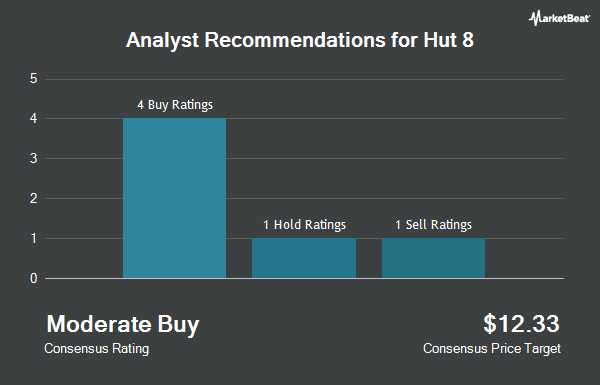

Shares of Hut 8 Corp. (NASDAQ:HUT - Get Free Report) have been given a consensus rating of "Buy" by the nineteen analysts that are currently covering the stock, MarketBeat Ratings reports. Fifteen equities research analysts have rated the stock with a buy recommendation and four have assigned a strong buy recommendation to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $26.7059.

A number of research analysts recently weighed in on HUT shares. Rosenblatt Securities lowered their price objective on shares of Hut 8 from $24.00 to $23.00 and set a "buy" rating on the stock in a research report on Monday. Roth Capital started coverage on shares of Hut 8 in a research report on Friday, June 6th. They set a "buy" rating and a $25.00 price objective on the stock. B. Riley initiated coverage on shares of Hut 8 in a research report on Wednesday, May 14th. They set a "buy" rating and a $25.00 price objective on the stock. HC Wainwright reiterated a "buy" rating and issued a $25.00 price target on shares of Hut 8 in a research report on Friday, May 9th. Finally, Northland Capmk upgraded shares of Hut 8 to a "strong-buy" rating in a research report on Monday, April 21st.

View Our Latest Stock Report on HUT

Hut 8 Price Performance

Shares of NASDAQ HUT traded down $0.14 during midday trading on Friday, hitting $22.22. 5,352,211 shares of the company traded hands, compared to its average volume of 5,630,467. Hut 8 has a 12-month low of $8.73 and a 12-month high of $31.95. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.81 and a quick ratio of 1.81. The stock has a 50-day moving average price of $19.83 and a 200 day moving average price of $16.69.

Hut 8 (NASDAQ:HUT - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported ($0.14) EPS for the quarter, beating analysts' consensus estimates of ($0.15) by $0.01. Hut 8 had a net margin of 112.81% and a return on equity of 8.73%. The firm had revenue of $41.72 million for the quarter, compared to analysts' expectations of $49.10 million. On average, equities research analysts forecast that Hut 8 will post -0.53 earnings per share for the current fiscal year.

Insider Buying and Selling at Hut 8

In other news, Director Joseph Flinn sold 11,069 shares of the firm's stock in a transaction that occurred on Monday, June 23rd. The shares were sold at an average price of $15.77, for a total value of $174,558.13. Following the completion of the transaction, the director owned 19,791 shares of the company's stock, valued at approximately $312,104.07. This trade represents a 35.87% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 11.20% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently made changes to their positions in the business. Vanguard Group Inc. increased its holdings in shares of Hut 8 by 1.4% in the 1st quarter. Vanguard Group Inc. now owns 6,546,935 shares of the company's stock valued at $76,075,000 after acquiring an additional 87,550 shares during the period. Geode Capital Management LLC increased its holdings in shares of Hut 8 by 13.7% in the 2nd quarter. Geode Capital Management LLC now owns 2,563,091 shares of the company's stock valued at $47,679,000 after acquiring an additional 309,113 shares during the period. Jericho Capital Asset Management L.P. acquired a new position in shares of Hut 8 in the 4th quarter valued at $37,400,000. D. E. Shaw & Co. Inc. acquired a new position in shares of Hut 8 in the 4th quarter valued at $27,115,000. Finally, Massachusetts Financial Services Co. MA increased its holdings in shares of Hut 8 by 181.2% in the 1st quarter. Massachusetts Financial Services Co. MA now owns 1,287,163 shares of the company's stock valued at $14,957,000 after acquiring an additional 829,484 shares during the period. Hedge funds and other institutional investors own 31.75% of the company's stock.

About Hut 8

(

Get Free Report)

Hut 8 Corp., together with its subsidiaries, acquires, builds, manages, and operates data centers for digital assets mining, computing, and artificial intelligence in the United States. It operates in four segments: Digital Assets Mining, Managed Services, High Performance Computing Colocation and Cloud, and Other.

Featured Stories

Before you consider Hut 8, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hut 8 wasn't on the list.

While Hut 8 currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.