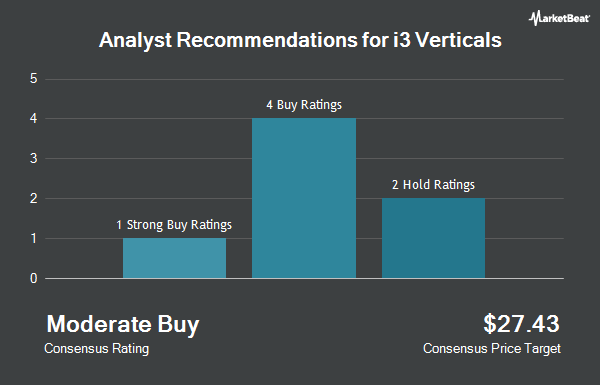

Shares of i3 Verticals, Inc. (NASDAQ:IIIV - Get Free Report) have been given an average rating of "Moderate Buy" by the eight analysts that are presently covering the company, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, two have issued a hold recommendation and five have assigned a buy recommendation to the company. The average twelve-month price objective among analysts that have issued a report on the stock in the last year is $34.3333.

Several analysts have recently weighed in on IIIV shares. DA Davidson boosted their price objective on shares of i3 Verticals from $34.00 to $39.00 and gave the stock a "buy" rating in a research report on Wednesday, August 13th. Zacks Research downgraded shares of i3 Verticals from a "hold" rating to a "strong sell" rating in a research report on Wednesday, October 1st. Weiss Ratings reiterated a "buy (b-)" rating on shares of i3 Verticals in a research report on Wednesday. Benchmark reiterated a "buy" rating and issued a $39.00 price target (up previously from $33.00) on shares of i3 Verticals in a research report on Monday, August 11th. Finally, Morgan Stanley upped their price target on shares of i3 Verticals from $25.00 to $30.00 and gave the company an "equal weight" rating in a research report on Tuesday, August 12th.

Read Our Latest Report on i3 Verticals

i3 Verticals Trading Up 0.4%

Shares of NASDAQ:IIIV opened at $31.79 on Friday. The company has a market capitalization of $1.03 billion, a PE ratio of 6.09 and a beta of 1.28. i3 Verticals has a twelve month low of $22.12 and a twelve month high of $33.59. The firm has a 50 day simple moving average of $31.12 and a 200-day simple moving average of $27.72.

Insider Activity at i3 Verticals

In related news, General Counsel Paul Maple sold 2,500 shares of the company's stock in a transaction on Thursday, September 11th. The shares were sold at an average price of $31.04, for a total value of $77,600.00. Following the completion of the sale, the general counsel owned 33,269 shares in the company, valued at $1,032,669.76. This represents a 6.99% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Timothy Mckenna sold 6,882 shares of the business's stock in a transaction on Tuesday, August 12th. The shares were sold at an average price of $31.81, for a total transaction of $218,916.42. Following the completion of the transaction, the director directly owned 3,876 shares in the company, valued at $123,295.56. This represents a 63.97% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 11,272 shares of company stock worth $355,862 in the last 90 days. 59.07% of the stock is owned by insiders.

Hedge Funds Weigh In On i3 Verticals

Several institutional investors have recently bought and sold shares of IIIV. Rhumbline Advisers increased its stake in i3 Verticals by 2.2% in the 1st quarter. Rhumbline Advisers now owns 36,331 shares of the company's stock valued at $896,000 after buying an additional 786 shares during the period. NBC Securities Inc. increased its stake in i3 Verticals by 112,500.0% in the 1st quarter. NBC Securities Inc. now owns 1,126 shares of the company's stock valued at $27,000 after buying an additional 1,125 shares during the period. Mirae Asset Global Investments Co. Ltd. increased its stake in i3 Verticals by 2,744.4% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,048 shares of the company's stock valued at $51,000 after buying an additional 1,976 shares during the period. Principal Financial Group Inc. acquired a new position in i3 Verticals in the 1st quarter valued at $1,253,000. Finally, D.A. Davidson & CO. acquired a new position in i3 Verticals in the 1st quarter valued at $232,000. 84.22% of the stock is owned by institutional investors and hedge funds.

i3 Verticals Company Profile

(

Get Free Report)

i3 Verticals, Inc provides integrated payment and software solutions primarily to the public sector and healthcare markets in the United States. It operates in two segments, Software and Services, and Merchant Services. The company offers payment processing services that enables upper and lower court case management, collections, finance and accounting, motor vehicle and carrier registration, e-filing and taxation, license plate inventory, property tax management, utility billing, professional licensing, document workflow, and law enforcement software; assists public schools in completing payment processing functions, including accepting payments for online or at school lunches, and school activities.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider i3 Verticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and i3 Verticals wasn't on the list.

While i3 Verticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.