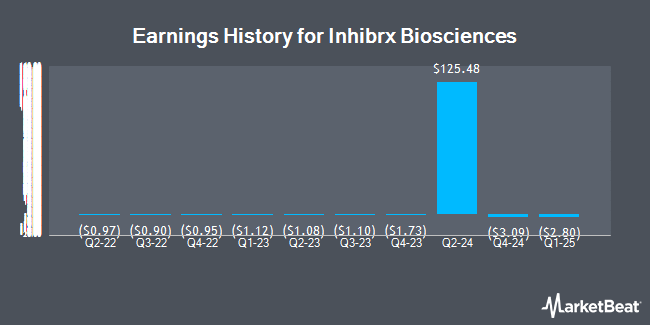

Inhibrx Biosciences (NASDAQ:INBX - Get Free Report) released its earnings results on Wednesday. The company reported ($1.85) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($2.92) by $1.07, Zacks reports. The firm had revenue of $1.30 million for the quarter.

Inhibrx Biosciences Stock Performance

Inhibrx Biosciences stock traded up $0.41 during midday trading on Monday, reaching $23.74. 34,875 shares of the company's stock were exchanged, compared to its average volume of 104,862. The company has a debt-to-equity ratio of 1.45, a quick ratio of 4.98 and a current ratio of 4.98. Inhibrx Biosciences has a 52 week low of $10.81 and a 52 week high of $25.29. The stock's 50-day simple moving average is $19.36 and its 200 day simple moving average is $15.12. The firm has a market cap of $343.76 million, a price-to-earnings ratio of -2.24 and a beta of 0.24.

Wall Street Analysts Forecast Growth

INBX has been the subject of a number of research reports. JMP Securities reiterated a "market perform" rating on shares of Inhibrx Biosciences in a report on Thursday, May 15th. Wall Street Zen raised shares of Inhibrx Biosciences from a "sell" rating to a "hold" rating in a research note on Sunday.

Read Our Latest Analysis on Inhibrx Biosciences

Institutional Investors Weigh In On Inhibrx Biosciences

Large investors have recently added to or reduced their stakes in the business. Strs Ohio acquired a new position in shares of Inhibrx Biosciences in the first quarter valued at $27,000. Bank of America Corp DE grew its stake in Inhibrx Biosciences by 19.2% in the 2nd quarter. Bank of America Corp DE now owns 9,130 shares of the company's stock valued at $130,000 after buying an additional 1,469 shares during the last quarter. Invesco Ltd. bought a new position in Inhibrx Biosciences in the 2nd quarter valued at about $193,000. Bridgeway Capital Management LLC acquired a new stake in Inhibrx Biosciences during the second quarter worth approximately $235,000. Finally, Russell Investments Group Ltd. lifted its position in Inhibrx Biosciences by 11.0% during the second quarter. Russell Investments Group Ltd. now owns 29,993 shares of the company's stock worth $428,000 after acquiring an additional 2,963 shares during the last quarter. Institutional investors own 82.46% of the company's stock.

Inhibrx Biosciences Company Profile

(

Get Free Report)

Inhibrx, Inc, a clinical-stage biopharmaceutical company, develops a pipeline of novel biologic therapeutic candidates. The company's therapeutic candidate includes INBRX-101, an alpha-1 antitrypsin (AAT)-Fc fusion protein therapeutic candidate, which is in Phase 1 clinical trials for use in the treatment of patients with AAT deficiency.

Recommended Stories

Before you consider Inhibrx Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inhibrx Biosciences wasn't on the list.

While Inhibrx Biosciences currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.