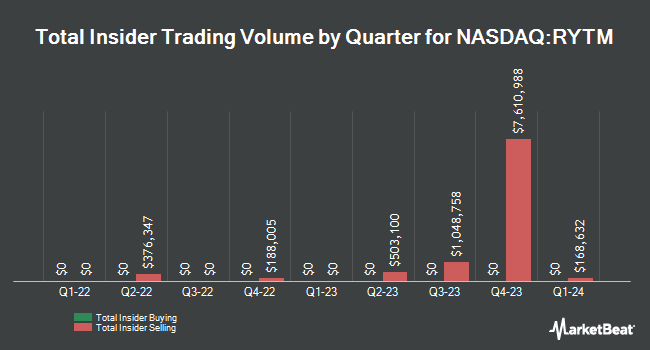

Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM - Get Free Report) CAO Christopher Paul German sold 1,500 shares of the business's stock in a transaction on Tuesday, August 12th. The shares were sold at an average price of $95.00, for a total transaction of $142,500.00. Following the completion of the transaction, the chief accounting officer owned 922 shares in the company, valued at approximately $87,590. The trade was a 61.93% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website.

Christopher Paul German also recently made the following trade(s):

- On Wednesday, July 9th, Christopher Paul German sold 3,817 shares of Rhythm Pharmaceuticals stock. The shares were sold at an average price of $80.75, for a total transaction of $308,222.75.

- On Tuesday, June 10th, Christopher Paul German sold 2,069 shares of Rhythm Pharmaceuticals stock. The shares were sold at an average price of $67.19, for a total transaction of $139,016.11.

Rhythm Pharmaceuticals Trading Down 0.8%

RYTM stock traded down $0.76 during midday trading on Tuesday, hitting $97.33. The stock had a trading volume of 61,880 shares, compared to its average volume of 664,821. The firm has a market cap of $6.46 billion, a P/E ratio of -32.32 and a beta of 2.38. Rhythm Pharmaceuticals, Inc. has a 1-year low of $43.57 and a 1-year high of $99.04. The business has a fifty day moving average price of $79.09 and a two-hundred day moving average price of $65.40.

Rhythm Pharmaceuticals (NASDAQ:RYTM - Get Free Report) last released its earnings results on Tuesday, August 5th. The company reported ($0.75) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.66) by ($0.09). Rhythm Pharmaceuticals had a negative net margin of 117.13% and a negative return on equity of 1,831.43%. The firm had revenue of $48.50 million during the quarter, compared to analyst estimates of $43.72 million. During the same quarter in the previous year, the firm earned ($0.55) EPS. Rhythm Pharmaceuticals's quarterly revenue was up 66.8% on a year-over-year basis. On average, equities analysts anticipate that Rhythm Pharmaceuticals, Inc. will post -4.32 EPS for the current year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. BI Asset Management Fondsmaeglerselskab A S purchased a new position in Rhythm Pharmaceuticals during the first quarter worth about $34,000. State of Wyoming purchased a new position in Rhythm Pharmaceuticals during the fourth quarter worth about $61,000. GF Fund Management CO. LTD. purchased a new position in Rhythm Pharmaceuticals during the fourth quarter worth about $72,000. Mirae Asset Global Investments Co. Ltd. boosted its holdings in Rhythm Pharmaceuticals by 16.2% during the second quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,458 shares of the company's stock worth $155,000 after purchasing an additional 342 shares during the last quarter. Finally, CWM LLC boosted its holdings in Rhythm Pharmaceuticals by 92.3% during the first quarter. CWM LLC now owns 2,584 shares of the company's stock worth $137,000 after purchasing an additional 1,240 shares during the last quarter.

Analysts Set New Price Targets

Several research firms have weighed in on RYTM. Oppenheimer lifted their price target on shares of Rhythm Pharmaceuticals from $76.00 to $110.00 and gave the company an "outperform" rating in a research note on Thursday, July 10th. Leerink Partnrs raised shares of Rhythm Pharmaceuticals to a "strong-buy" rating in a research note on Monday, July 7th. Guggenheim lifted their price target on shares of Rhythm Pharmaceuticals from $119.00 to $120.00 and gave the company a "buy" rating in a research note on Wednesday, August 6th. Wall Street Zen raised shares of Rhythm Pharmaceuticals from a "sell" rating to a "hold" rating in a research note on Saturday, July 26th. Finally, Needham & Company LLC reissued a "buy" rating and set a $95.00 target price (up from $72.00) on shares of Rhythm Pharmaceuticals in a research report on Wednesday, July 9th. One analyst has rated the stock with a Strong Buy rating and fourteen have issued a Buy rating to the stock. According to data from MarketBeat, Rhythm Pharmaceuticals currently has an average rating of "Buy" and a consensus price target of $101.57.

Get Our Latest Research Report on Rhythm Pharmaceuticals

Rhythm Pharmaceuticals Company Profile

(

Get Free Report)

Rhythm Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases. The company's lead product candidate is IMCIVREE (setmelanotide), a rare melanocortin-4 receptor for the treatment of pro-opiomelanocortin (POMC), proprotein convertase subtilisin/kexin type 1, leptin receptor (LEPR) deficiency obesity, and Bardet-Biedl and Alström syndrome.

See Also

Before you consider Rhythm Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rhythm Pharmaceuticals wasn't on the list.

While Rhythm Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.