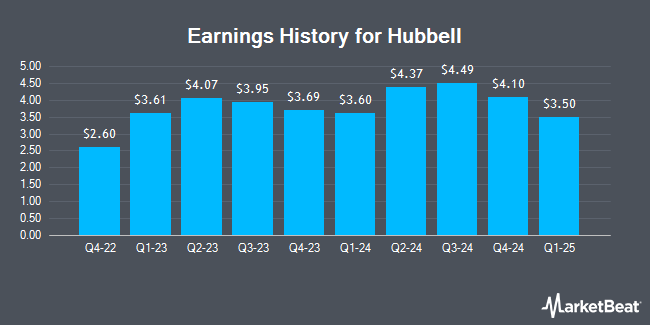

Hubbell (NYSE:HUBB - Get Free Report) issued its quarterly earnings data on Tuesday. The industrial products company reported $4.93 EPS for the quarter, topping analysts' consensus estimates of $4.36 by $0.57, Zacks reports. The company had revenue of $1.48 billion during the quarter, compared to the consensus estimate of $1.51 billion. Hubbell had a net margin of 14.76% and a return on equity of 27.63%. Hubbell updated its FY 2025 guidance to 17.650-18.15 EPS.

Hubbell Price Performance

NYSE:HUBB opened at $437.54 on Thursday. Hubbell has a 52 week low of $299.42 and a 52 week high of $481.35. The company has a quick ratio of 0.73, a current ratio of 1.30 and a debt-to-equity ratio of 0.30. The stock has a market capitalization of $23.35 billion, a PE ratio of 28.41, a price-to-earnings-growth ratio of 2.39 and a beta of 0.99. The stock's 50-day moving average price is $407.30 and its 200-day moving average price is $383.39.

Hubbell Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 29th will be given a dividend of $1.32 per share. This represents a $5.28 dividend on an annualized basis and a dividend yield of 1.21%. The ex-dividend date is Friday, August 29th. Hubbell's dividend payout ratio (DPR) is presently 35.72%.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently issued reports on HUBB shares. Wall Street Zen downgraded Hubbell from a "buy" rating to a "hold" rating in a research report on Friday, April 11th. Wells Fargo & Company upped their price target on Hubbell from $420.00 to $445.00 and gave the stock an "equal weight" rating in a research report on Wednesday. Barclays upped their price target on Hubbell from $414.00 to $420.00 and gave the stock an "equal weight" rating in a research report on Wednesday, July 9th. Finally, JPMorgan Chase & Co. upped their price target on Hubbell from $352.00 to $417.00 and gave the stock a "neutral" rating in a research report on Friday, May 16th. Six equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $459.38.

View Our Latest Stock Report on HUBB

Insider Transactions at Hubbell

In other Hubbell news, CEO Gerben Bakker sold 7,723 shares of the firm's stock in a transaction that occurred on Wednesday, May 14th. The shares were sold at an average price of $384.63, for a total value of $2,970,497.49. Following the transaction, the chief executive officer directly owned 82,101 shares of the company's stock, valued at $31,578,507.63. This trade represents a 8.60% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Carlos M. Cardoso sold 400 shares of the firm's stock in a transaction that occurred on Wednesday, May 21st. The stock was sold at an average price of $386.29, for a total transaction of $154,516.00. Following the completion of the transaction, the director directly owned 1,727 shares in the company, valued at $667,122.83. This trade represents a 18.81% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.66% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the business. Acadian Asset Management LLC acquired a new stake in shares of Hubbell during the 1st quarter worth approximately $599,000. Jones Financial Companies Lllp increased its holdings in shares of Hubbell by 171.9% during the 1st quarter. Jones Financial Companies Lllp now owns 2,401 shares of the industrial products company's stock worth $795,000 after buying an additional 1,518 shares during the last quarter. Empowered Funds LLC increased its holdings in shares of Hubbell by 18.9% during the 1st quarter. Empowered Funds LLC now owns 1,233 shares of the industrial products company's stock worth $408,000 after buying an additional 196 shares during the last quarter. Finally, Geneos Wealth Management Inc. increased its holdings in shares of Hubbell by 271.9% during the 1st quarter. Geneos Wealth Management Inc. now owns 212 shares of the industrial products company's stock worth $70,000 after buying an additional 155 shares during the last quarter. 88.16% of the stock is owned by hedge funds and other institutional investors.

Hubbell Company Profile

(

Get Free Report)

Hubbell Incorporated, together with its subsidiaries, designs, manufactures, and sells electrical and utility solutions in the United States and internationally. It operates through two segments, Electrical Solutions and Utility Solutions. The Electrical Solution segment offers standard and special application wiring device products, rough-in electrical products, connector and grounding products, lighting fixtures, and other electrical equipment for use in industrial, commercial, and institutional facilities by electrical contractors, maintenance personnel, electricians, utilities, and telecommunications companies, as well as components and assemblies.

See Also

Before you consider Hubbell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hubbell wasn't on the list.

While Hubbell currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.