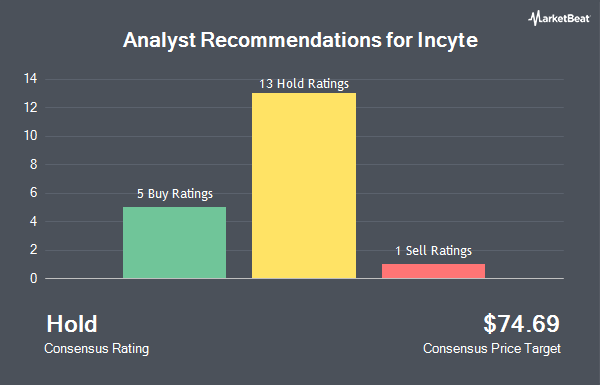

Shares of Incyte Corporation (NASDAQ:INCY - Get Free Report) have been given a consensus rating of "Hold" by the nineteen analysts that are covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, twelve have assigned a hold rating, five have given a buy rating and one has given a strong buy rating to the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is $84.7857.

A number of brokerages recently commented on INCY. Zacks Research upgraded Incyte from a "hold" rating to a "strong-buy" rating in a research report on Friday, October 10th. BMO Capital Markets reiterated an "underperform" rating and set a $60.00 price objective (up from $52.00) on shares of Incyte in a research note on Wednesday, July 30th. Barclays started coverage on shares of Incyte in a report on Friday, August 1st. They set an "overweight" rating and a $90.00 price target for the company. Stifel Nicolaus upped their price target on shares of Incyte from $110.00 to $115.00 and gave the stock a "buy" rating in a report on Monday, September 22nd. Finally, Royal Bank Of Canada boosted their price objective on shares of Incyte from $72.00 to $81.00 and gave the company a "sector perform" rating in a research report on Wednesday, September 24th.

Check Out Our Latest Research Report on INCY

Insider Activity

In related news, EVP Steven H. Stein sold 3,706 shares of the firm's stock in a transaction dated Monday, July 21st. The stock was sold at an average price of $67.94, for a total value of $251,785.64. Following the sale, the executive vice president directly owned 102,886 shares of the company's stock, valued at $6,990,074.84. This trade represents a 3.48% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Insiders own 17.80% of the company's stock.

Institutional Trading of Incyte

Hedge funds and other institutional investors have recently modified their holdings of the stock. Farther Finance Advisors LLC boosted its holdings in shares of Incyte by 474.1% during the 1st quarter. Farther Finance Advisors LLC now owns 1,550 shares of the biopharmaceutical company's stock valued at $94,000 after acquiring an additional 1,280 shares in the last quarter. Assenagon Asset Management S.A. raised its position in Incyte by 37.6% in the first quarter. Assenagon Asset Management S.A. now owns 8,846 shares of the biopharmaceutical company's stock valued at $536,000 after purchasing an additional 2,418 shares during the last quarter. Fifth Third Bancorp increased its stake in shares of Incyte by 2.0% in the first quarter. Fifth Third Bancorp now owns 9,103 shares of the biopharmaceutical company's stock valued at $551,000 after buying an additional 179 shares during the period. Wealth Enhancement Advisory Services LLC increased its stake in shares of Incyte by 66.5% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 79,735 shares of the biopharmaceutical company's stock valued at $4,828,000 after buying an additional 31,851 shares during the period. Finally, Mn Services Vermogensbeheer B.V. increased its stake in shares of Incyte by 14.1% in the first quarter. Mn Services Vermogensbeheer B.V. now owns 36,500 shares of the biopharmaceutical company's stock valued at $2,210,000 after buying an additional 4,500 shares during the period. Institutional investors own 96.97% of the company's stock.

Incyte Price Performance

Shares of NASDAQ INCY opened at $85.96 on Wednesday. The stock has a market capitalization of $16.79 billion, a PE ratio of 19.54, a P/E/G ratio of 0.66 and a beta of 0.73. The company has a debt-to-equity ratio of 0.01, a current ratio of 2.85 and a quick ratio of 2.78. The business has a fifty day moving average price of $84.62 and a two-hundred day moving average price of $71.99. Incyte has a fifty-two week low of $53.56 and a fifty-two week high of $88.66.

Incyte Company Profile

(

Get Free Report)

Incyte Corporation, a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for hematology/oncology, and inflammation and autoimmunity areas in the United States and internationally. The company offers JAKAFI (ruxolitinib) for treatment of intermediate or high-risk myelofibrosis, polycythemia vera, and steroid-refractory acute graft-versus-host disease; MONJUVI (tafasitamab-cxix)/MINJUVI (tafasitamab) for relapsed or refractory diffuse large B-cell lymphoma; PEMAZYRE (pemigatinib), a fibroblast growth factor receptor kinase inhibitor that act as oncogenic drivers in liquid and solid tumor types; ICLUSIG (ponatinib) to treat chronic myeloid leukemia and Philadelphia-chromosome positive acute lymphoblastic leukemia; and ZYNYZ (retifanlimab-dlwr) to treat adults with metastatic or recurrent locally advanced Merkel cell carcinoma, as well as OPZELURA cream for treatment of atopic dermatitis.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Incyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Incyte wasn't on the list.

While Incyte currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.