Inovio Pharmaceuticals (NASDAQ:INO - Get Free Report) will likely be announcing its Q2 2025 earnings results after the market closes on Tuesday, August 12th. Analysts expect the company to announce earnings of ($0.65) per share and revenue of $0.01 million for the quarter.

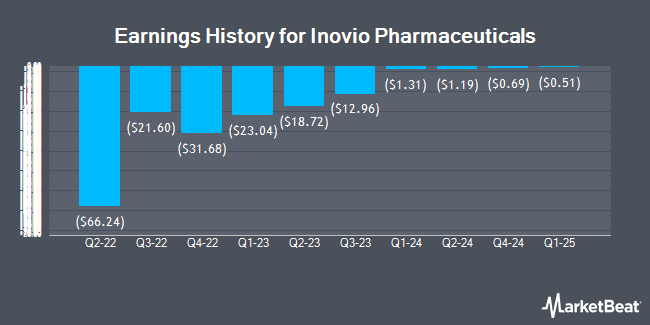

Inovio Pharmaceuticals (NASDAQ:INO - Get Free Report) last posted its quarterly earnings results on Tuesday, May 13th. The biopharmaceutical company reported ($0.51) earnings per share for the quarter, beating analysts' consensus estimates of ($0.74) by $0.23. The company had revenue of $0.07 million during the quarter, compared to analyst estimates of $0.01 million. On average, analysts expect Inovio Pharmaceuticals to post $-4 EPS for the current fiscal year and $-3 EPS for the next fiscal year.

Inovio Pharmaceuticals Stock Performance

Shares of INO traded down $0.03 during mid-day trading on Friday, reaching $1.41. The company had a trading volume of 391,413 shares, compared to its average volume of 1,463,670. The company's 50 day simple moving average is $1.73 and its 200 day simple moving average is $1.85. Inovio Pharmaceuticals has a 1-year low of $1.30 and a 1-year high of $8.63. The company has a market capitalization of $51.70 million, a price-to-earnings ratio of -0.44 and a beta of 1.38.

Institutional Investors Weigh In On Inovio Pharmaceuticals

A hedge fund recently raised its stake in Inovio Pharmaceuticals stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of Inovio Pharmaceuticals, Inc. (NASDAQ:INO - Free Report) by 39.6% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 20,781 shares of the biopharmaceutical company's stock after buying an additional 5,894 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. owned 0.06% of Inovio Pharmaceuticals worth $34,000 at the end of the most recent reporting period. 26.79% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts have issued reports on the stock. Piper Sandler assumed coverage on shares of Inovio Pharmaceuticals in a report on Wednesday, July 9th. They set an "overweight" rating and a $5.00 price target for the company. Royal Bank Of Canada restated a "sector perform" rating and set a $5.00 price target on shares of Inovio Pharmaceuticals in a report on Wednesday, May 14th. Oppenheimer lowered their price target on shares of Inovio Pharmaceuticals from $15.00 to $13.00 and set an "outperform" rating for the company in a report on Wednesday, May 14th. Finally, Wall Street Zen upgraded shares of Inovio Pharmaceuticals from a "sell" rating to a "hold" rating in a report on Friday, June 27th. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $8.80.

View Our Latest Research Report on Inovio Pharmaceuticals

About Inovio Pharmaceuticals

(

Get Free Report)

Inovio Pharmaceuticals, Inc, a biotechnology company, focuses on the discovery, development, and commercialization of DNA medicines to treat and protect people from diseases associated with human papillomavirus (HPV), cancer, and infectious diseases. Its DNA medicines platform uses precisely designed SynCon that identify and optimize the DNA sequence of the target antigen, as well as CELLECTRA smart devices technology that facilitates delivery of the DNA plasmids.

Read More

Before you consider Inovio Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inovio Pharmaceuticals wasn't on the list.

While Inovio Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.