Wells Fargo & Company upgraded shares of Incyte (NASDAQ:INCY - Free Report) from an equal weight rating to an overweight rating in a report released on Wednesday morning, Marketbeat Ratings reports. The brokerage currently has $89.00 price target on the biopharmaceutical company's stock, up from their previous price target of $67.00.

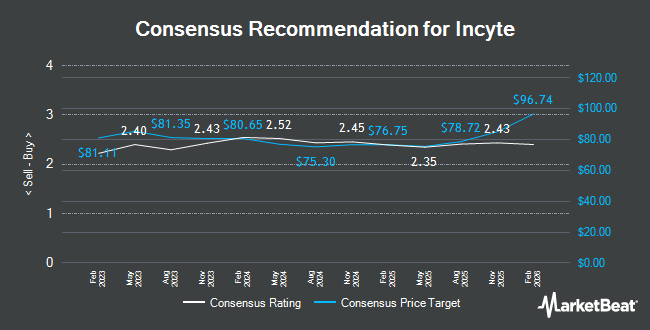

Other analysts have also issued research reports about the stock. Citigroup boosted their price target on shares of Incyte from $88.00 to $103.00 and gave the company a "buy" rating in a research note on Wednesday, July 30th. Stifel Nicolaus raised shares of Incyte from a "hold" rating to a "buy" rating and boosted their target price for the stock from $75.00 to $107.00 in a research report on Monday, June 16th. JPMorgan Chase & Co. dropped their price target on shares of Incyte from $68.00 to $67.00 and set a "neutral" rating on the stock in a research report on Monday, July 14th. Truist Financial increased their price objective on Incyte from $73.00 to $79.00 and gave the stock a "hold" rating in a research note on Wednesday, July 30th. Finally, Barclays started coverage on Incyte in a report on Friday, August 1st. They issued an "overweight" rating and a $90.00 target price on the stock. One investment analyst has rated the stock with a sell rating, ten have issued a hold rating, seven have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $81.20.

Check Out Our Latest Analysis on INCY

Incyte Stock Up 0.2%

Incyte stock traded up $0.19 during mid-day trading on Wednesday, reaching $78.39. The stock had a trading volume of 1,159,998 shares, compared to its average volume of 1,694,727. The firm has a market capitalization of $15.31 billion, a PE ratio of 17.82, a price-to-earnings-growth ratio of 0.62 and a beta of 0.71. Incyte has a fifty-two week low of $53.56 and a fifty-two week high of $83.95. The stock's 50-day simple moving average is $70.23 and its 200-day simple moving average is $66.86. The company has a debt-to-equity ratio of 0.01, a quick ratio of 2.78 and a current ratio of 2.85.

Insider Buying and Selling

In other Incyte news, EVP Sheila A. Denton sold 599 shares of the firm's stock in a transaction on Wednesday, July 2nd. The shares were sold at an average price of $68.61, for a total value of $41,097.39. Following the completion of the transaction, the executive vice president directly owned 26,504 shares of the company's stock, valued at $1,818,439.44. This trade represents a 2.21% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Steven H. Stein sold 14,952 shares of the business's stock in a transaction on Monday, July 14th. The shares were sold at an average price of $68.47, for a total transaction of $1,023,763.44. Following the transaction, the executive vice president owned 97,466 shares of the company's stock, valued at $6,673,497.02. This trade represents a 13.30% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 56,098 shares of company stock worth $3,836,196 in the last 90 days. 17.80% of the stock is owned by company insiders.

Institutional Trading of Incyte

Institutional investors and hedge funds have recently modified their holdings of the business. Banque Transatlantique SA bought a new stake in Incyte during the first quarter valued at approximately $26,000. FNY Investment Advisers LLC bought a new stake in shares of Incyte during the 2nd quarter worth $27,000. Raiffeisen Bank International AG bought a new stake in shares of Incyte during the 4th quarter worth $34,000. Hilltop National Bank purchased a new position in Incyte in the second quarter worth $37,000. Finally, SVB Wealth LLC bought a new position in Incyte in the first quarter valued at $39,000. Hedge funds and other institutional investors own 96.97% of the company's stock.

About Incyte

(

Get Free Report)

Incyte Corporation, a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for hematology/oncology, and inflammation and autoimmunity areas in the United States and internationally. The company offers JAKAFI (ruxolitinib) for treatment of intermediate or high-risk myelofibrosis, polycythemia vera, and steroid-refractory acute graft-versus-host disease; MONJUVI (tafasitamab-cxix)/MINJUVI (tafasitamab) for relapsed or refractory diffuse large B-cell lymphoma; PEMAZYRE (pemigatinib), a fibroblast growth factor receptor kinase inhibitor that act as oncogenic drivers in liquid and solid tumor types; ICLUSIG (ponatinib) to treat chronic myeloid leukemia and Philadelphia-chromosome positive acute lymphoblastic leukemia; and ZYNYZ (retifanlimab-dlwr) to treat adults with metastatic or recurrent locally advanced Merkel cell carcinoma, as well as OPZELURA cream for treatment of atopic dermatitis.

Featured Articles

Before you consider Incyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Incyte wasn't on the list.

While Incyte currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.