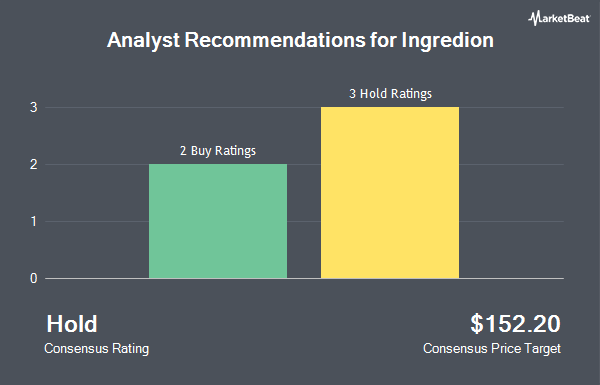

Ingredion Incorporated (NYSE:INGR - Get Free Report) has been assigned an average recommendation of "Hold" from the five ratings firms that are presently covering the company, Marketbeat.com reports. Three equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company. The average twelve-month price target among brokers that have issued a report on the stock in the last year is $151.40.

A number of analysts have recently commented on the company. Wall Street Zen raised Ingredion from a "buy" rating to a "strong-buy" rating in a research report on Sunday, June 8th. UBS Group boosted their target price on Ingredion from $149.00 to $151.00 and gave the stock a "neutral" rating in a report on Wednesday, July 9th. Finally, Oppenheimer cut their target price on Ingredion from $167.00 to $155.00 and set an "outperform" rating on the stock in a research note on Tuesday, April 22nd.

View Our Latest Stock Analysis on INGR

Insider Buying and Selling at Ingredion

In related news, SVP Larry Fernandes sold 2,400 shares of the stock in a transaction dated Wednesday, May 7th. The shares were sold at an average price of $135.82, for a total value of $325,968.00. Following the sale, the senior vice president directly owned 31,996 shares of the company's stock, valued at $4,345,696.72. This represents a 6.98% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Corporate insiders own 1.80% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the company. First Trust Advisors LP grew its stake in Ingredion by 1.9% in the fourth quarter. First Trust Advisors LP now owns 583,081 shares of the company's stock valued at $80,209,000 after purchasing an additional 10,703 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. purchased a new stake in Ingredion in the first quarter valued at approximately $646,000. Brown Advisory Inc. boosted its holdings in shares of Ingredion by 8.4% in the 1st quarter. Brown Advisory Inc. now owns 2,318 shares of the company's stock valued at $313,000 after acquiring an additional 180 shares during the last quarter. Transcend Capital Advisors LLC raised its stake in shares of Ingredion by 156.7% during the 1st quarter. Transcend Capital Advisors LLC now owns 11,086 shares of the company's stock valued at $1,499,000 after buying an additional 6,768 shares during the last quarter. Finally, Oppenheimer & Co. Inc. lifted its holdings in Ingredion by 24.0% in the first quarter. Oppenheimer & Co. Inc. now owns 26,953 shares of the company's stock valued at $3,644,000 after acquiring an additional 5,215 shares during the period. 85.27% of the stock is currently owned by hedge funds and other institutional investors.

Ingredion Price Performance

INGR opened at $126.53 on Tuesday. The company has a debt-to-equity ratio of 0.41, a current ratio of 2.78 and a quick ratio of 1.81. The stock's 50 day simple moving average is $136.12 and its 200 day simple moving average is $133.58. The firm has a market cap of $8.14 billion, a price-to-earnings ratio of 12.34, a PEG ratio of 1.01 and a beta of 0.71. Ingredion has a 1 year low of $118.85 and a 1 year high of $155.44.

Ingredion (NYSE:INGR - Get Free Report) last posted its earnings results on Friday, August 1st. The company reported $2.87 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.78 by $0.09. The company had revenue of $1.83 billion for the quarter, compared to analysts' expectations of $1.89 billion. Ingredion had a return on equity of 19.04% and a net margin of 9.24%. Ingredion's quarterly revenue was down 2.4% on a year-over-year basis. During the same period last year, the firm earned $2.87 earnings per share. As a group, analysts predict that Ingredion will post 11.14 earnings per share for the current year.

Ingredion Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, July 22nd. Stockholders of record on Tuesday, July 1st were issued a $0.80 dividend. The ex-dividend date was Tuesday, July 1st. This represents a $3.20 dividend on an annualized basis and a dividend yield of 2.5%. Ingredion's payout ratio is 31.22%.

About Ingredion

(

Get Free Report)

Ingredion Incorporated, together with its subsidiaries, manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries in North America, South America, the Asia Pacific, Europe, the Middle East, and Africa.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ingredion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingredion wasn't on the list.

While Ingredion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.