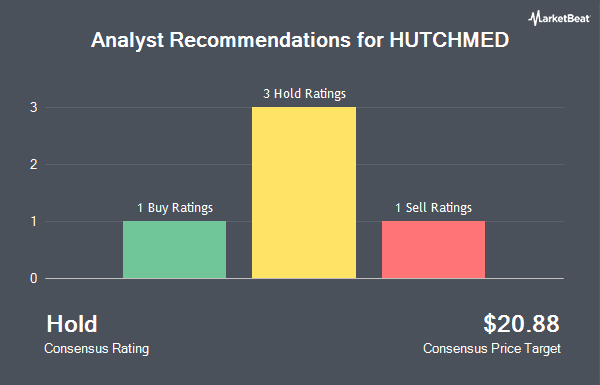

HUTCHMED (China) Limited Sponsored ADR (NASDAQ:HCM - Get Free Report) has been given an average rating of "Hold" by the five analysts that are covering the stock, Marketbeat reports. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and one has given a buy rating to the company. The average 1-year price objective among brokerages that have issued ratings on the stock in the last year is $20.8750.

A number of research firms recently commented on HCM. Bank of America increased their price target on HUTCHMED from $27.00 to $28.00 and gave the company a "buy" rating in a research report on Tuesday, July 22nd. Wall Street Zen lowered HUTCHMED from a "buy" rating to a "hold" rating in a research report on Sunday, September 7th. Weiss Ratings reissued a "hold (c)" rating on shares of HUTCHMED in a research report on Saturday, September 27th. Zacks Research lowered HUTCHMED from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, September 9th. Finally, Morgan Stanley lowered HUTCHMED from an "equal weight" rating to an "underweight" rating and lowered their price target for the company from $18.00 to $13.75 in a research report on Monday, September 22nd.

View Our Latest Report on HUTCHMED

HUTCHMED Price Performance

Shares of NASDAQ:HCM traded down $0.03 during trading on Friday, reaching $16.09. 68,187 shares of the stock were exchanged, compared to its average volume of 78,201. The company has a debt-to-equity ratio of 0.05, a current ratio of 4.65 and a quick ratio of 4.51. HUTCHMED has a 1-year low of $11.51 and a 1-year high of $21.50. The stock has a fifty day moving average of $16.36 and a two-hundred day moving average of $15.46.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of HCM. Jane Street Group LLC grew its stake in HUTCHMED by 128.0% in the 1st quarter. Jane Street Group LLC now owns 222,241 shares of the company's stock valued at $3,343,000 after purchasing an additional 124,771 shares during the period. XY Capital Ltd grew its stake in HUTCHMED by 142.4% in the 1st quarter. XY Capital Ltd now owns 113,136 shares of the company's stock valued at $1,702,000 after purchasing an additional 66,460 shares during the period. ABN Amro Investment Solutions bought a new position in HUTCHMED in the 2nd quarter valued at $962,000. Tema Etfs LLC bought a new position in HUTCHMED in the 2nd quarter valued at $641,000. Finally, Vident Advisory LLC grew its stake in HUTCHMED by 78.3% in the 1st quarter. Vident Advisory LLC now owns 19,728 shares of the company's stock valued at $297,000 after purchasing an additional 8,664 shares during the period. Institutional investors own 8.82% of the company's stock.

About HUTCHMED

(

Get Free Report)

HUTCHMED (China) Ltd. is a holding company, which engages in the research and development, manufacture, and sale of pharmaceuticals and health-oriented consumer products. It operates through the Oncology/Immunology and Other Ventures segments. The Oncology/Immunology segment includes the discovery, development, and commercialization of targeted therapies and immunotherapies for the treatment of cancer and immunological diseases.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HUTCHMED, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HUTCHMED wasn't on the list.

While HUTCHMED currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.